Obstacles in the New Economy & How to Beat Them

Direct selling is at a serious inflection point. With the triple threat of inflation, post-pandemic malaise, and the invasion of Ukraine continuing to burden sales for industry leaders, companies must ask themselves: how have distributor and consumer desires, expectations, and behaviors changed? Many direct selling companies have made the mistake of focusing on their processes, operations, and business results without considering the psychologies and behaviors of distributors and end consumers.

What can direct selling companies today do to account for these changes? How should direct sellers evolve to compete in the New Economy of the 2020s? The answers to the questions are at once simpler and more complex than most people think.

1. Distributors Are Tired.

While direct selling is somewhat siloed off from the larger economy (due to the industry’s singular nature), still, it can’t help but be affected by some of the dominant trends in the workforce. Chief among them is the same sense of overwork that sparked, first, the Great Resignation, and second, “quiet quitting” in traditional organizations. 81%+ of the workforce as of last year felt overwhelmed, while threats of a recession looming will not have helped matters in 2023.

The story isn’t all that different in direct selling, where 2021, the latest year with conclusive data, showed a 5.2% decrease in direct selling distributors overall. At best, it seems that consultant turnover rates remained stagnant through 2022, with sales productivity not reaching the highs of the pandemic, when members of the field were stuck at home and more likely to spend more time on social business-building at a time when loneliness was rampant among older adults.

In addition, distributors have simple ways to earn money that in their eyes, might not require as much initial effort. They can sign up with a gig platform. They can create an eCommerce shop after registering with Etsy. They can find part-time or freelance work. How can direct selling persuade distributors to give it their “timeshare” in today’s marketplace? If the New Economy has been defined so far by trends like the Great Resignation and quiet quitting, direct selling decision-makers need a way around this.

Direct selling field operations cannot proceed as normal without enhancing reliability, capability, and ultimately sales performance at scale among field distributors. Leaders in field operations and sales must reconsider how they drive field efforts or risk further corporate downturns.

SOLUTION: Embrace digital transformation and the benefits of modern technology.

At a basic level, direct selling is at even more of a disadvantage than traditional companies here. Distributors are obviously not employees and cannot be compelled to perform or be productive. They must be subtly, continually persuaded to sell. And so the “tools” that direct sellers use to appeal to distributors take on outsize importance.

The “tools” that distributors have access to, the means by which they onboard, upskill, and sell to consumers, are the points of connection between the company and the distributor: they are the main hinge point that binds the company together with the individual. When distributors see the company’s tools as bare bones, their estimation of the company goes down. When distributors see the company’s tools as state-of-the-art, their estimation of the company goes up. We see this borne out at Rallyware, where we provide an all-in-one field Performance Enablement Platform for sales forces.

Last year direct selling companies, after adding “Incentives & Recognition” tools to their Distributor Experience (i.e., the set of tools the distributor has access to), saw a 3.4X average increase in user sessions, meaning that richer, smarter, more state-of-the-art tools–or points of connection–result in a more engaged, less “tired” field.

We’ll dive into this more later, because from this solution alone, it’s not clear what kinds of tools are useful for the New Economy.

2. Consumers Are More Cautious.

Today’s consumers have to navigate inflation, a more uncertain job market, and the pressures of interest rates, all at once. It makes sense, then, that consumer-facing industries like retail and direct selling have seen downturns even among leaders. Meanwhile, as of December 2022, consumer spending on services had jumped 8.7% year over year, reflecting a shift in priorities away from tangible goods.

So part of the reason why direct selling has seen flagging distributor enthusiasm is this–it’s just become harder to sell. It’s harder to get customers to part with their hard-earned money. This is particularly true in the wake of the pandemic, when many consumers were spending more freely and now are tightening their purse strings. How do direct sellers drive field sales performance and behaviors, and thus more revenue (as well as earnings for distributors themselves, encouraging them to stay in the field)?

Again, though this might seem to be a consumer-facing question, it really impacts field operations. A maximally empowered field will be able to convert more customers. Operations and sales leaders would do well to pay attention.

SOLUTION: Embrace digital technology that connects distributor activities to real, measurable sales results. and the achievement of distributor goals and corporate business outcomes, at every turn.

Many technological, distributor-facing platforms simply provide “onboarding tools” or “learning tools” to make these processes easier, “digitalizing” them. While such tools can be helpful, they do not quite meet the moment nor the market, which require field sales performance enablement at every turn. Largely, Rallyware’s “Performance Enablement” model of technology architecture has been built to address this reality.

Performance Enablement means that each action taken by a distributor gets leveraged intelligently by the platform to enable higher (sales) performance. Nothing happens in a vacuum. When the distributor gets recommended learning content, the platform intelligently calibrates the right content to company KPIs (does revenue need to rise? How about retention?) and the distributor’s self-defined goals and sales progress.

