The Founders of Three Multimillion-Dollar Direct Selling Companies Share the Lessons Learned From Building Their Brands From the Group Up.

The courageous entrepreneur who ventures into building their own startup is destined to face innumerable challenges. Marketplace disruptions, supply chain upheaval and talent mismatches are just the tip of the iceberg. Unforeseen obstacles litter the road for startup leaders, and yet, it’s the success stories we tend to fixate on. While these victories are inspiring and worth applauding, the behind-the-scenes moments of mistakes made and the actionable insights that follow are where true momentum can be found.

To learn from this valuable startup mentality, Direct Selling News sat down with three direct selling founders leading multimillion-dollar brands to uncover the challenges their companies have faced and the valuable insight gained from the solutions they designed.

Lorde + Belle: Learning to Act Like a Startup

In a startup, financial security is a goal, not an entry point. For Lorde + Belle Founder and CEO Bill Xiang, who had already built two successful companies and worked in the beauty industry for 15 years, there were still valuable lessons to learn about navigating a direct selling startup. Xiang’s financial cushion allowed him to fund the venture and avoid the bootstrap mentality that requires a lean executive team and innovative problem solving. Instead, he was able to recruit corporate leaders from megawatt brands and scaled the company into a massive engine before it even got off the ground.

“We didn’t treat this company as a true startup,” Xiang said. “In reality, our organization and operations were a startup, but we were treating it like a multimillion-dollar company. That doesn’t go well in a startup environment. We had the wrong corporate mindset, the wrong software, the wrong operations. It was like getting out of mud in the beginning; it took a lot of energy.”

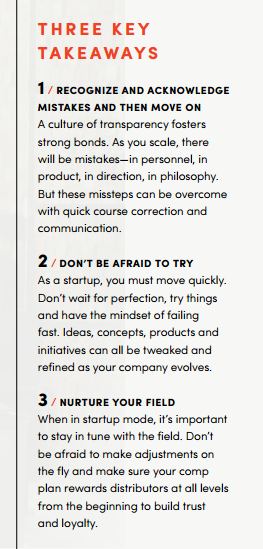

There was no skyrocketing to success in those early days, and Xiang discovered that the beauty category within direct selling was its own unique niche. The first year became about what Xiang calls “failing forward” and recalibrating his leadership style. He ditched his sidelines managerial approach and dug into the tedium of the business, working in every aspect of the business, including IT, customer service, warehouse, product development and hiring a team that would align with his redirected vision.

Above all, Xiang embraced transparency. By being open and honest with the field, he was able to build trust and loyalty and create alignment between the corporate team’s goals and the field’s expectations.

“I’m always transparent with the field when challenges and setbacks happen, but I also tell them we are not giving up. The field will stick with you because of your belief if you don’t give up,” Xiang said.

Today, Lorde + Belle has reached an exciting phase where leadership dynamics are in sync, and the company is seeing steady, organic growth.

Now, Xiang, his corporate team and field leaders are aligned, harnessing everyone’s experiences to elevate Lorde + Belle from a startup to a legacy powerhouse. “We’ve evolved to create a unique, one-of-a-kind hybrid omnichannel model that fosters true entrepreneurialism, legacy and family.”

pawTree: Steady Growth Is Healthy Growth

Roger Morgan specialized in the pet retail business before launching pawTree in 2014. He knew how to identify market opportunities and how to scale growth and teams to build strong, sustainable profitability. Which is why, when pawTree’s initial month-over-month growth was strong but didn’t happen at the explosive rate expected, it was a sobering reality.

“We built it, and they didn’t really come pouring in like we had hoped,” Morgan said. “That was kind of frustrating, and it led to lots of experiments and new ideas and things to try. It was a year of making constant tweaks, and honestly, we’ve continued to make tweaks and try new things for ten years to accelerate growth, and we’ve had ten years of consecutive record sales. I don’t know that we ever stopped, and I don’t know that we will ever stop testing and trying things.”

Morgan’s experience didn’t offer any shortcuts for building pawTree from the ground up. He was used to dropping products in big box retailers and having instant and widespread brand recognition, but direct selling brand awareness is a slow burn that requires time and word of mouth. That deliberate, steady start created a solid foundation for the company to build upon, and Morgan now sees the direct selling model as something that has insulated the company from threats that harmed or took out some of his competitors.

“The big box retailers are constantly pushing you down in terms of cost, which requires some suppliers to reevaluate their quality levels,” Morgan said. “We’re not dependent on any one major retailer. We don’t have to do what they say or risk losing a huge chunk of our revenue. That lack of customer concentration risk really allows us to be in the driver’s seat with our brand; with our product quality; and with our pricing. We don’t have to apologize for it.”

Color Street: The Direct Selling Learning Curve

Before Fa Park founded Color Street, his category-creating nail polish strips caught the eye of major retailers. Beginning in 2005, he became a supplier for Walgreens, Walmart, Ulta, Sephora, Sally Hansen, Revlon and 3,000 retailers in Europe. The production, research and development, manufacturing and lab science all happened in-house, so when he launched Color Street in 2017, the company was already supported by 300 trained employees.

Growth happened at exponential rates, posting sales of $120 million in 2018 and then growing to six times that amount by 2021. At this pinnacle, Park, who was still adapting to direct selling culture, began to notice opportunity disparity in his field. The compensation plan design he had outsourced to a consulting company had created an unfair distribution of income.

“Some levels made too much money, and the middle and lower levels were struggling,” Park said. “Stylists who did not join early should still have access to an equal opportunity for their efforts. That is why I changed the compensation plan to be more balanced. I wanted to build the company culture to be fair and support our Stylists.”

The shift, while a positive move, collided with the seismic economic shifts brought about by the pandemic and the availability of gig economy jobs. Within two years, Color Street saw an anticipated decline of Stylists, many of whom were the company’s top earners. It was a setback that inspired a new vision for Park, who is now on a mission to make Color Street a direct competitor to tech gig companies and their instant paychecks.

“Our fundamental business environment was changed,” Park said. “Our DNA is to develop the best innovative product. We don’t have to worry about the future because our product is the value, but I already have a number of teams—an economic business research team and others—who are proactively determining how we can transform to make sure our Stylists earn income quickly.”

From the July/August 2024 issue of Direct Selling News magazine.