-

February 2025Brought to you by Direct Selling Capital Advisors

Direct Selling Index Drops Slightly in February but Outperforms the DJIA for the Second Consecutive Month

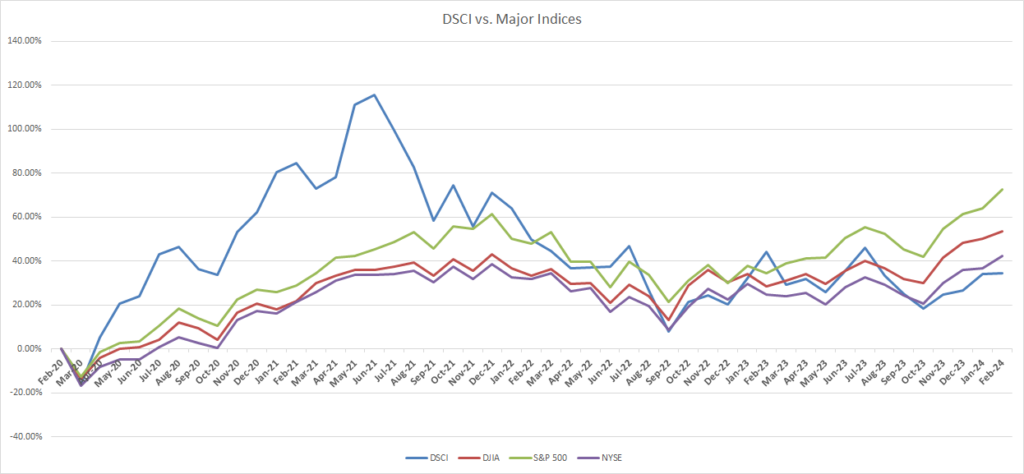

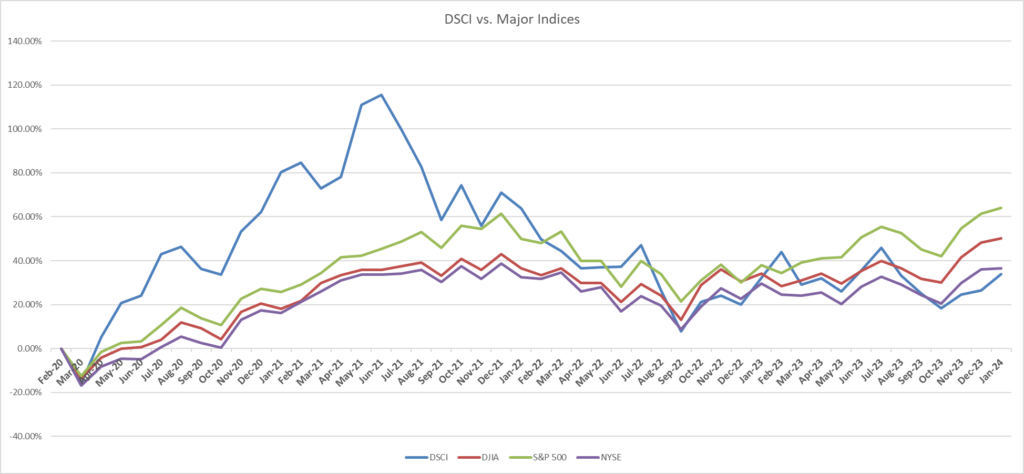

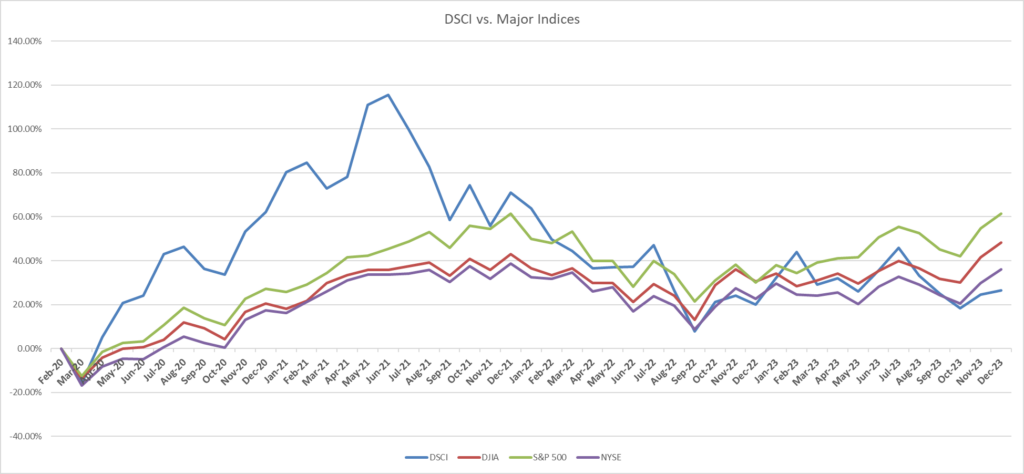

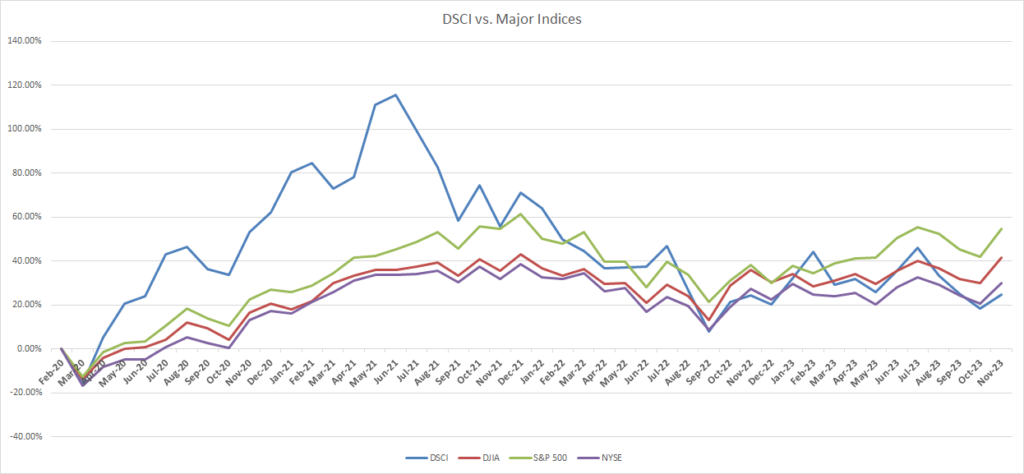

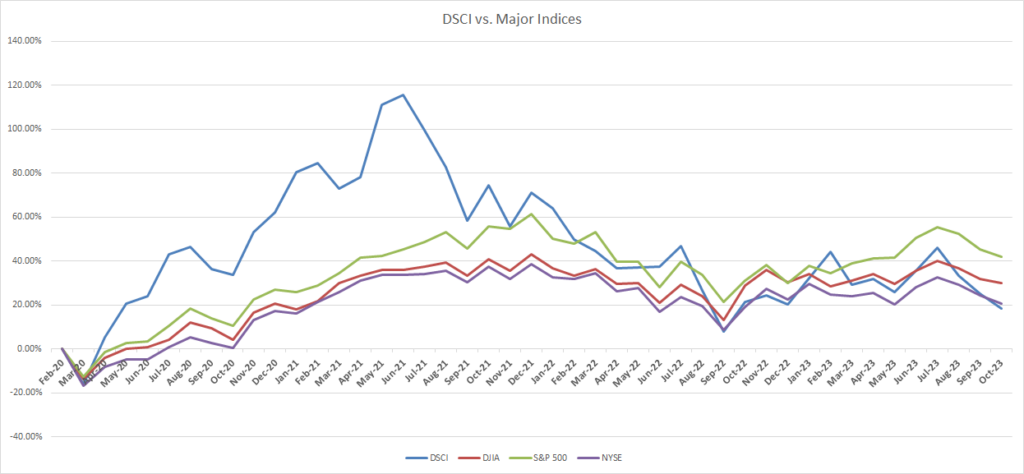

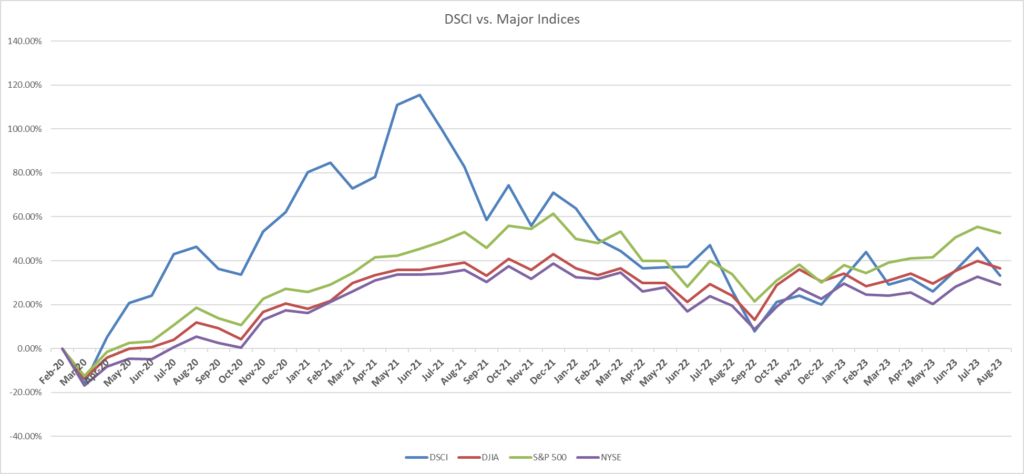

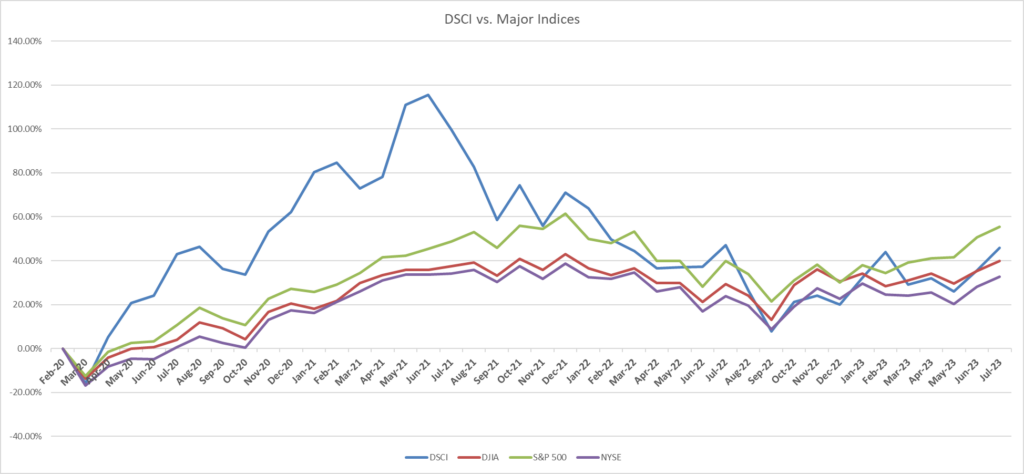

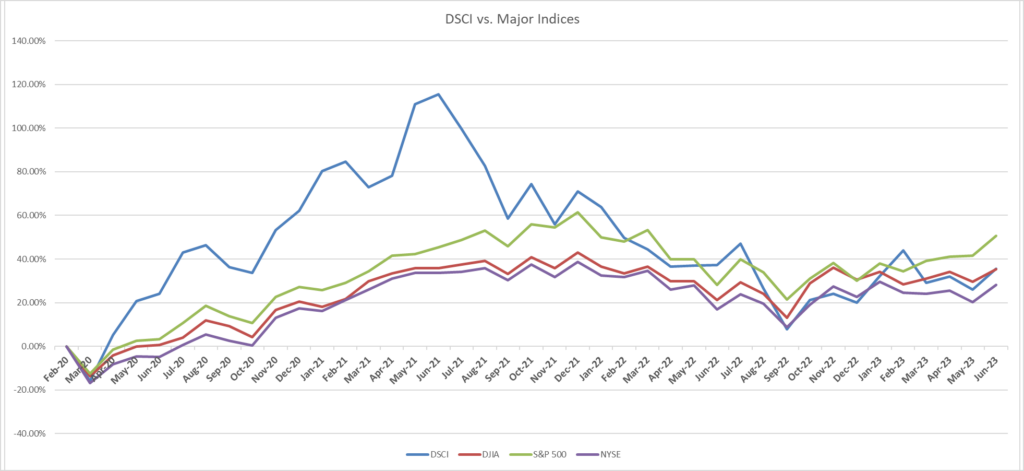

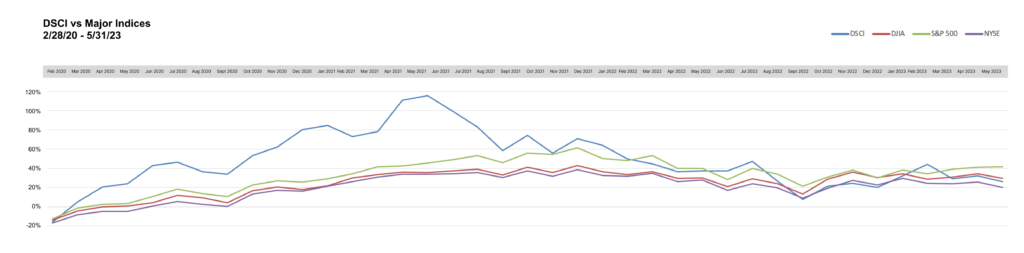

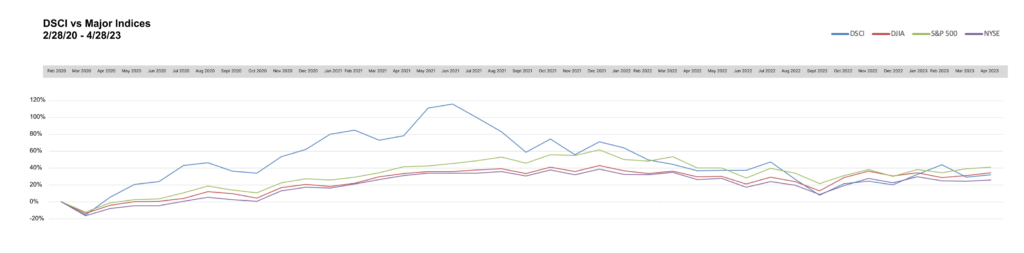

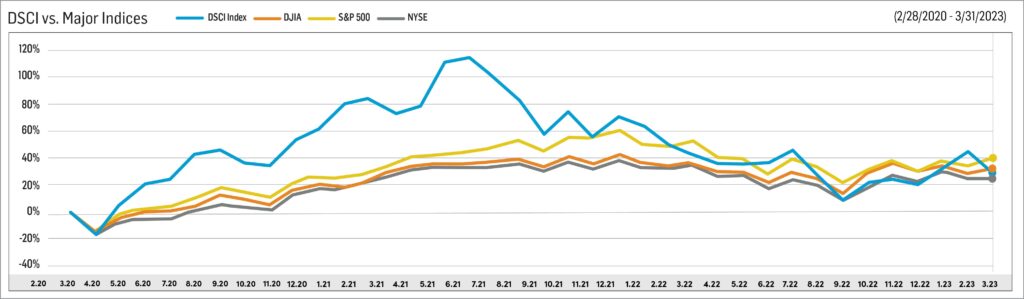

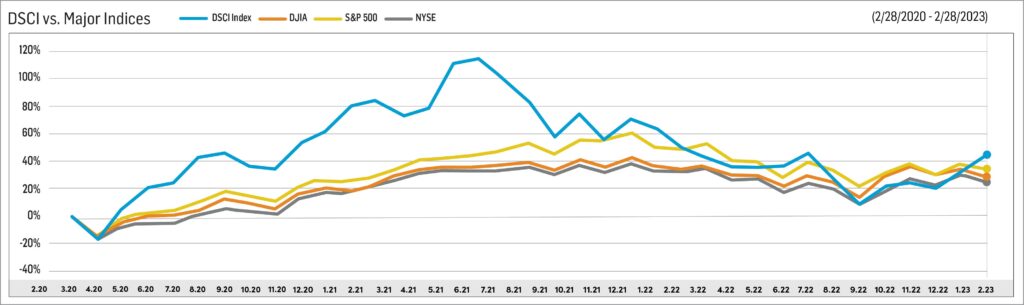

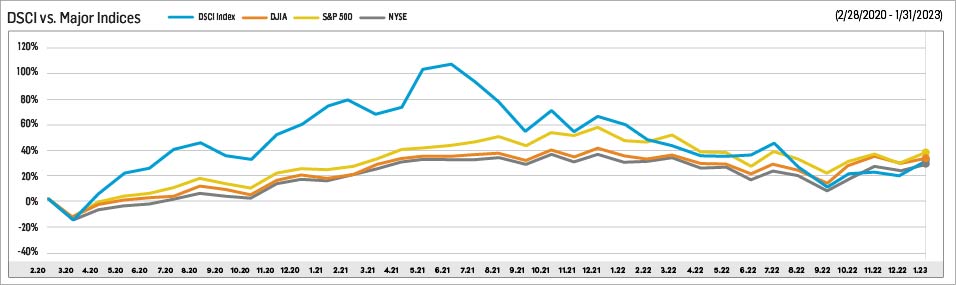

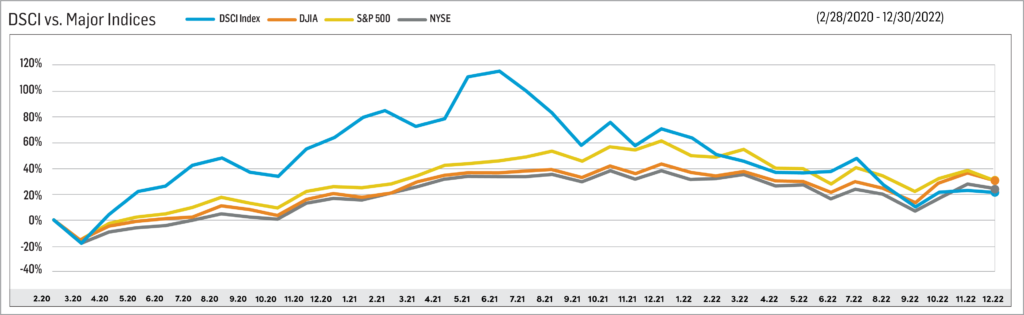

