4 Reasons for Direct Selling Optimism Post-Pandemic

Direct selling demonstrated its resilience in a challenging environment in the last year achieving record highs in sales, sellers and customers in the U.S.

As the U.S. economy continues its recovery from the pandemic, a continued rapidly evolving retail and labor market provides opportunities and challenges for direct selling, along with a few key reasons for long-term optimism.

Before we dive into the direct selling-specific data and analysis, below is some macroeconomic context with trends impacting the direct selling channel.

STATE OF U.S. ECONOMY

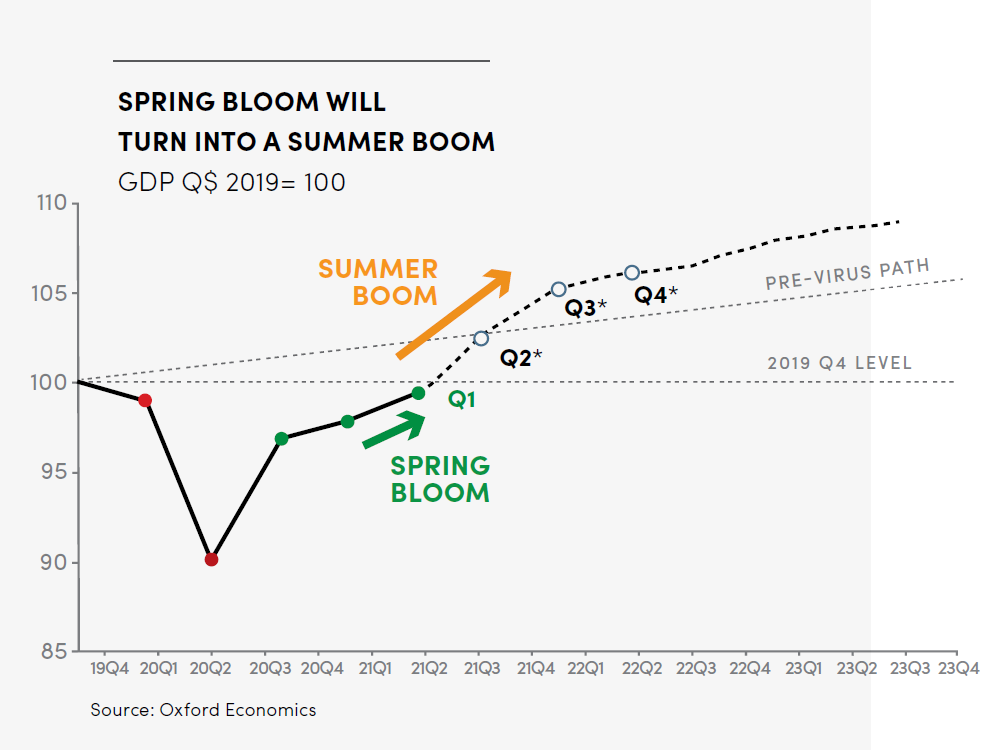

Although last year’s recession triggered by the Coronavirus pandemic was historically sudden, deep, and broad, the recovery in the U.S. has been faster than many initially expected.

Oxford Economics expects U.S. GDP to exceed the pre-pandemic level and pre-pandemic growth path by Q3 of this year.

Last month, the National Retail Federation issued an upward revision to its forecast that retail sales will increase “between 10.5 percent and 13.5 percent to more than $4.44 trillion this year as the economy accelerates its pace of recovery.”

