Having a well-designed comp plan helps turn the vision of a company into reality.

We are seeing a key evolution of comp plans that support a customer-centric approach to building the business.

As the marketplace and industry evolve, many direct selling and network marketing companies have either modified their comp plans or are considering it in the future. I have been involved in changes of this nature with various companies from both a design and technology standpoint. I often find companies are in the weeds of micro components of comp plan design before covering the macro components that are critical to the success of the micro components. Even if you hire a comp plan expert for the micro components, you will still need to consider the macro components I outlined in this article.

Whether a company is building or modifying a comp plan, there are some key questions to consider:

- Do you want to build an opportunity-centric or customer-centric business model?

- How much should a company payout in their compensation plan? According to BusinessforHome.org, the 2020 average cumulative payout was 34.64 percent.

- How does a company allocate commission between those who sell their products and services vs. those who override that group? However, in your comp plan payout, how much is variable in nature (incentives, bonuses, etc.)? A well-designed comp plan does not require incentives to drive revenue. Incentives magnify the fixed payouts of a comp plan, but if they become too much of the total compensation, they will likely diminish the profitability of the company. It is important to set a ceiling on the variable payouts to ensure the profitability of the company.

- How are you allocating commissions between recruiting and customer acquisition vs. for relationships?

- What behaviors are essential to drive in their compensation plan? Compensation plans often focus on money and movement. Culture is about behavior. There needs to be alignment between the two.

- How do companies address the imbalance between performance and compensation paid? The imbalance is created over time when commissions to those overriding sales are passive vs. rewarded for performance. You must consider how to allocate between junior leaders (performance drivers), managers (manage to organize but not personally building), and ambassadors (legacy leaders that work to achieve passive income).

While keeping in mind that the questions should be addressed with all the stakeholders involved in building or modifying a comp plan, there are other factors to be considered as well. To build a more empowering future, we must understand the past. Comp plan architecture has evolved. Currently, we are seeing a key evolution of comp plans that support a customer-centric approach to building the business. This is driven by changes in both the marketplace and regulatory community.

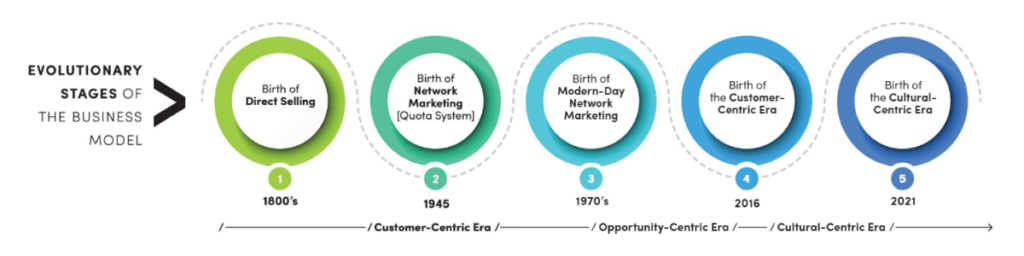

A Quick History Lesson

Over the life of the direct selling channel, there have been various key periods and pivot points. Many of these were defined based on the philosophies that drove the business during these periods. The industry started solely as a distribution channel. In the mid ‘40s, we began to see an evolution that introduced a different business model that allowed a distributor to build a team. During that time, to be a distributor, you had to operate as a sales rep under an existing distributor until you earned the right to be an independent distributor. In the ’70s, we moved toward what we know today as the opportunity-centric era.

While opportunity will always be a key part of building a larger sales force, the marketplace has evolved to more of a customer focus. This began what we refer to as the “customer-centric era” that is driving business today. Today, we are seeing a renewed focus on culture and what I refer to as the birth of the “cultural-centric era.” Culture is the differentiator with direct selling companies. The discussion is no longer which has what priority in building the business; leading with opportunity or leading with the product. These two paths mustn’t compete for priority but work in tandem to build a healthy culture that is strong on relationships.

Opportunity-Centric Comp Plans

Opportunity-centric comp plans have their foundation around moving up a company’s marketing plan and making more money. Recruiting and recognition are the two highest-paid activities that drive sales. Personal growth plays a big role in addicting distributors to the culture. They are typically defined by the following components:

- A large percentage of the commission dollars are paid in overrides vs to those distributors that sell products.

- A significant percentage of distributors make little to no money.

- There is a heavy focus on recruiting and customer acquisition.

- These comp plans drive business by marketing hope around the business opportunity. Too often, that hope is created around extreme examples of highly successful distributors.

- These types of comp plans tend to create a customer base that is heavily skewed around distributor buying vs. sales to end consumers.

- These companies create a lot of disengagement of micro-entrepreneurs and customers. We refer to this as “churn,” and the most churn occurs in the first six months of a new distributor’s journey. Typically, when these distributors leave, so do their customers.

- The design of these comp plans tends to be excessively complicated in both design and language of comp plan acronyms.