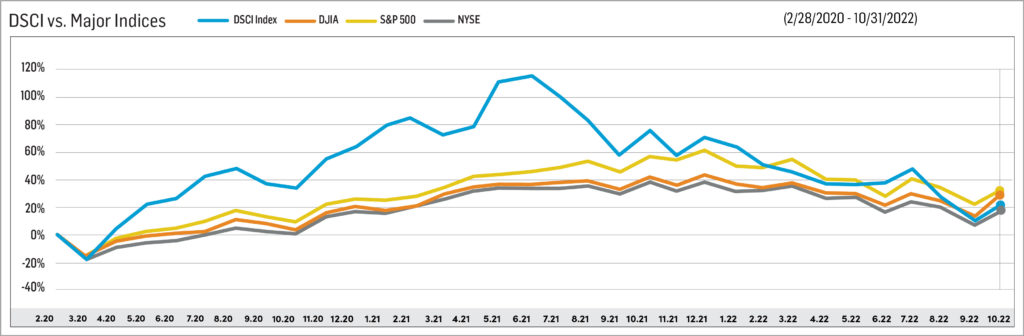

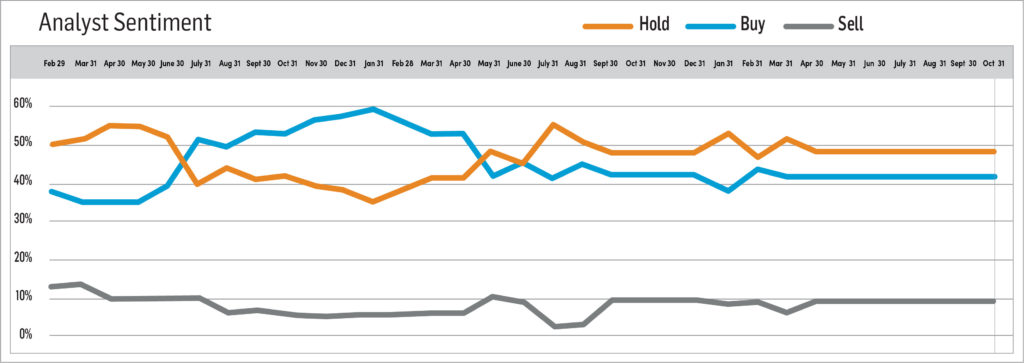

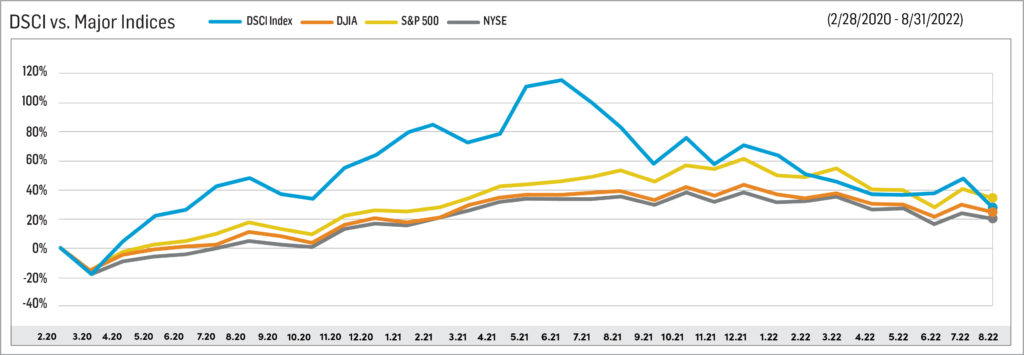

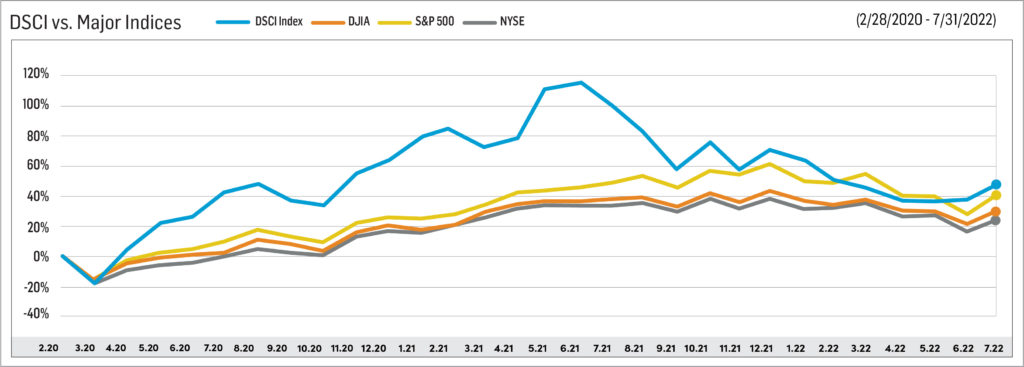

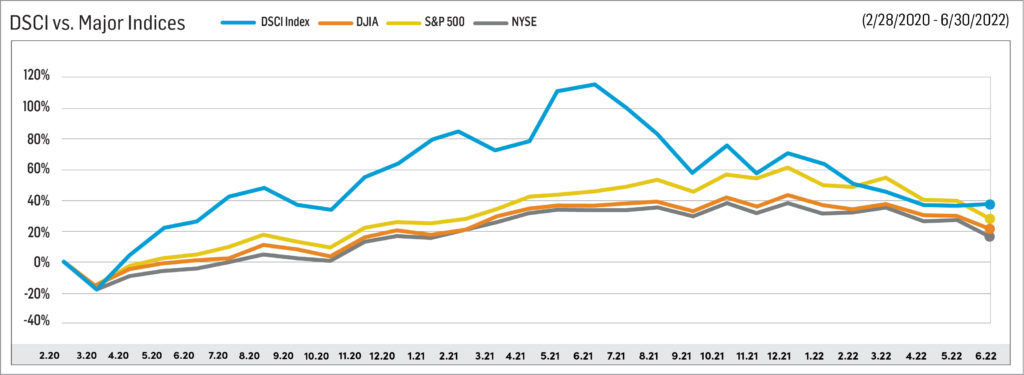

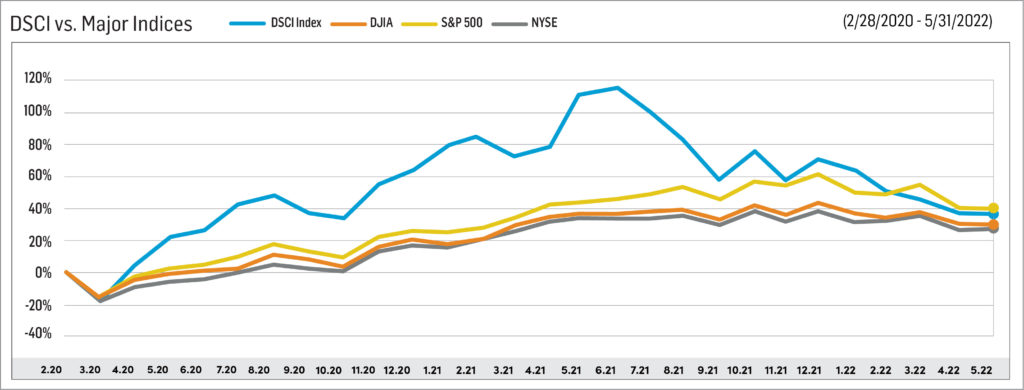

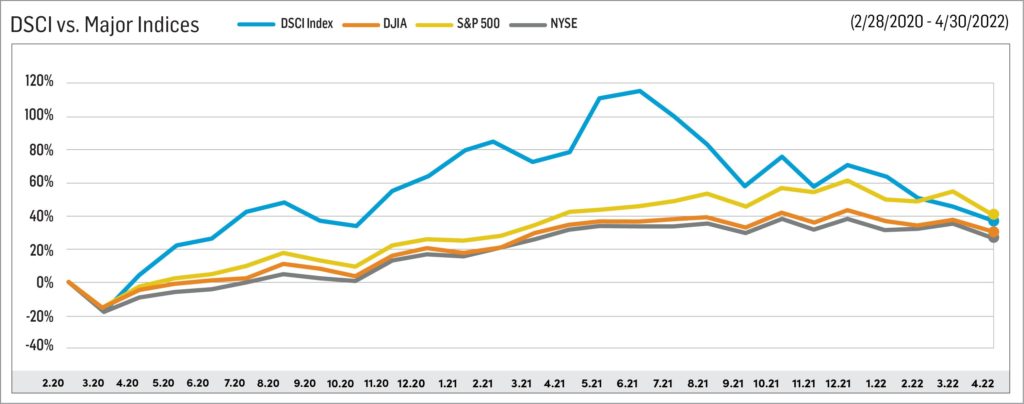

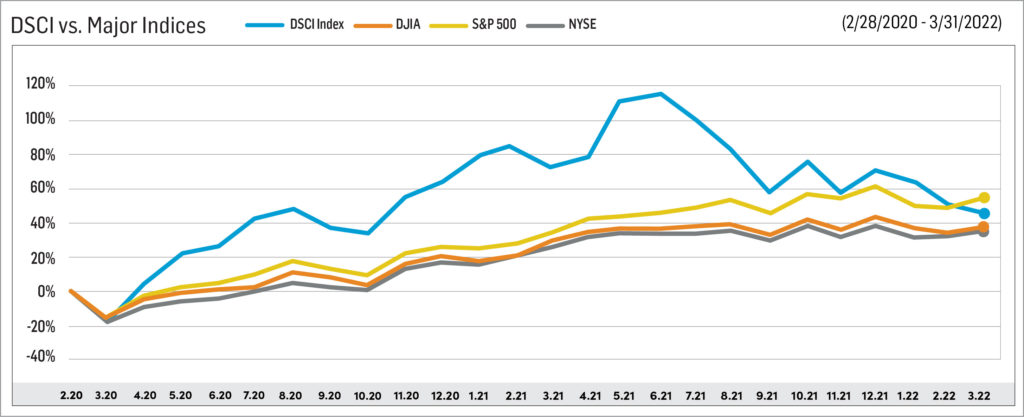

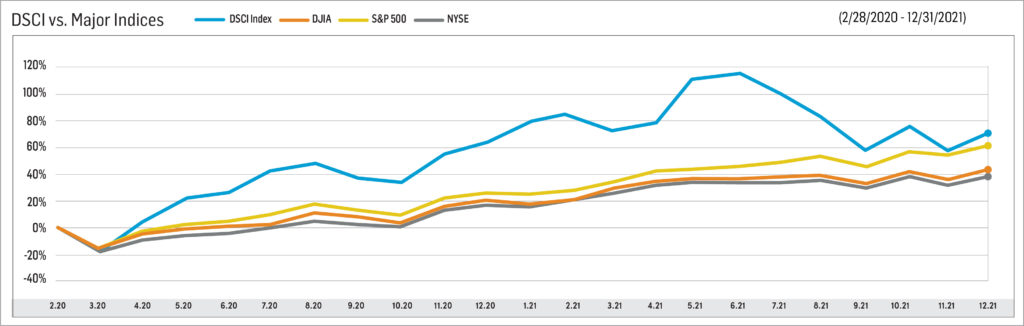

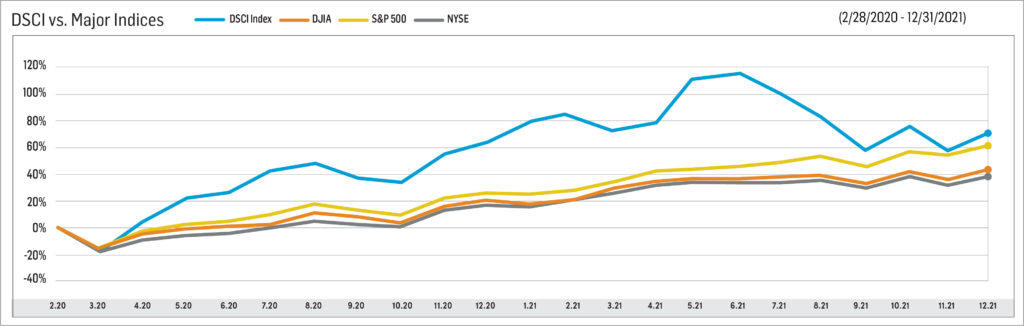

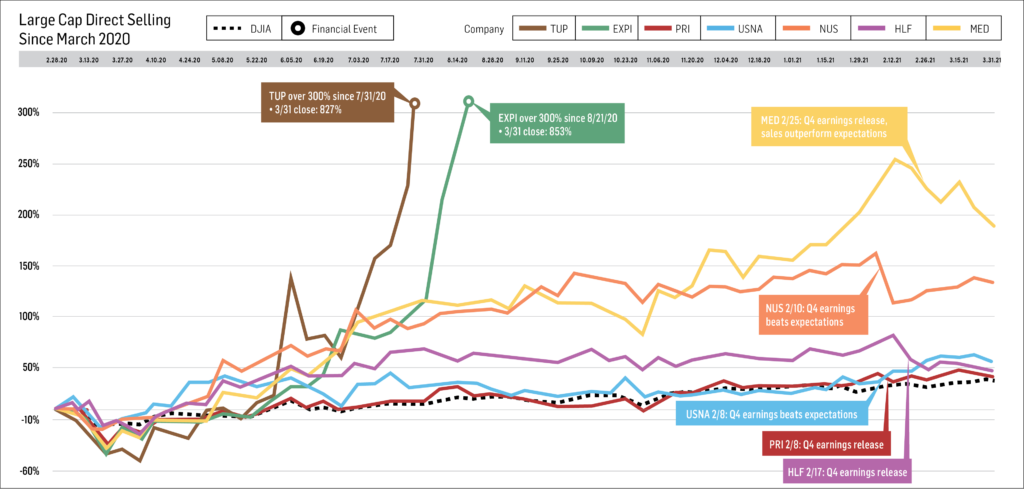

The Direct Selling Capital Advisors Direct Selling Index (DSCI) inched 0.1% lower in February, but it outperformed the Dow Jones Industrial Average (DJIA) for the second straight month. The DJIA fell 1.6% in February. Over the first two months of 2025, the DSCI has gained 5.8%, nearly double the DJIA’s 3.0% increase.

