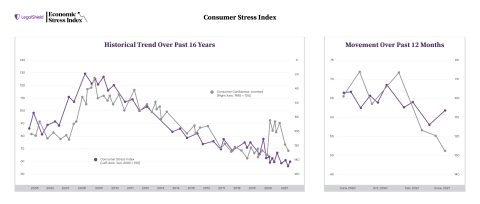

LegalShield released its June Economic Stress Index which includes five sub-indices—Consumer Stress, Bankruptcy, Foreclosure, Housing Construction and Housing Sales—that indicate the economic and financial status of U.S. households and small businesses. The LegalShield Consumer Stress Index rose in June for the second consecutive month. The index’s consumer finance component peaked, reaching record levels, as plan members sought assistance with credit reports and repair, vehicle financing, title loans and billing disputes. The index worsened by 1.7 points in June, totaling 61.5.

“While stimulus payments, federal protections, and forbearance programs have kept consumer stress muted throughout the pandemic, financial strain appears to be increasing as government interventions are being phased out,” said LegalShield CEO Jeff Bell.

The Bankruptcy index continues to remain low, recording its second-lowest reading to date. Bankruptcies and foreclosures will be important to monitor as federal protection programs expire, but the data does not suggest an imminent increase.