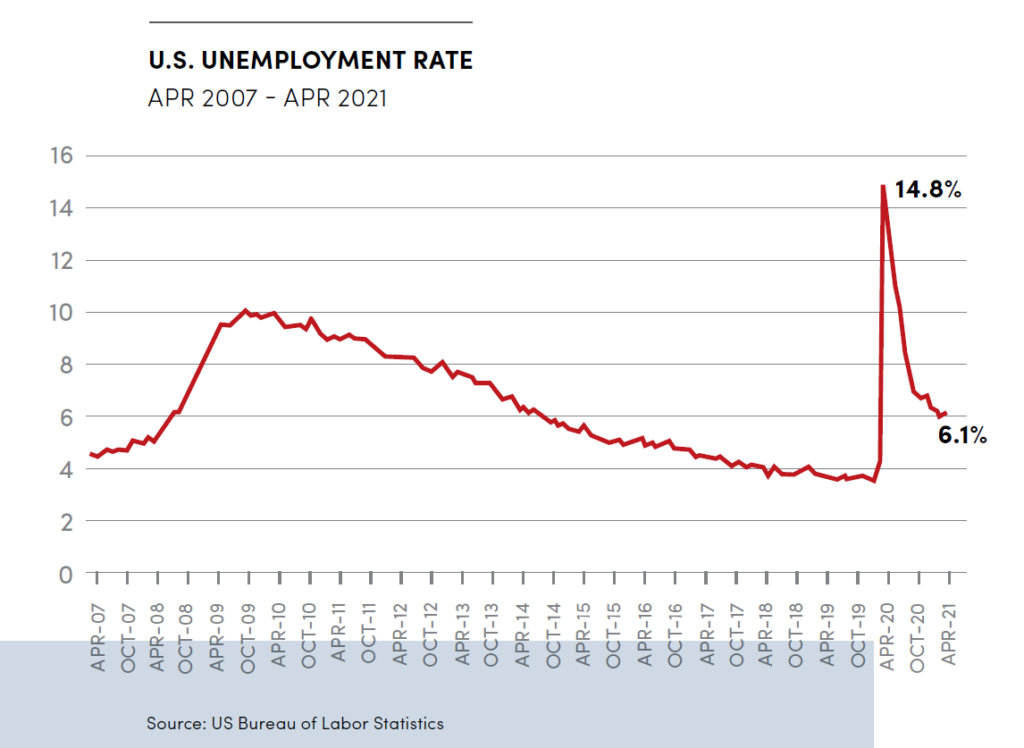

After a spike in the unemployment rate well exceeding Great Recession levels, unemployment is continuing to decline toward pre-pandemic levels:

The U.S. Congressional Budget Office forecasts the unemployment rate will rebound to its pre-pandemic level in 2022.

Consumer confidence is also nearing pre-pandemic levels. In part due to increasing values of stocks and homes, U.S. household wealth increased to a record $136.9 trillion in Q1, 2021. (This represents a 3.8 percent increase over the previous quarter and almost double Americans’ wealth from 10 years ago). And, thanks to government stimulus efforts, American income and savings is higher than pre-pandemic.

However, not everything in the economy is going smoothly: Global supply chain challenges are widespread, and inflation is edging up. Although, there is reason to think these inflation/supply issues will not be long-term. According to Chief U.S. Economist at Oxford Economics, Greg Daco, “Inflation is a feature of this recovery, not a bug. Essentially it reflects this imbalance between very strong demand from consumers and businesses and a gradually responding supply to that very strong demand. And, as there is this mismatch between very strong demand and gradually accelerated supply, there are pockets of price pressures.”