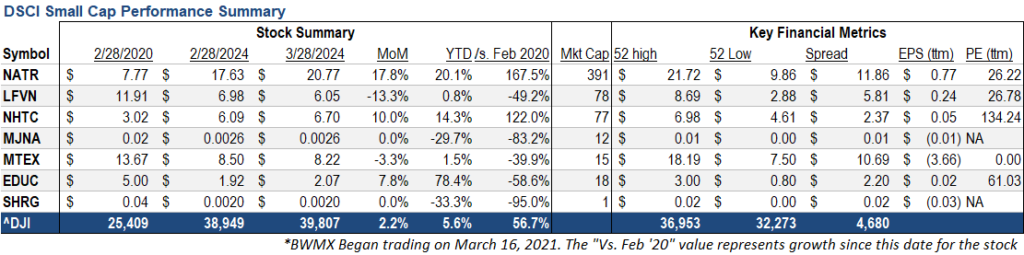

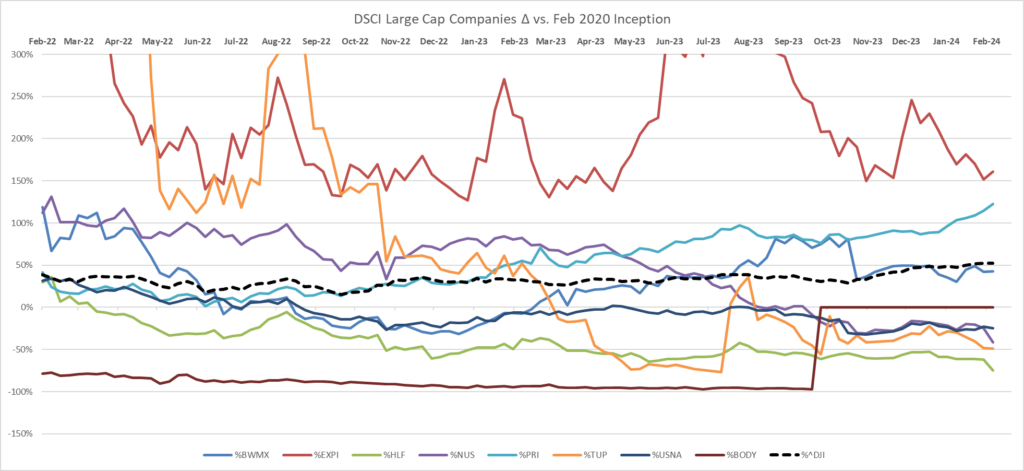

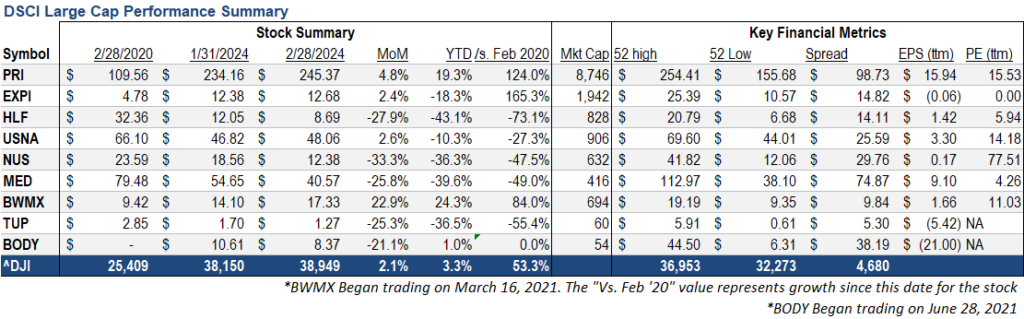

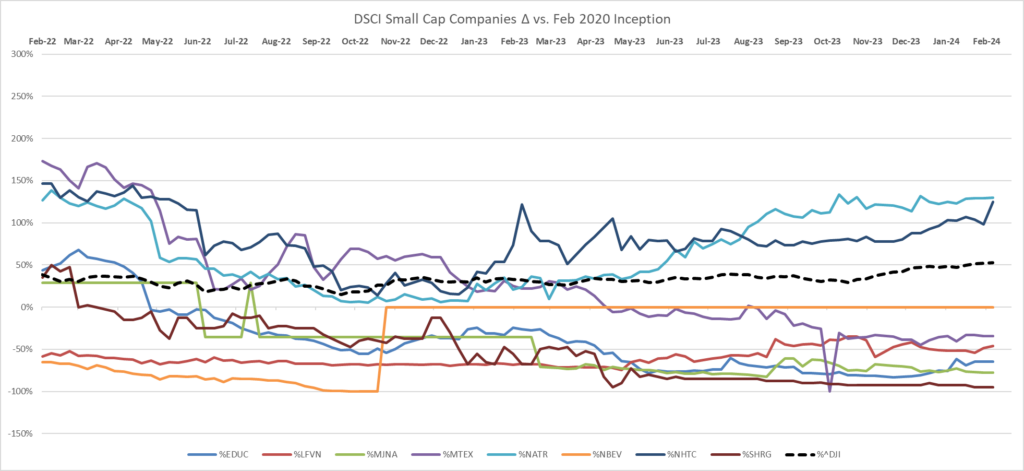

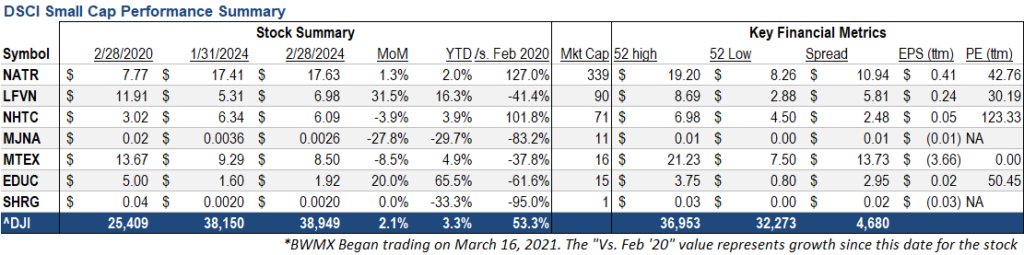

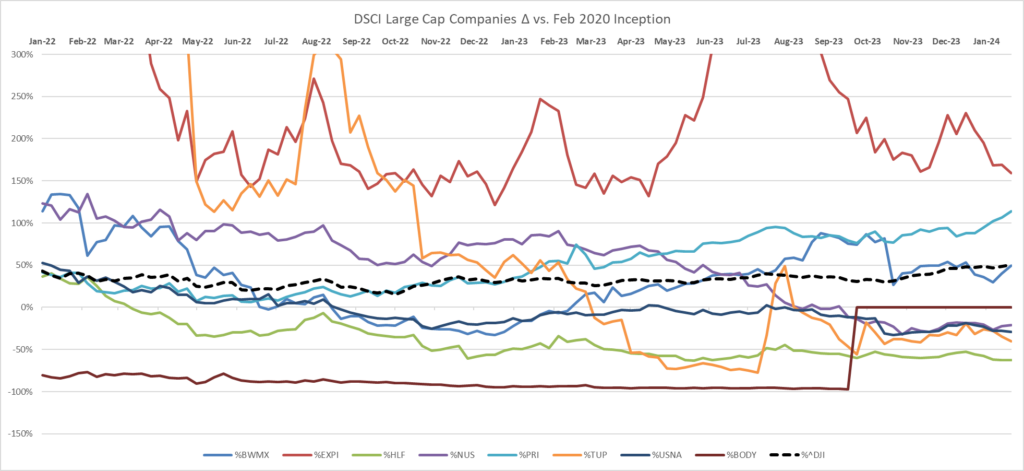

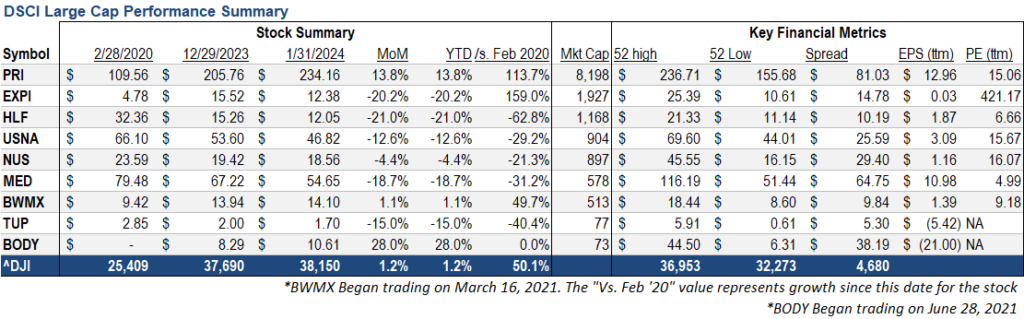

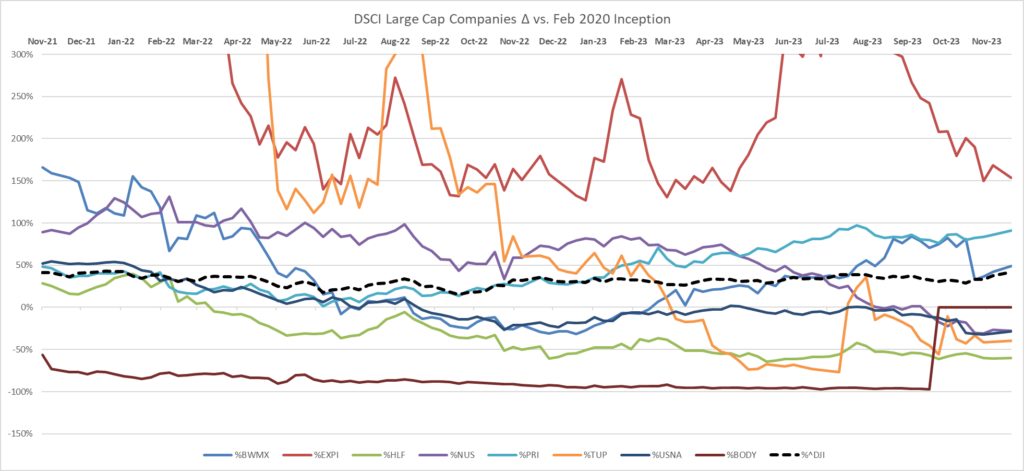

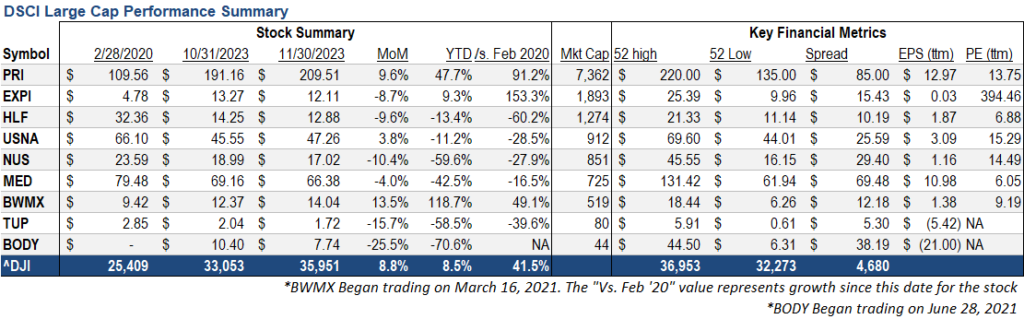

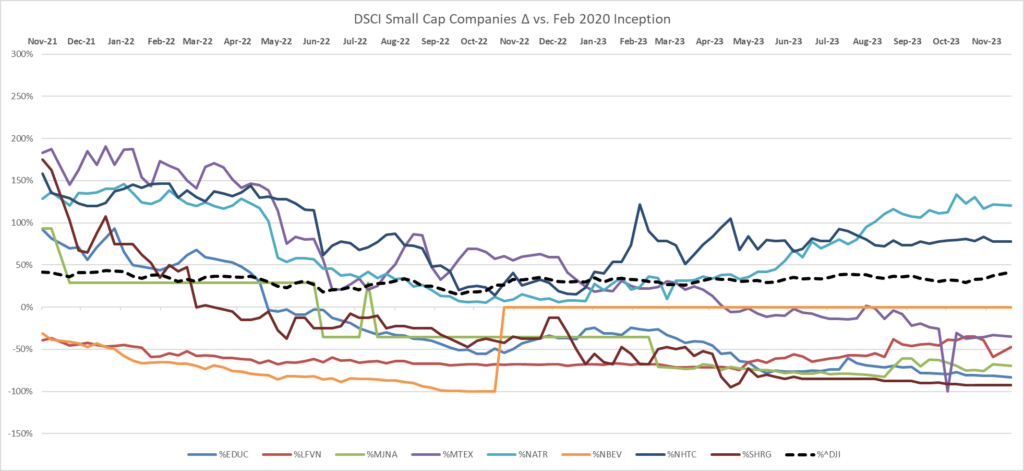

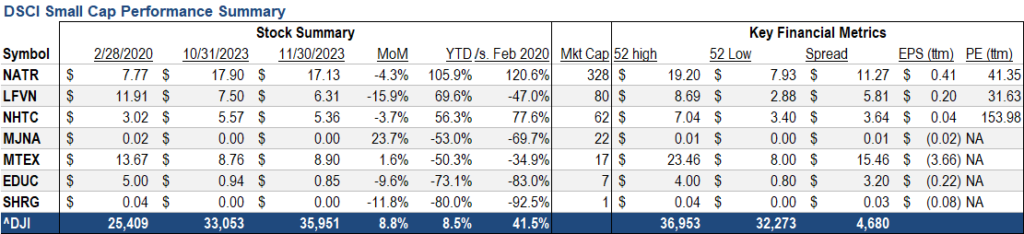

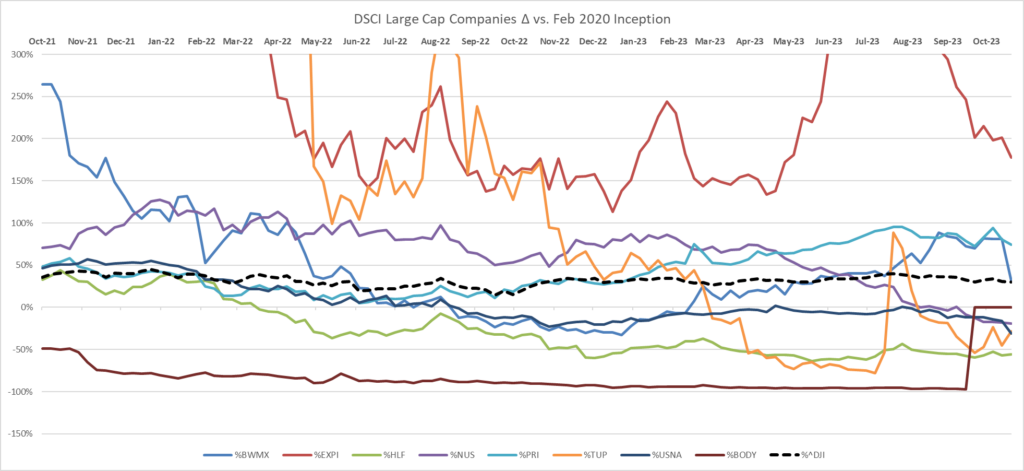

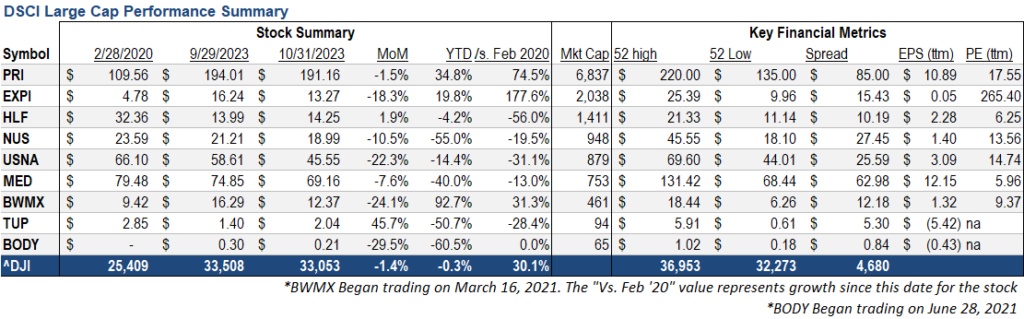

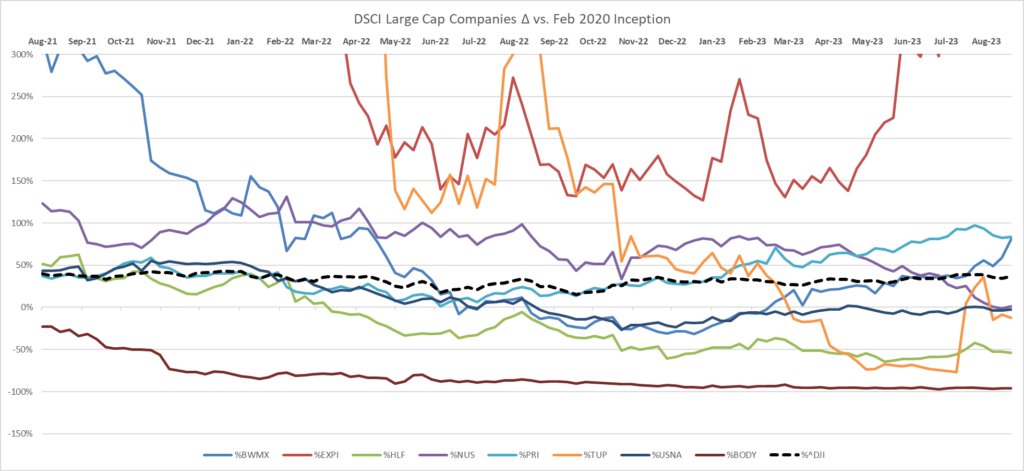