Any direct selling company must investigate a few key factors that are typical with opportunity-centric comp plans. The markup of products ranges from 8x to 14x the cost of goods sold, which often makes selling to end consumers challenging if the price was a key factor in their decision. Comp plan payouts could comprise as much as 50 percent of sales. Over time, this created large imbalances between performance and compensation. Most importantly, this type of comp plan creates regulatory risk and is typically the ones that regulators often define as “illegal pyramids.”

Customer-Centric Comp Plans

Customer-centric comp plans lead with the product and services sold by the company and its distributors. While the business opportunity is still important, the path to success is found through building a big customer base, especially with end consumers. They are typical defined by the following components:

- A large majority of commission dollars are paid to retailers vs. overrides.

- Active distributors can earn a significant part-time income by simply building a customer base.

- These companies tend to have a high “customer density”. Customer density is defined as the number of consumers per active distributor. You will see customer density ratios of 8 to 1 (8 customers per active distributor) or higher.

- Customer acquisition drives sales, but customer retention drives the stability of the business.

- Recruiting is often tied to converting satisfied customers to become distributors who want to market a company’s products or services because they are raving fan customers.

- The income narrative is typically around part-time income focused on (1) building a customer base and (2) find a few teammates who do the same.

- A large majority of sales are driven by repeat end consumers.

My Advice

There are various ways to build a direct selling business. You have to judge which one is best for you. We are seeing an increased innovation in comp plan architecture and new hybrid models. Before you build or modify a comp plan, you have to ensure the vision of the company is well defined. That includes defining the key behaviors that will turn your vision into reality. A well-designed comp plan helps turn the vision of a company into reality.

For those companies that are looking to modify an existing comp plan, you have to accept that with any comp plan change, there will be winners and losers. The pushback will likely be from your legacy leaders who seek to protect their income and influence in the company. Ultimately, it is important to educate them that a reduction in compensation (which is likely) isn’t a loss but more of an investment into the stability and healthy growth of their income over time. This is especially challenging for leaders that built their business during the opportunity-centric era and believe:

- They were promised what they earn in the current compensation plan.

- They earned the right to passive income.

- The behaviors that drove success in the past will continue to drive success in the future.

We must always remember that complexity is the enemy of execution. The profile of a direct selling entrepreneur is not a seasoned entrepreneur. Therefore, simplicity is critical in comp plan design. In the back office design my tech company, Shapetech Solutions LLC, built for the marketplace today, it is not critical for someone to understand the comp plan to be successful in the business. The days of back offices operating as information portals are over. A successful back office should drive key behaviors and actions that drive revenue over the lifetime journey of a distributor. Comp plan design should be aligned with the design of a company’s back office to truly be successful.

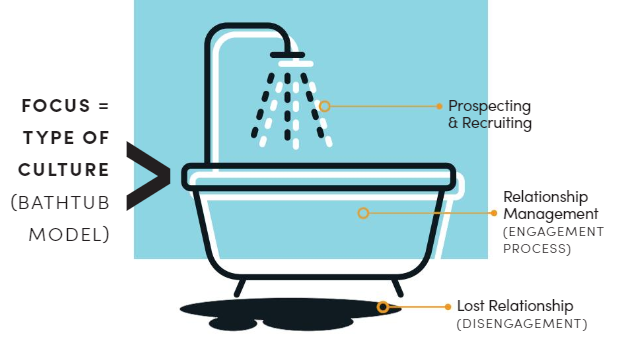

Finally, focus on the tub. As you can see from the graph above, sales can be driven through the faucet, tub, or drain. However, success is tied to creating a massive amount of relationships. The two largest relationship groups are customers and micro-entrepreneurs. Good comp plan design focuses on building relationships with these two groups. Leaders are created from these groups, and if you fail to keep these relationships, leaders will churn also. Focus on distributor engagement and customer retention. It is important to remember that when we lose customers, distributors will likely disengage or leave the business. Compensation design must address this issue if the goal is to build a healthy and stable direct selling business.

In closing, as I mentioned at the beginning of this article, we are entering into a “cultural-centric era”. We are seeing the beginning of the “Pygital Movement” that requires successful businesses to build culture both online and offline, now more than ever. Culture is driven by people’s experiences, and great companies are masterful at the experience game. I can assure you that if th

e culture doesn’t practice the proven behaviors that create an empowering and engaged community, the value of any comp plan will be compromised. Like product and opportunity, the comp plan lives within culture, not independent of it. Cultures evolve but people tend to stay true to their core values. In that context, what often defeats comp plan modifications is not the design of a comp plan itself but more the courage it takes to change one that is holding on to old thinking.

GORDON HESTER is a direct selling industry veteran, lecturer, consultant and an accomplished author. He is on the DSA Research Committee, the DSA Government Relationship Committee and is on the Board of the DSEF. Hester owns a stack technology company, Shapetech Solutions.

From the July 2021 issue of Direct Selling News magazine.