Are You Keeping Pace?

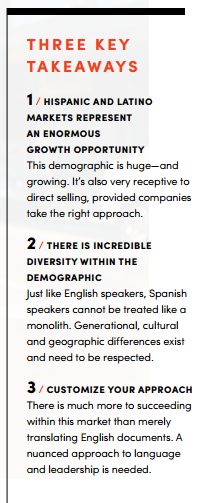

Building a smart international expansion strategy means looking for momentum-building markets with untapped growth potential. In 2024, that indisputably includes the Hispanic and Latino markets.

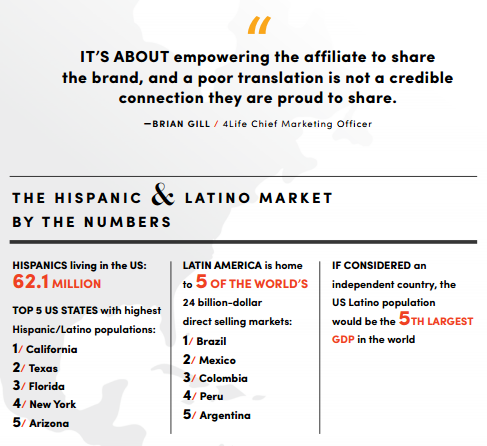

In Mexico alone, the direct selling market is projected to surge to $19.48 billion by 2028. That staggering number doesn’t include the more than 60 million Latinos living and working within the US, or the fact that direct selling is already a staple for the Latin American population, where a quarter of beauty and personal care sales take place through a direct selling relationship (compared to eight percent globally).

“Latinos in the United States represent a larger consumption market than the entire economy of nations like Italy, Canada or Russia,” shared Judith Sanchez Lopez, PM-International General Manager, Latin America. “If Latinos living in the United States were an independent country, the US Latino GDP would be the fifth largest GDP in the world, larger than the GDPs of India, the United Kingdom or France.”

There are a number of direct selling companies who have already captivated the Hispanic and Latino markets and are thriving. There are two distinct scenarios at play here: US-based companies that are dominating in Hispanic markets and foreign-based companies doing the same.

DSN 2023 Bravo Growth Award winner Princess House successfully serves this corner of the US market. Other examples include 4Life, Hy Cite, Immunotec and relative newcomer ACTIVZ. These companies are also strong in other Spanish-speaking markets.

Betterware de Mexico and Omnilife are based in Mexico and making huge strides in that market and throughout the region.

It could be tempting to assume that the same strategies and approaches that work for US customers would be a fit for the Hispanic population living within the US, or even the neighboring Latin American populations, but that assumption is a sure-fire way to fail. Ignoring the unique communication styles of each individual market is not only ineffective, it’s disrespectful. There are cultural sensitivities that should be honored; product preferences that need to be prioritized; and local talent that deserve to be elevated to leadership.

“Companies that want to be successful need to stop making Latin American countries an extension of their current market,” said Mauricio Domenzain, Immunotec Chief Executive Officer. “By that, I mean you really need to commit to the market. We can’t simply send one manager to Latin America now and then wait to see if it’s going to work or not. It’s a full commitment, not just the addition of another flag on your wall or your website. You have to truly become part of that market to understand the cultural needs.”

Copy and Paste Isn’t a Strategy

What works in the United States doesn’t automatically translate to success on a global scale. That goes for products, but it’s also a good rule to live by when it comes to communication, marketing materials and events. For companies founded in the US or who predominantly operate within the US, expanding to include Spanish-speaking consumers is not as simple as hiring a translator or relying on Google Translate. These translations are often choppy, with no regard for local idioms or speaking rhythms.

Solving for this pain point has been a game changer for brands like 4Life, who overhauled their communication process to treat Spanish as its own first language rather than relying entirely on English. The company now enlists two separate content creator teams, one who is primarily English-speaking and one who is primarily Spanish-speaking, to design materials. The end result prevents poor translations that damage credibility.

“If you go to our convention, we are 80-85 percent Hispanic,” said Brian Gill, 4Life Chief Marketing Officer. “Five years ago, out of respect, we stopped translating English to Spanish. It’s not enough to have great translators. A Hispanic whose primary language is Spanish should be the one creating our materials. It’s about empowering the affiliate to share the brand, and a poor translation is not a credible connection they are proud to share.”