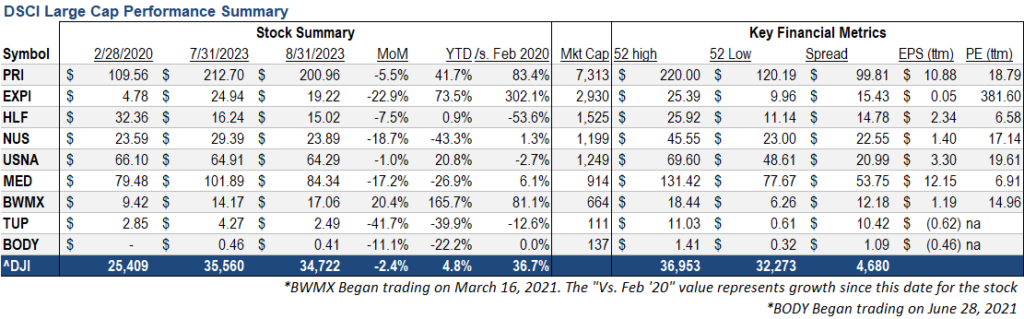

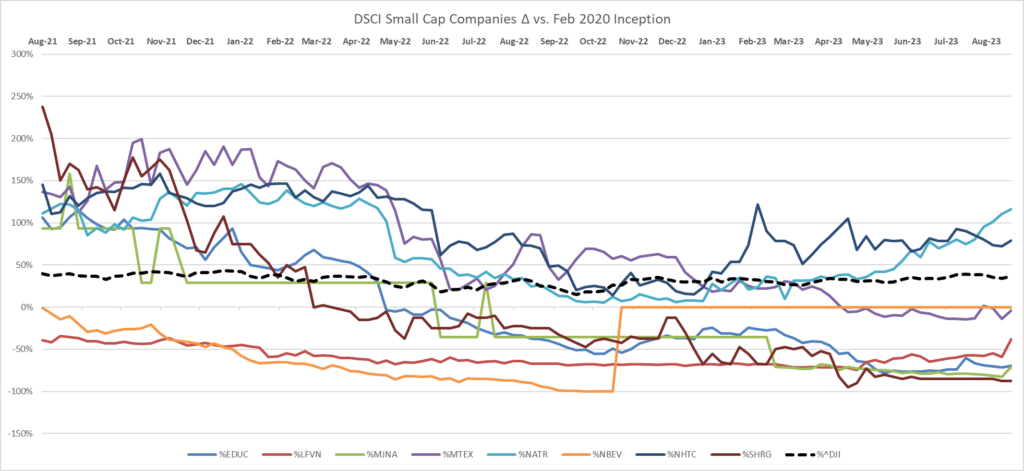

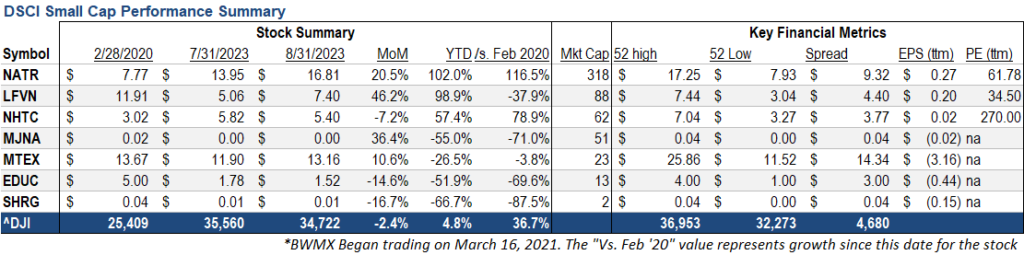

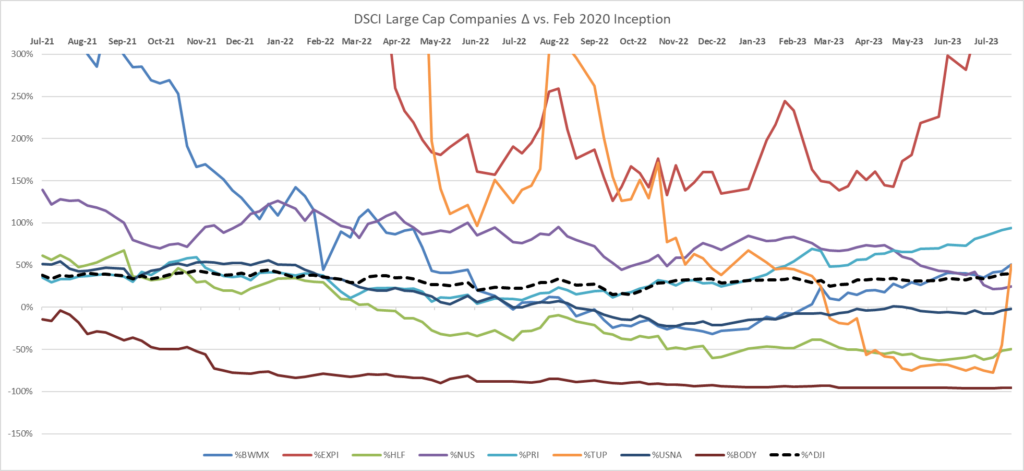

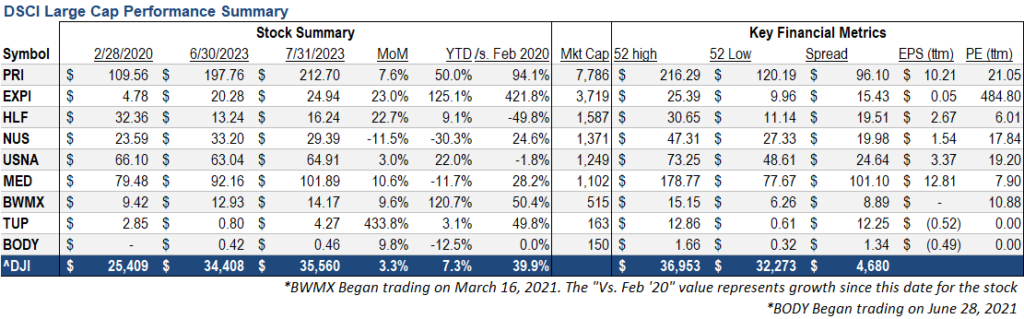

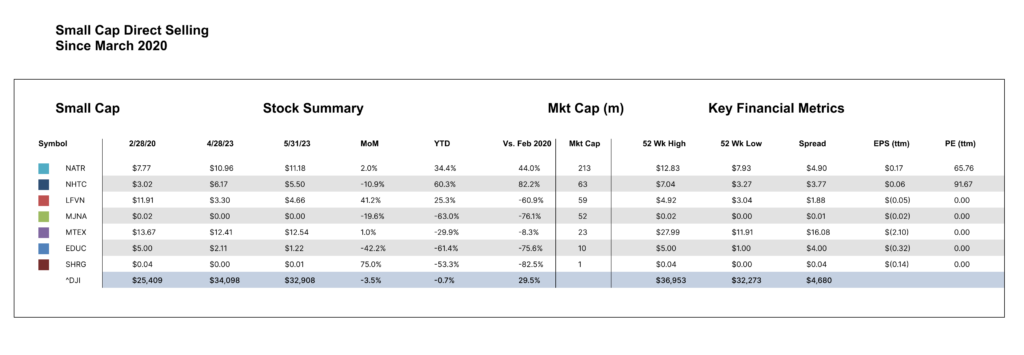

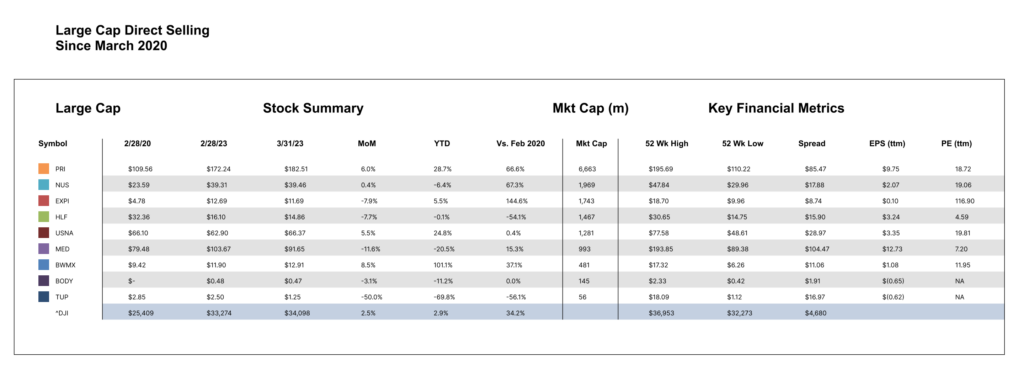

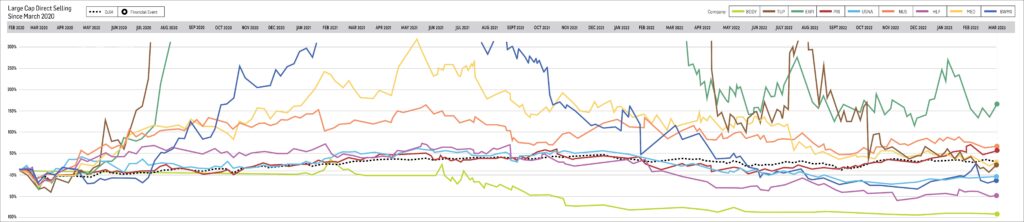

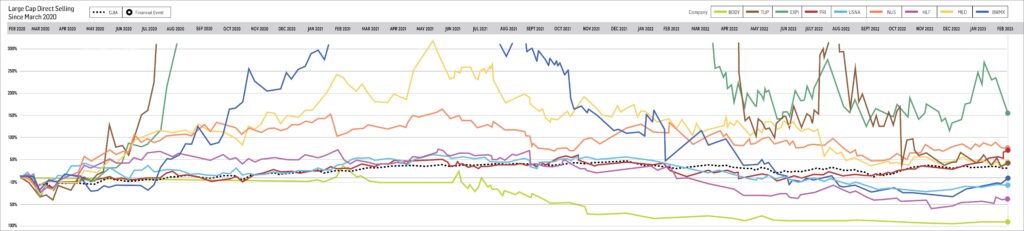

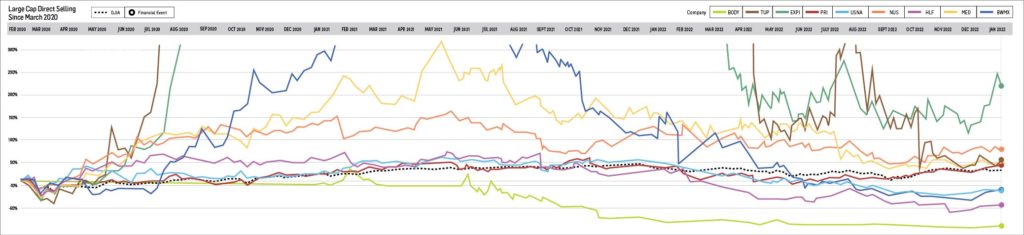

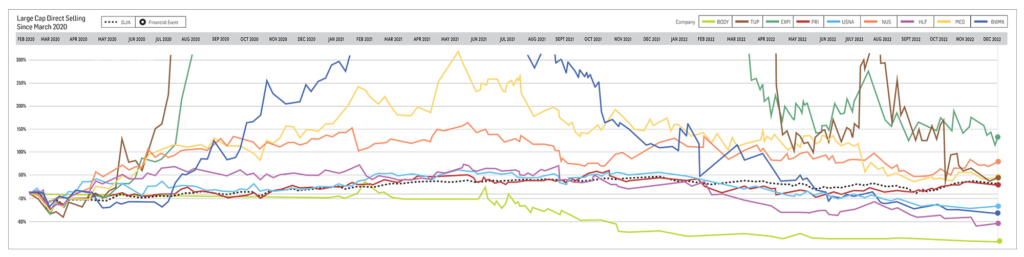

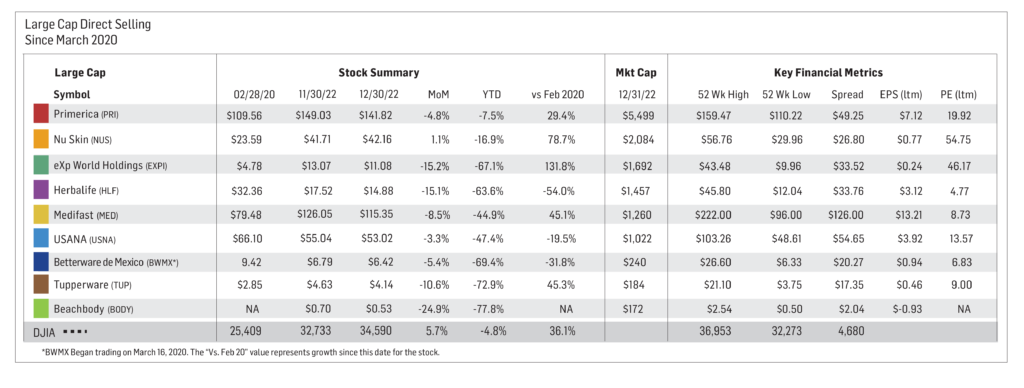

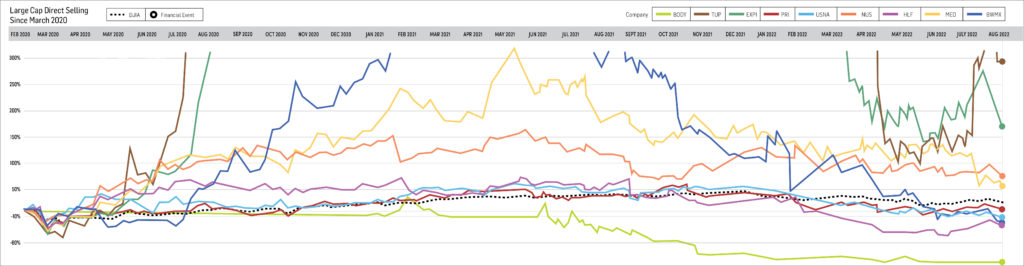

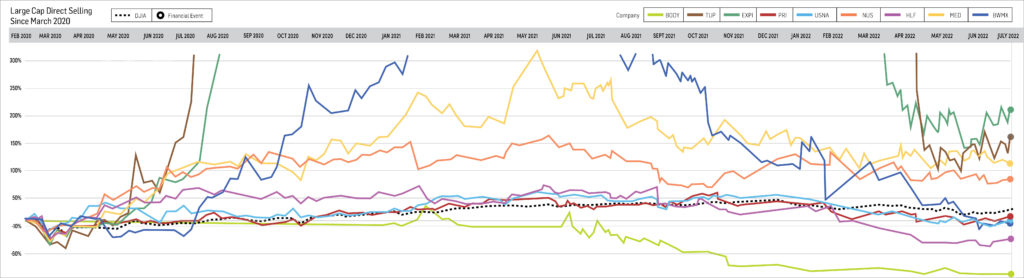