The result is not just a “learning journey.” It’s a business-building experience attuned to the shifting needs and goals of the distributor, with the aim of driving the sales performance and behaviors that will benefit her and the company. Learning becomes upskilling, the enhancement of field capabilities. What we see is knowledge for the sake of enablement.

The point here is that it’s not enough to digitalize field operations, but to digitally transform the field experience in a way that enables and prioritizes sales performance. This explains why we’ve calculated that direct selling companies on average +53% sales productivity growth via upskilling in the Performance Enablement model. Distributors become active salespersons, not just reps to be bought from.

3. Distributors Want Direct Selling Companies to Care About Them.

With a larger amount of direct selling companies competing for a smaller amount of distributors, organizations have to stand apart from the pack. Furthermore, consumers generally want brands to care about them, and there’s no reason why distributors shouldn’t feel this way as well: after all, logically speaking, they’re representing a brand, and they should feel connected to it. Distributors want a personalized experience with the direct selling brand they rep–that feeling of, “Oh, they know me.” Having this capability is at the very least a way for an organization to stand apart.

This is a tall ask at a time when companies are competing to see how much they can cut costs. Every week brings a fresh round of layoffs for major companies (Amazon, Meta, Disney, Lyft), and though that wave may not have hit direct selling yet, still there’s the imperative in an uncertain environment to slash expenses. Yet how can you invest in personalization and recognition for the field while trimming budgets?

Surprisingly, you can do both by digitally transforming field operations using the Performance Enablement model.

Solution: Embrace consolidation in digital transformation.

Tech consolidation helps you both cut expenses, by cutting out multiple vendors, and further personalize the distributor’s experience. At Rallyware, we’ve found that the Performance Enablement model for consolidating tech has borne fruit. Customers bring multiple tools under one umbrella, saving money and time spent on separate vendors.

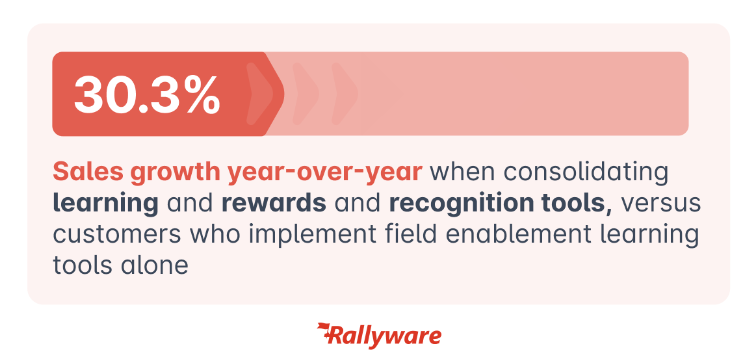

At the same time, data from separate tools flow into the results and recommendations from the others. This leads to an optimally personalized experience, enabling the distributor for sales performance in the way that’s right for her. The business outcomes are significant and measurable. To be specific, on average, our internal research has found, direct sellers see 30.3% sales growth year-over-year when consolidating learning and rewards and recognition tools, versus customers who implement field enablement learning tools alone.

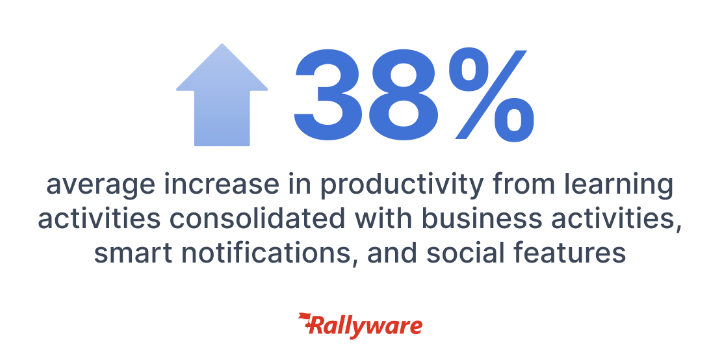

Further, as we discuss in our Performance Enablement Platform white paper, learning activities consolidated with business activities, smart notifications, and social features result in an average 38% increase in productivity.

Cutting costs while doing more with your technology sounds like a paradox, doesn’t it? It’s not, really. It’s simply what’s required to grow in, and transform field operations for, the distributor and consumer of the 2020s. And it’s what Performance Enablement technology is built to provide.

Finally, breakthrough technologies like an Artificial Intelligence (AI) Chat Agent will help the distributor feel a connection with the brand, the company, and its products. In essence, this Chat Agent, as developed and exclusively provided by Rallyware, uses the latest advances in natural language processing to deliver an AI-enabled smart assistant to the distributor, answering her queries and showing her not only answers, but sales aids and suggestions to help her sales performance. With an easy-to-use, mobile smart assistant, the distributor feels cared for. She also feels: this company is on the cutting edge of technology. She trusts them.

Rallyware invests in, and delivers, major leaps forward in direct selling technologies. We’re transforming direct selling today with the tools and products of tomorrow. Accelerate your digital transformation and clear the competition. Request your demonstration today.