Homogenous, hand-me-down resources communicate the message that international markets are inferior, less valuable and unappreciated. Conversely, when companies allocate the resources and staff necessary to maintain and develop a culturally relevant, localized brand with tools that take local language, lifestyle and history into consideration, customers and distributors take note. A successful entry into Hispanic and Latino markets is one that allows the population to embrace entrepreneurial opportunity while preserving its own cultural DNA.

“Entering the Hispanic market was not secondary or an afterthought; it was our primary thought,” said David Brown, ACTIVZ Chief Executive Officer. “Our Spanish-speaking distributors are constantly amazed that they get new products and materials first and that they weren’t translated from English. Everyone responds well to attention and responsiveness, and that’s probably the secret to our success.”

Honor Culture Past and Present

Family is a core value for the Hispanic and Latin American markets, and consumers in these demographics typically have great reverence for their parents and their tightly-knit communities. The US ethos of independent, self-made success doesn’t land the same within these cultures, so even well-intentioned corporate leaders commissioned from the company’s US headquarters could get off on the wrong foot without realizing it.

“It’s not only the language, but it’s also the culture that you need to understand,” explained Domenzain. “You need to have people on the ground—people directly from those markets—who understand and can serve that market the correct way.”

Leaders also need to consider how each new generation brings their own energy and inspiration to the foundational values of the Hispanic and Latin American cultures. From a corporate standpoint, that means being willing to adjust the speed and style of work. Omnilife addressed this generational evolution by implementing a shift from graphic design to a focus on social media, leaving behind big format printing in favor of video and digital formats and encouraging all of its departments to embrace the Gen Z style of work, which is quick to adapt to change.

“We are integrating younger generations into our corporate team, and that has helped make us relevant,” said Eduardo Ros, Omnilife Marketing Manager. “Our communications and packaging have become younger. We have received testimonies from people in Ecuador and Peru who tell us that working with second- and third-generation distributors who are younger has helped them see how best to take advantage of this opportunity and approach the business differently.”

Recognize the Uniqueness of Each Market

Each country and community has its own unique traditions and habits, and the Latin American market is no exception. There is no one-size-fits-all approach that would respectfully reach this vast audience, and it’s important to remember that there are distinctions among the adjectives often used to describe this diverse group of cultures within and outside of the US. The word Hispanic describes Spanish speakers, including those living within the US and Spain, while Latinos is reserved for those living within Latin America, including Brazil, where Portuguese is the official national language.

“Hispanics in the US are not a monolith,” Sanchez Lopez said. “They are a combination of countries, cultures, slang, levels of acculturation and generations. You need to decide who you want to target, understand what sets them apart and then ask yourself if your company is communicating and interacting in a way that respects their cultural differences and strongest drivers.”

For companies with a broad footprint across countries with similar but distinct cultures, discovering what makes each market tick is critical to securing healthy, welcomed growth among distributors and potential customers. Hy Cite, for example, courts Latinos in eight different countries, including the US and Brazil. Efficiency is incredibly important, so the company harmonizes its content, but it also takes care to modify even the smallest details to communicate that each individual market matters.

“The way we present our products changes depending on the audience,” said Paulo Moledo, Hy Cite President and Chief Executive Officer. “Our recipes used on social media, for instance, feature arepas in Colombia and tacos in Mexico. We also pay attention to our call center services. We learned the hard way that the agent accent speaking to customers from different markets is an important variable.”

Moledo also emphasizes the significance of making sure corporate expresses with actions that they value distributors’ wellbeing just as much as their earning opportunity. For Hy Cite, that means facilitating a close relationship between executives and top leaders; leaning into recognition; and designing ways for distributors and customers to voice their opinions and experiences.

“Latinos, more than most, need to feel heard,” Moledo said. “As fast as we could after the pandemic, we started having events, conventions and meetings with independent distributors, and the attendance has been outstanding. We invest more today in events than we did pre-pandemic, but the return on that personal, face-to-face touch is great.”

Operating with inclusion and respect as the highest priorities is non-negotiable. It’s imperative that companies take the extra steps to ensure the opportunity they are presenting is tailor-made for the audience receiving it, and that their presence improves the quality of life for the people who call that country home. When diversity of backgrounds and ways of doing business are treated with dignity and honor, executives who have successfully built bridges into the Latino and Hispanic cultures say there is a shared entrepreneurial spirit that transcends language barriers and countries of origin.

“It doesn’t matter what language you speak or what country you’re in, everyone is looking for the same thing,” Domenzain said. “To be a part of something bigger than yourself.”

From the November 2023 issue of Direct Selling News magazine.