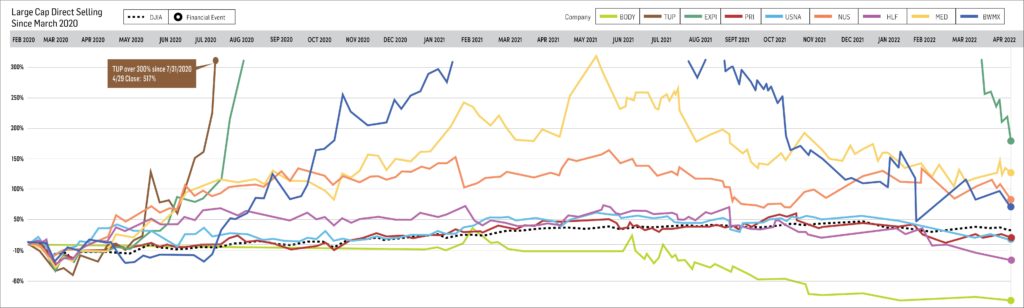

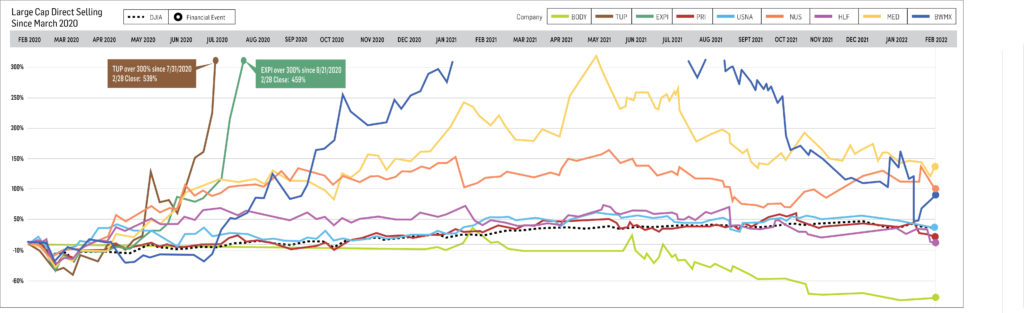

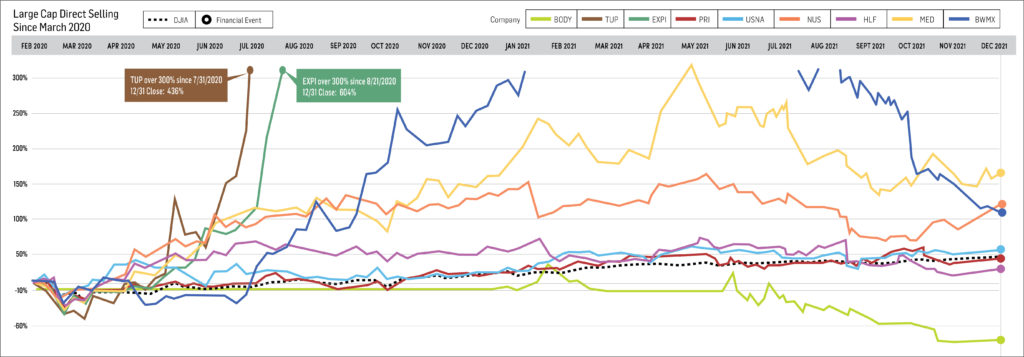

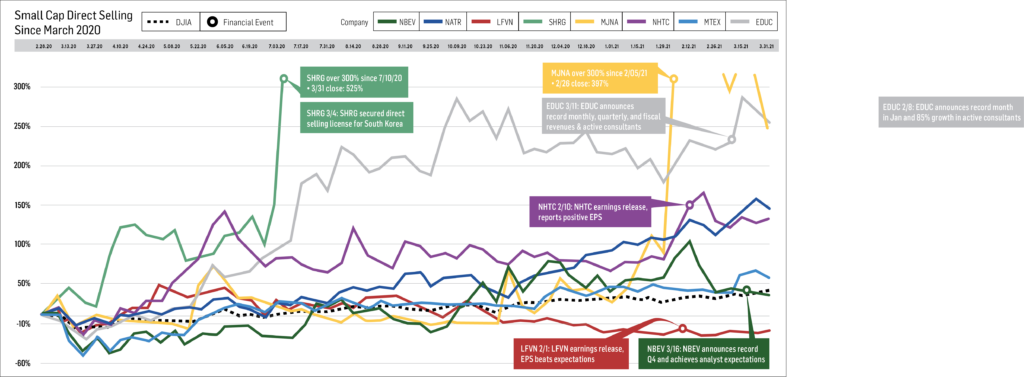

Large cap direct selling stocks generally outperformed their smaller cap peers in February. Four large cap DSCI components gained during the month, paced by a 52% jump in the stock price of Herbalife Nutrition, Inc. (NYSE: HLF), while the share prices of six large cap DSCI members fell. By comparison, one small cap direct selling stock with a market value of more than $2 million increased, while three decreased.