DIRECT SELLING HAS DEMONSTRATED REMARKABLE RESILIENCE

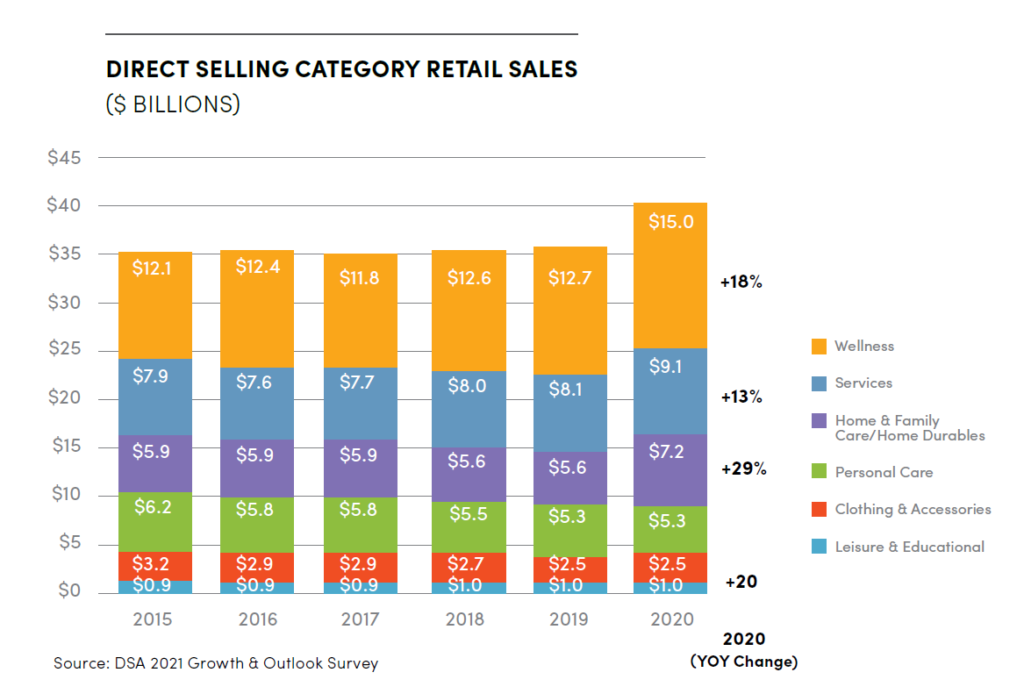

According to DSA’s 2021 Growth & Outlook Survey, direct selling set record highs in sales ($40.1 billion), direct sellers (7.7 million), and customers (more than 41.6 million) in the U.S. in 2020.

Following are more detailed breakdowns of these stats and some potential drivers of the growth.

In the last year, direct selling was a source of in-demand products and services during a time when brick and mortar was largely shuttered and other parts of retail were slowed by significant supply chain issues. You can see growth across many categories within direct selling, much of which is reflective of broader consumer trends.

Increasing Customer-Centricity

Customers reached an all-time high driven by a 19.4 percent YOY increase in preferred customers* to 32.6 million in 2020. (*Preferred customers are those that have signed a preferred customer agreement with a direct selling company where they may be eligible to pay wholesale prices for products/services. They are not eligible to sell products/services to others, and they are not eligible to earn).

According to DSA-Ipsos 2020 Consumer Attitudes & Entrepreneurship Study, consumers value the following most about direct selling; “I feel good about supporting a small business” (69 percent) and “the personal service that direct sellers provide” (67 percent).

There was also a record high in direct sellers in 2020, with 7.7 million direct sellers in the U.S. in 2020 (a 13.2 percent increase over 2019).

The DSA-Ipsos 2020 Consumer Attitudes & Entrepreneurship Study shows that Americans still desire entrepreneurship and supplemental income opportunities. Direct selling compares favorably against the alternatives such as the gig economy.

How Does Direct Selling Achieve Sustained Growth?

First, there are a few key challenges/questions the direct selling channel must overcome:

- As retail competition ramps up with the continued reopening of brick & mortar, will that have a negative impact on direct selling?

- As the labor market tightens (nearing full employment, labor shortages, rising wages, and increasing demand for gig competitors like Uber, Lyft, Airbnb, etc., which were negatively impacted during the pandemic).

The following are four reasons for optimism for direct selling overcoming these challenges:

- According to DSA’s DataTracker (quarterly KPI-tracking survey), QuickPulse (monthly pandemic/recovery-tracking survey), and public company Q1 filings, there’s no indication that direct selling growth is slowing in 2021 YTD.

- Americans’ expectations of work are shifting. There are indications that entrepreneurship and flexible, supplemental earning opportunities will still be in demand. Even with declining unemployment, there will likely be demand for diversified, supplemental income streams. Direct selling continues to compare favorably.

- DSA’s 2021 Digital Transformation Study shows several direct selling companies invested significant resources to transforming their companies virtually including: e-commerce/mobile commerce, social selling, virtual events, faster payments, etc. These digital transformations likely put those companies in a stronger position to compete even as the brick & mortar reopens and retail competition ramps up. The ability to combine the improved e-commerce/m-commerce/social selling experience and its increased reach with the personal touch that is a key differentiator for direct selling and can help drive sustained growth.

- There are several possible post-pandemic retail trends that direct selling can capitalize on:

Community

- Direct selling provides consumers with personalized knowledge and recommendations on products and services, coaching and support in reaching personal goals (e.g. weight loss, fitness, cooking, etc.), and it provides a broader sense of community (which can all be important as people seek face-to-face community and connection after the pandemic).