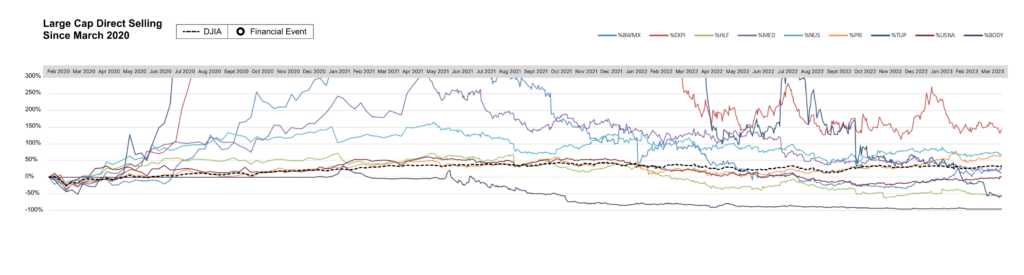

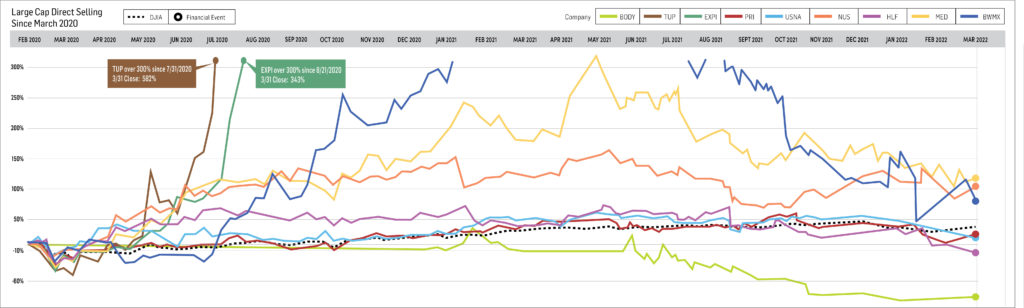

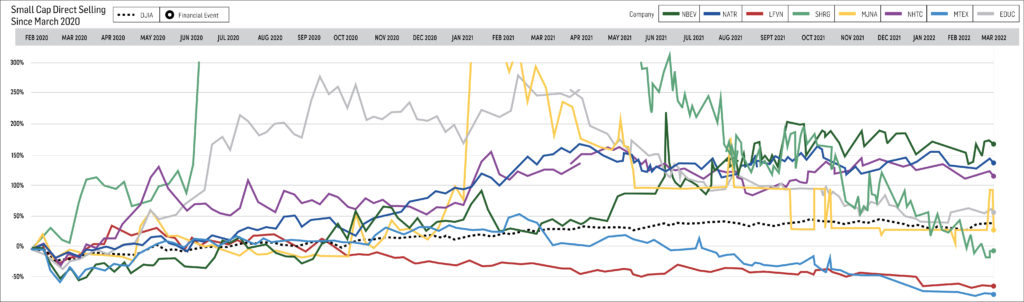

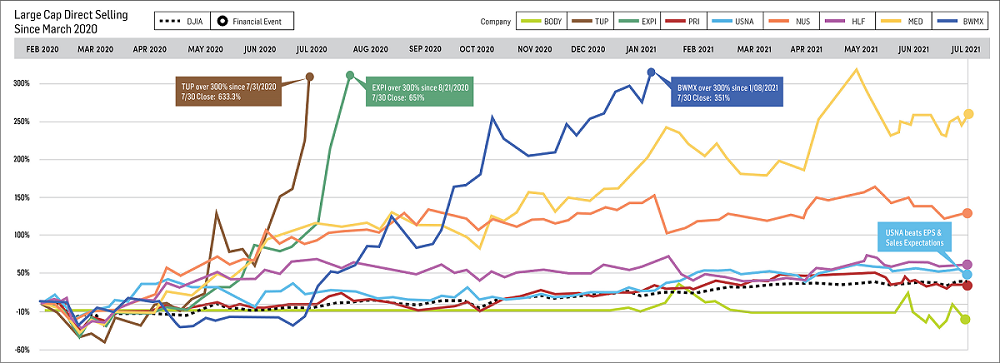

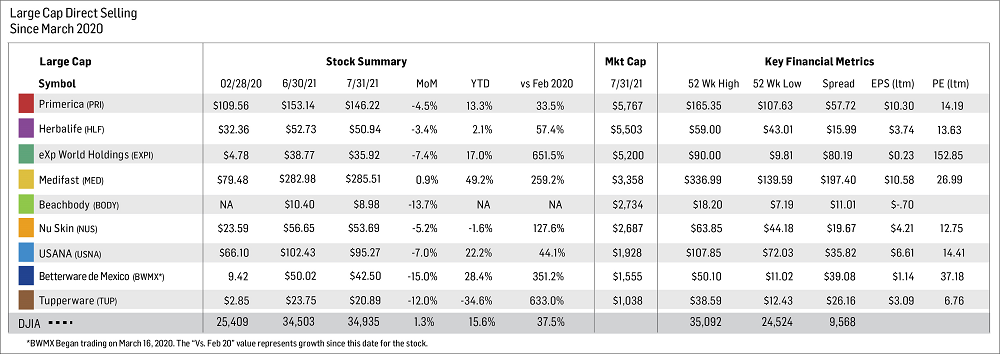

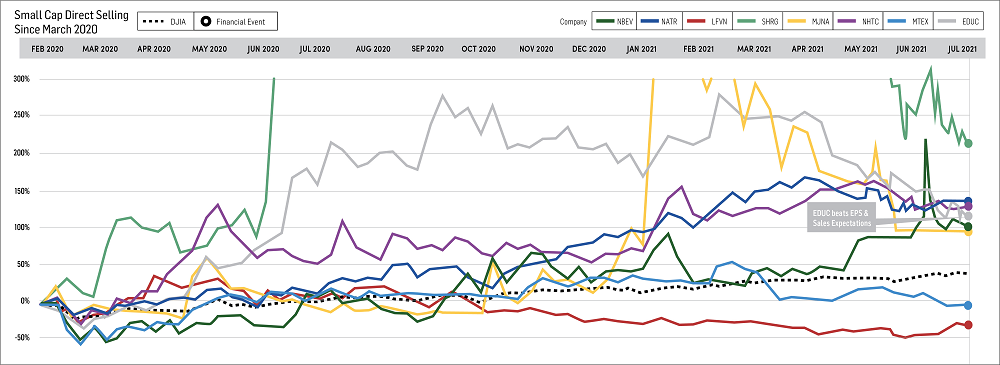

From a longer-term perspective, the DSCI has gained an aggregate 39.2% since its March 1, 2020 inception. The DJIA has outperformed the direct selling index over this period. Since March 1, 2020, the DJIA has appreciated 72.5%.

In February 2025, fear seemed to supplant greed as the dominant factor in the US stock and bond markets. Indeed, NASDAQ: TLT, the widely traded ETF that focuses on long-term Treasury bonds, soared 5.3% last month, while the DJIA and the broader S&P 500 Index declined 1.6% and 1.4%, respectively. This represents the largest monthly return differential in favor of long-term Treasuries since March 2020 when investors were beginning to understand details about the COVID-19 virus.

What happened? President Trump’s near daily announcements regarding potential tariffs on Mexico, Canada, China and the European Union, among others, has created significant policy uncertainty and weighed on investor sentiment. In addition, recent key economic releases, including retail sales, services PMI (a measure of business activity in the sector), and The Conference Board’s widely followed Consumer Confidence Index, have fallen short of analysts’ expectations. Finally, the previously bullet-proof Magnificent Seven stocks have fallen out of favor this year; indeed, six of the seven high-profile, fast-growing stocks have underperformed the S&P 500 over the first nine weeks of 2025. In the interim, the stock market has struggled to find a leadership group to replace this core group of stocks.

Looking Forward

Direct selling stocks have largely finished reporting their 4Q 2024 and full-year 2024 financials, so DSCI stocks will be most heavily affected by the tone of the overall stock market. Clearly, February and the first week of March have demonstrated the stock market has transitioned to a more volatile phase than its more consistent (positive) tenor of the last two years, but several factors remain in place that are supportive of continued economic growth and solid potential returns for stock market investors.

First, despite the recent tepid economic statistics, the US economy still seems poised for about 2% GDP growth in 2025—even if the Trump Administration implements aggressive, rapidly changing and fairly broad-based tariffs. Second, job growth in the US remains robust; payrolls have increased on average 210,000 per month over the last four months.

Third, analysts and economists expect earnings for the S&P 500 to increase more than 10% in 2025 after rising about 18% in 4Q 2024. Finally, declines in the prices of many widely held stocks have prompted many investors to turn bearish, a time-tested contrarian indicator. According to the American Association of Individual Investors, 61% of investors expect the stock market to decline over the next six months, the highest proportion since September 2022. September 2022 marked the approximate bottom of a sharp stock market decline which began in November 2021. Since September 2022, the S&P 500 has jumped about 50%.

CHARTS & ANALYSIS

Direct Selling Capital Advisors Index

The DSCI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million. The index is rebalanced monthly, and no single issue is permitted to represent more than 20% of its total value. In such an event, the excess weighting would be redistributed among the other index components.

The DSCI declined slightly in February, but it outperformed the DJIA during the month. The DSCI lost 0.1% in February, a much smaller loss than the DJIA’s 1.6% decrease in the month. DSCI data is tracked back to March 1, 2020. The direct selling index has risen 39.2% since that date versus a 72.5% appreciation for the DJIA over the same period.