Rachel Bonsignore, Vice President, GfK Consumer Life at GfK said, “There’s a couple of areas to think about when you consider consumers and where they stand in this critical moment as well and in the near future. One area that we’ve really been looking closely at is how the rise in social responsibility in the last couple years has really transformed into a stronger emphasis on community and connecting with people locally. We’ve seen people increasingly say that they want to belong to groups that share their interests or beliefs, that they express themselves through their communities or their cultures. We’ve seen throughout the pandemic that things like mutual aid and supporting local and small businesses have really been a way for people to leverage the power of groups and the power of community. We think that’s a really interesting trend that is going to continue as people move further away from self interest and only doing things because it’s something they want and realizing it’s something that serves the collective good and mutual interest.”

Meeting customers with anything… anywhere, anytime

- As Steve Dennis says in Remarkable Retail, “the power in retail has shifted to the consumer.” As the American consumer becomes more knowledgeable, expectations increase, and behavior continues to shift, it’s important for retailers to continue to meet consumers where they are. Direct selling has shown agility in going digital in the last year. Now, there will likely be more of a balance of in-person.

- “We’ve seen that balance of power in the information age—the access consumers have to the info about the brands they want to shop and frequent. It’s shifted even further, and it’s accelerated in favor of the consumer who now shops for anything, anywhere, anytime, and does so with a different mindset from even a few years ago… In this environment, understanding the customer and anticipating what they need, what they want, and then offering products, services, and the experiences that resonate with that customer is increasingly critical to the success and survival at a time when the industry is evolving so quickly.” -Matthew Shay, CEO National Retail Federation

In-person sales will still represent the majority of retail for the near future

- According to Emarketer, “Following a strong Q1 fueled by government stimulus, we have increased our forecast for U.S. retail e-commerce sales in 2021. U.S. e-commerce sales are expected to grow 17.9 percent this year (higher than the 13.7 percent predicted in January 2021) to reach $933.30 billion. That pushes e-commerce’s share of total U.S. retail sales to 15.3 percent, up from 14.0 percent last year. E-commerce is now on track to surpass 20 percent of total retail by 2024.”

Even though e-commerce grew at 32 percent last year and is expected to grow 18 percent this year, e-commerce only represents a fraction of overall retail. (15 percent by Emarketer estimates). The reopening of in-person shopping provides an enormous opportunity to meet customers where they are and combine the best of both worlds, leveraging the reach and convenience of online with the community, coaching, and personalization of in-person.

Despite the predictions above, we don’t yet know exactly what direct selling and retail changing consumer behavior will look like in the second half of 2021 and beyond. We do know it will be constantly changing, evolving, and require continued innovation and creativity on behalf of retailers.

DSA and its Industry Research Committee are still working to establish our forecast for 2021 and beyond, which will be included in DSA’s 2021 Growth & Outlook Report to be published later this summer. This Report will provide a forecast and actionable recommendations on how to leverage trends impacting direct selling to meet or even exceed the upper bands of this forecast.

Revisiting Antifragility

Last year in this publication I explored how direct selling can be “antifragile” or being able to benefit from volatility and disorder. What worked in the last 16 months may not be what works in the next 16 months. But, using this as a continued opportunity to strengthen your business, continuously adapting can position direct selling for long-term growth.

As Harley Finkelstein, President of Shopify says, “It feels like we’re in a time of great breakage, of great change. And it feels to me like what is emerging through this global pandemic are two types of people and two types of entrepreneurs and two types of individuals, which is those that are resistant that are waiting for things to go back to the status quo that are looking forward and anticipating when normalcy will return. But then there’s this whole other cohort of people, a whole other cohort of businesses even, who are resilient, who are not waiting for the status quo to return but rather are thinking about how they can use what is happening as this incredible catalyst to change everything and to pivot and to adapt.”

Why aspire to return to normal when we can use this as an opportunity to be creative, innovative, and reimagine the channel?

BEN GAMSE, Director of Industry Insights, Direct Selling Association, is passionate about uncovering market trends, understanding consumer behavior, and delivering actionable insights to help make better business decisions and drive growth. For more than eight years, Ben has led the market research department at Direct Selling Association