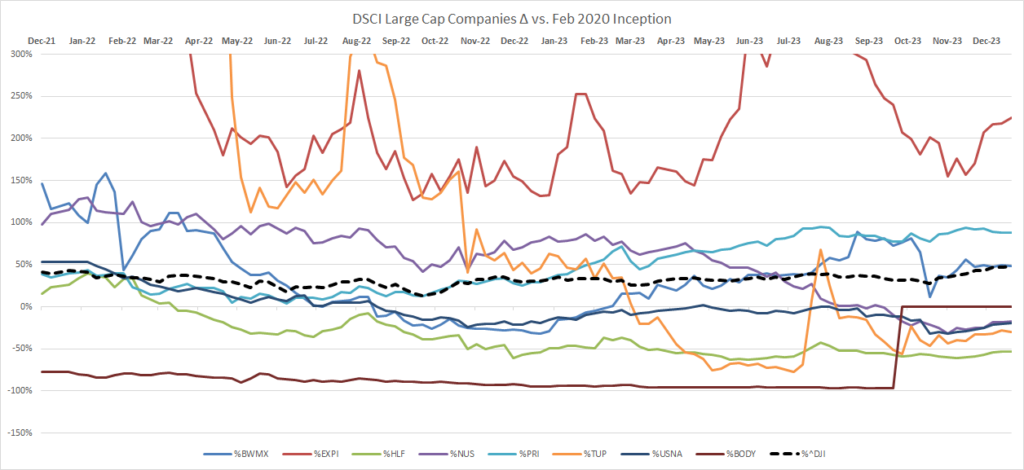

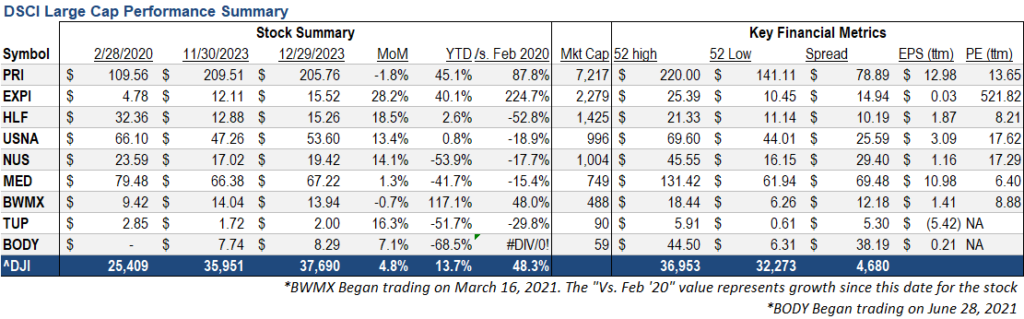

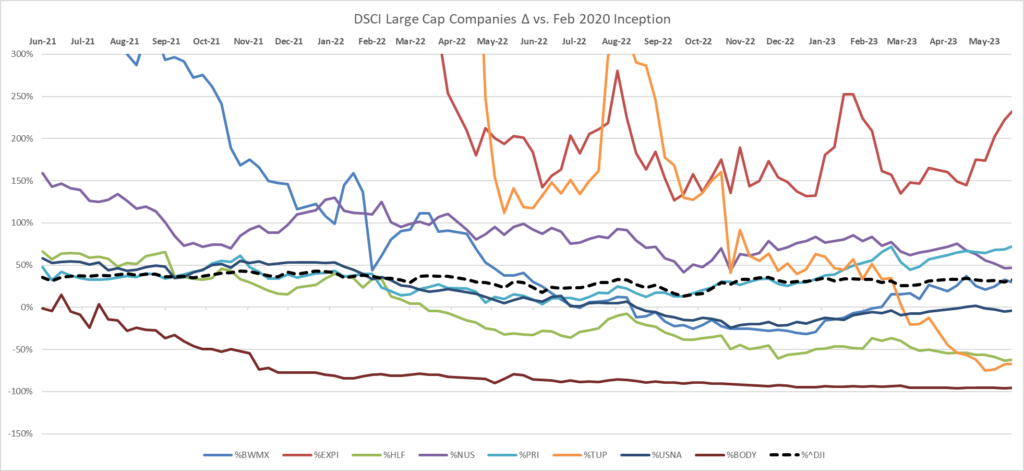

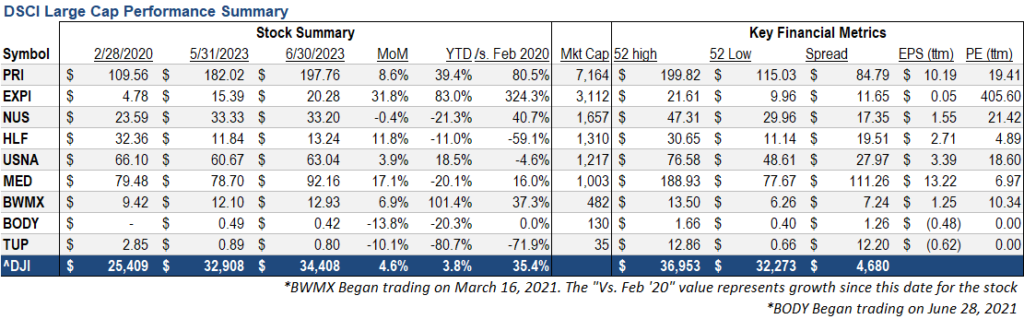

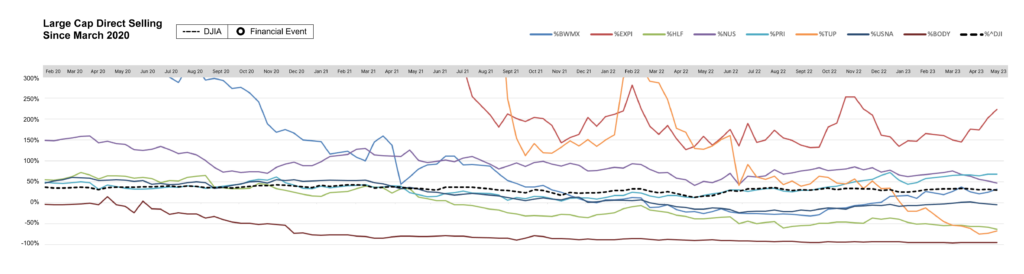

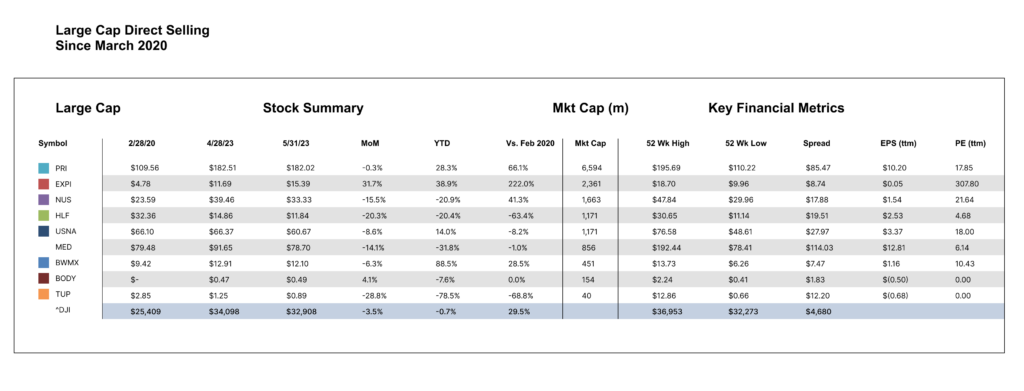

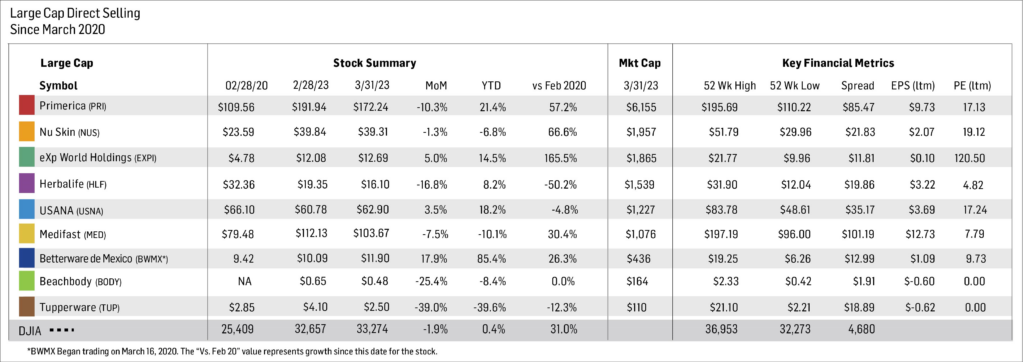

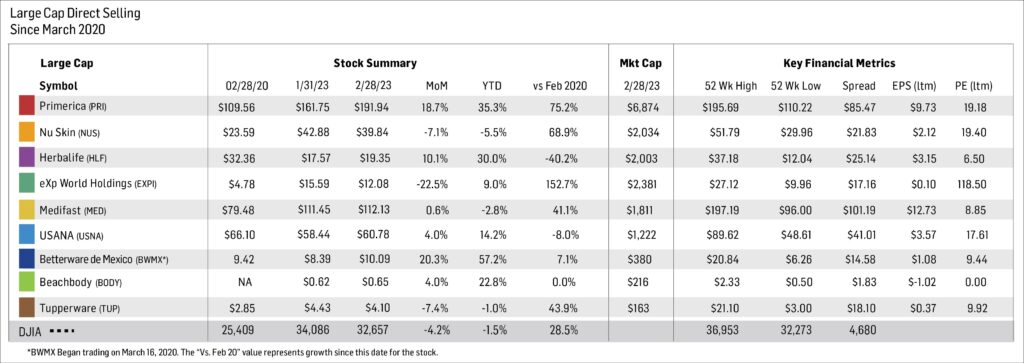

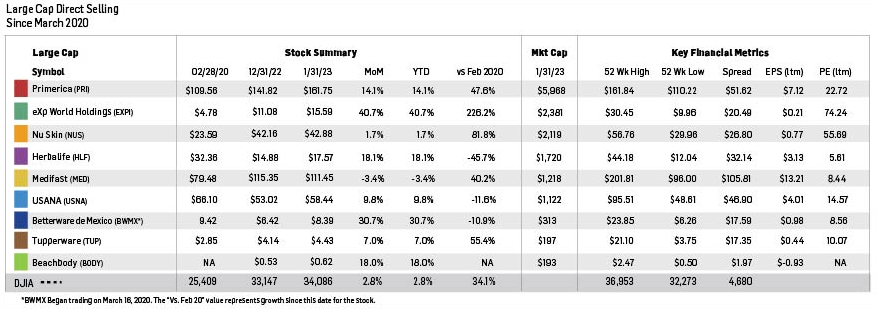

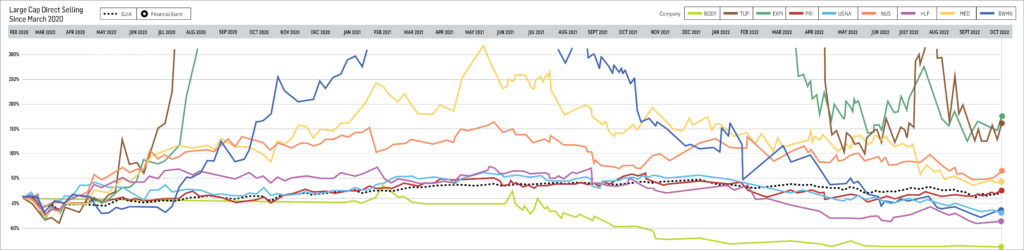

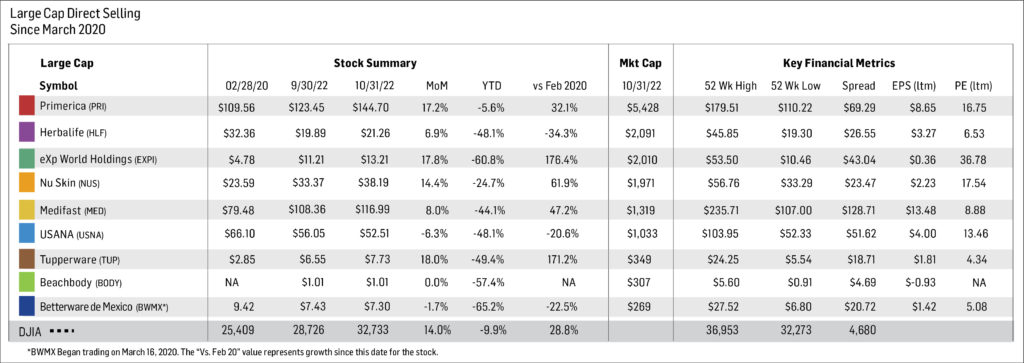

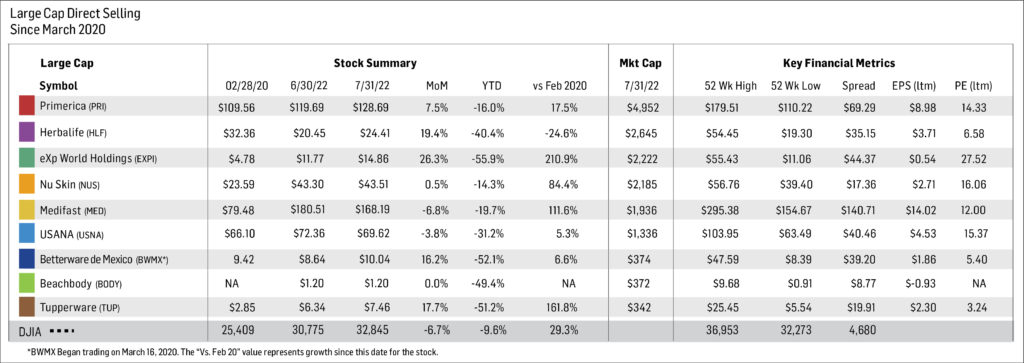

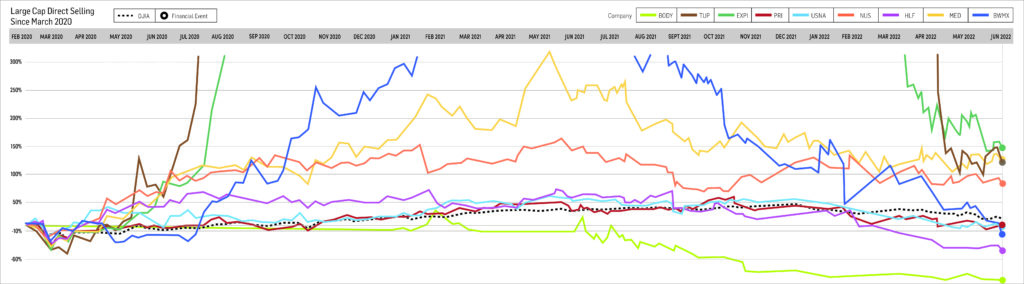

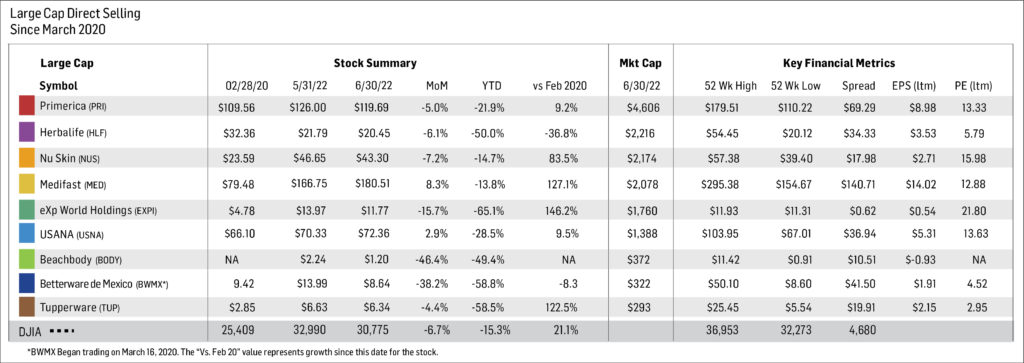

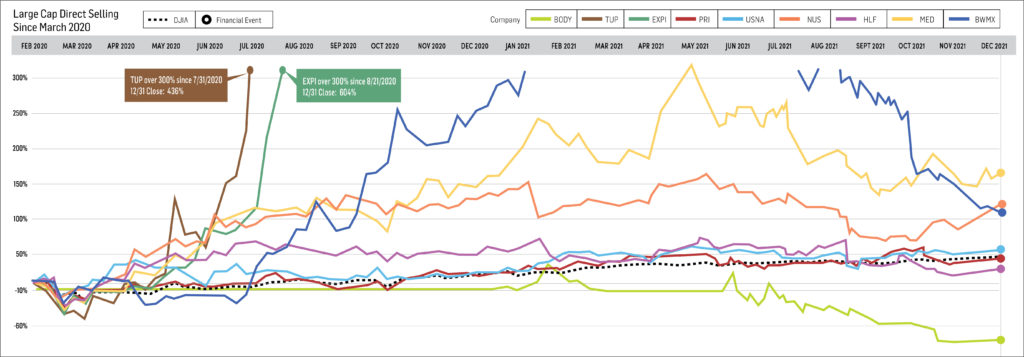

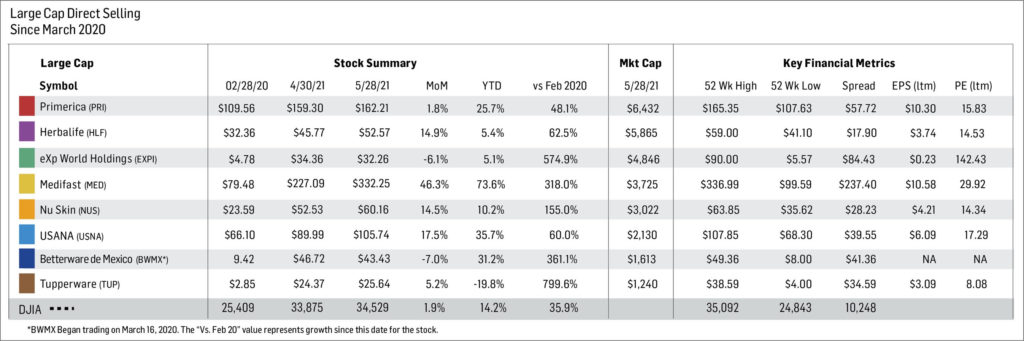

Large Cap

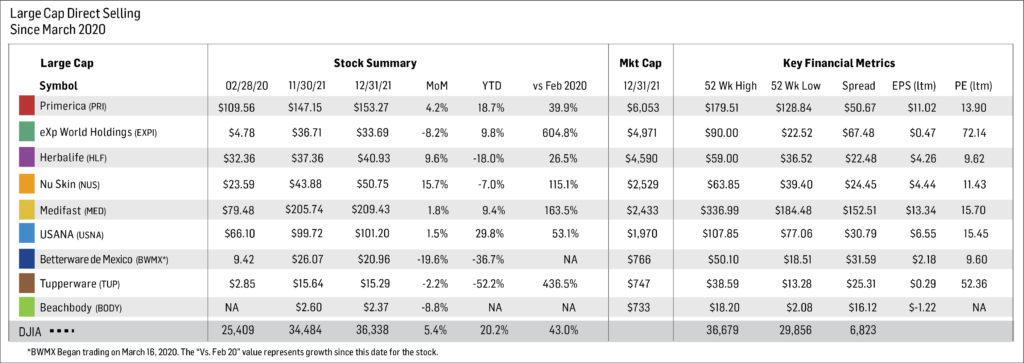

Betterware de Mexico (NASDAQ: BWMX) inched 0.8% higher in February, bringing its YTD gain to 1.5%. Since the March 1, 2020 inception of the DSCI, BWMX has appreciated 20.5%.

On February 27, BWMX reported 4Q 2024 consolidated net revenue of $3.8 billion pesos, up 11.1% from 3.4 billion pesos in the year-ago period. The stronger sales were driven by innovation, improved incentives, and a revamped catalog. On the other hand, the company’s adjusted EBITDA fell 5.8% in 4Q 2024 to 772 million pesos from 820 million pesos in 4Q 2023. The decline is mostly attributable to a 17.3% reduction in Jafra Mexico’s 4Q 2024 EBITDA; significant synergies and cost optimization benefits were recognized in the division’s 4Q 2023 results. BWMX’s 4Q 2024 adjusted EPS was 11.70 pesos versus 10.59 pesos in 4Q 2023.

In 2025, BWMX management expect to post net revenue of 14.9-15.3 billion pesos, up from 14.101 billion pesos in the full year 2024, and 2.9-3.0 billion pesos of EBITDA compared with 2.775 billion pesos in 2024. This translates into year-over-year increases in each metric of between 6% and 9% in 2025.

BWMX began trading in March 2020 after the company’s merger with SPAC sponsor DD3 Acquisition Corp. BWMX specifically targets the Mexican market; it serves three million households through distributors and associates in approximately 800 communities throughout Mexico.

Nu Skin Enterprises, Inc. (NYSE: NUS) jumped 20.9% in February, making it the second best performing DSCI component during the month. Year to date, NUS has increased 14.9%. Nevertheless, NUS has fallen 66.4% since the direct selling index was established in March 2020. In comparison, the direct selling stock index and the Dow Jones Industrial Average have gained 39.2% and 72.5%, respectively, over this five-year period.

On February 13, 2025, NUS reported 4Q 2024 revenue and EPS from continuing operations of $445.6 million and $0.38 versus $488.6 million and $0.37, respectively, in the year-ago period. Importantly, revenue at the company’s fast-growing Rhyz subsidiary reached $83.1 million in 4Q 2024, up 27.7% from 4Q 2023. NUS’ overall 4Q 2024 revenue exceeded the guidance management issued in early November 2024, as the company has now essentially completed its restructuring plan.

In 2025, NUS anticipates improving business trends and a return to year-over-year growth in several of its markets, but it also expects continued economic challenges and poor consumer sentiment, particularly in Greater China and South Korea. Management projects full-year 2025 revenue and ongoing EPS of $1.48-$1.62 billion and $0.90-$1.30, respectively. Full-year 2024 revenue and EPS from ongoing operations totaled $1.73 billion and $0.84, respectively.

In early January 2025, NUS’ Rhyz subsidiary sold its Mavely affiliate marketing technology platform to Later for approximately $250 million in cash and a minority equity stake in the combined Later/Mavely business. About $33 million of this consideration will be paid to other equity holders in the Mavely business. Later is a portfolio company of Summit Partners. Mavely is expected to continue to provide certain technology and social commerce capabilities to support NUS’ marketing business.

Herbalife Nutrition, Inc. (NYSE: HLF) soared a DSCI-best 52% in February, emphatically breaking a two-month streak of double digit percentage monthly declines (negative 18.4% in January 2025 and negative 13.9% in December 2024). Over the first two months of 2025, HLF has appreciated 24.1%. Conversely, HLF is down 74.4% since the establishment of the DSCI on March 1, 2020, the second worst long-term performance for any large-cap DSCI component which has traded continuously since index inception.

On February 19, 2025, HLF reported 4Q 2024 sales of $1.21 billion, down 0.6% from $1.22 billion in 4Q 2023. On a constant currency basis, the company’s revenue increased 2.7% in the quarter. Even more constructive, HLF’s 4Q 2024 adjusted EBITDA reached $150.0 million, up from $108.0 million in the year-ago period, which translated into an adjusted EBITDA margin of 12.4% in 4Q 2024, up 340 basis points from 4Q 2023. In 4Q 2024, the number of new distributors joining HLF worldwide increased 22%, marking the company’s third consecutive quarter of year-over-year growth.

Also on February 19, HLF management issued guidance for full-year 2025 results. The company expects 2025 revenue to range from 3% below 2024 revenue of $4.99 billion to 3% above this figure. Furthermore, HLF’s 2025 adjusted EBITDA should be $600-$640 million compared with $634.8 million in 2024, and its 2025 capital expenditures should range from $100 to $130 million compared with $122.0 million in 2024.

On May 1, 2025, Stephan Gratziani will succeed Michael Johnson as HLF’s CEO. At that time, Mr. Johnson will transition to the role of HLF’s Executive Chairman.

Medifast, Inc. (NYSE: MED) shares declined 8.5% in February, bringing its loss for the first two months of 2025 to 18.5%. MED is the worst performing DSCI large cap member on a long-term basis; since the March 1, 2020 establishment of the DSCI, the stock has declined 81.9%.

On February 18, MED reported 4Q 2024 revenue of $119.0 million, down 37.7% from $191.0 million in 4Q 2023. The company’s adjusted diluted EPS fell even more sharply to $0.10 in 4Q 2024 from $1.09 in the year ago period. The number of active earning OPTAVIA coaches decreased to 27,100 in 4Q 2024 from 41,100 in 4Q 2023. MED expects its 1Q 2025 revenue and adjusted diluted EPS will be in the $100-$120 million and a loss of $0.50 to break-even ranges, respectively.

MED is realigning its business to respond to the evolving dynamics in the weight loss industry and to transform its business model to meet the soaring demand for GLP-1 medications. Indeed, up to 20 million people in the US could be using GLP-1 treatments by 2030 according to some projections. MED offers comprehensive support for GLP-1 medication users, including access to clinicians through LifeMD, as well as programs and products to help maintain muscle and minimize side effects. One such product designed for people on GLP-1 medications is OPTAVIA ASCEND, a line of high-protein, fiber-rich mini meals, as well as a daily nutrient pack. MED announced OPTAVIA ASCEND on January 7, 2025.

In February, shares of USANA Health Sciences, Inc. (NYSE: USNA) lost 9.1%. This performance pushed USANA’s YTD decline to 17.6%. Since the creation of the DSCI on March 1, 2020, USANA shares have lost 55.2% compared with gains of 39.2% and 72.5% for the direct selling index and the DJIA, respectively.

On February 25, USANA reported 4Q 2024 revenue and adjusted diluted EPS of $214 million and $0.64, both down from $221 million and $0.87, respectively, in the year ago period. USANA’s 4Q 2024 results exceeded its internal forecasts, highlighted by 7% sequential net sales growth. Positive momentum in the company’s Americas & Europe region generated year-over-year and sequential sales growth, while performance in its Asia Pacific region declined slightly and was in line with expectations.

USANA projects 2025 revenue and adjusted diluted EPS of $920 million to $1.0 billion and $2.35-$3.00, respectively. The company’s 2024 revenue totaled $855 million, and its 2024 adjusted diluted EPS was $2.59.

USANA’s 2025 revenue guidance includes $145-$160 million from recently acquired Hiya Health Products, LLC, a leading direct-to-consumer provider of high-quality children’s health and wellness products. On December 23, 2024, USANA closed its acquisition of a 78.8% controlling ownership stake in Hiya. The $205 million cash transaction is expected to be immediately accretive to USANA’s 2025 adjusted EBITDA. As of September 30, 2024, Hiya had more than 200,000 customers. For the twelve months ended September 30, 2024, Hiya generated net sales of $103 million, net income of $19 million, and adjusted EBITDA of $22 million. Hiya’s revenue for 2024 was about $112.5 million.

eXp World Holdings, Inc. (NASDAQ: EXPI) dropped 11.2% in February, adding to its 12.2% YTD loss. More constructively, EXPI shares have appreciated an aggregate 111.5% over the five years the DSCI has been computed, the second-best long-term mark for any DSCI member.

On February 20, EXPI, the fastest growing real estate brokerage in the world, reported 4Q 2024 revenue and adjusted EBITDA of $1.1 billion and $7.7 million, respectively. These measures compare favorably with $981 million and $3.1 million, respectively, in 4Q 2023. EXPI ended 2024 with strong momentum; its top ten U.S. agents closed over $100 million of transaction volume in December 2024 alone.

EXPI’s transaction volume in 4Q 2024 increased 17% to $45.3 billion from $38.7 billion in 4Q 2023. This performance is especially impressive given that US existing home sales in 2024 fell to their lowest level since 1995. Agents and brokers on EXPI’s platform totaled 82,980 as of December 31, 2024, down 5% from December 31, 2023, due primarily to the exit of unproductive agents.

A leading provider of financial services in the US and Canada, and by far the largest market cap stock in the DSCI, Primerica, Inc. (NYSE: PRI) inched 0.1% lower in February, slightly reducing its 6.8% YTD gain. PRI has appreciated 164.7% since March 1, 2020, the best long-term performance for any DSCI member.

On February 11, PRI reported 4Q 2024 adjusted operating revenue of $788.1 million, up 12% from $706.2 million in the year-ago period. The company’s adjusted operating EPS grew at an even faster pace (+14%), reaching $4.98 in 4Q 2024 versus $4.35 in 4Q 2023. Financial results were notably strong in 4Q 2024 driven by steady premium revenue growth due to the cumulative impact of new policy sales in recent periods which added to PRI’s large block of in-force life insurance policies. This growth, combined with higher Investment and Savings Products sales and rising client asset values, further boosted PRI’s overall performance in the quarter.

In 4Q 2024, PRI repurchased $44.4 million of its shares, completing the Board of Directors’ authorization to buy back $425 million of stock in 2024. In mid-November, PRI’s Board authorized $450 million of share repurchases from mid-November 2024 through December 31, 2025.

PRI’s Board also authorized a 16% increase in its quarterly dividend to $1.04 (a $4.16 annual rate). The higher dividend rate will be paid on March 14, 2025 to stockholders of record on February 21, 2025

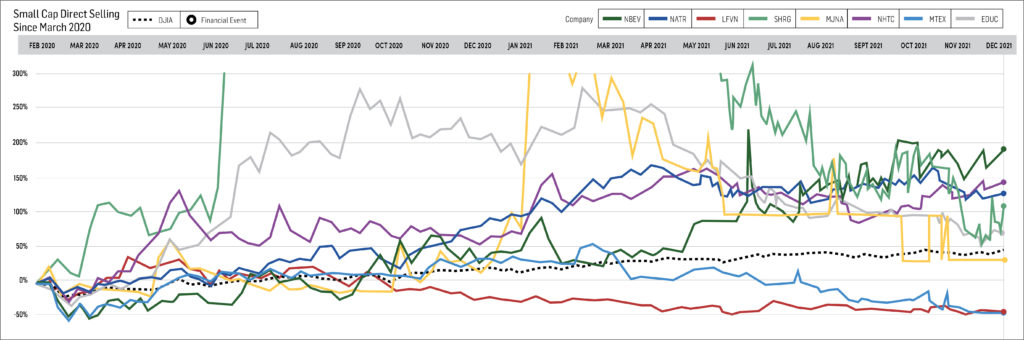

Nature’s Sunshine Products, Inc. (NASDAQ: NATR) increased 4.7% in February, which brought its YTD performance to nearly flat (negative 0.6%). Over the 60 months the DSCI has been calculated, NATR has gained 87.6%, the third best appreciation for any direct selling index stock over this period.

In early November, NATR, which markets and distributes nutritional and personal care products in more than 40 countries, reported 3Q 2024 net sales of $114.6 million, up 3% from $111.2 million in the year ago period. Adjusted EBITDA in 3Q 2024 totaled $10.7 million, about 5% higher than $10.3 million in 3Q 2023. NATR’s impressive results in 3Q 2024 were driven by robust customer growth in Japan and Taiwan, continued progress in South Korea and customer activation in Central Europe.

Factoring in its solid results in 3Q 2024, NATR reset its full year 2024 net sales and adjusted EBITDA guidance slightly higher to $443-$448 million and $40-$42 million from previous ranges of $436-$445 million and $39-$42 million, respectively. NATR plans to report its 4Q 2024 financial results after the stock market closes on March 11th.

LifeVantage Corporation (NASDAQ: LFVN) dropped 18.9% in February, ending a three-month skein of outsized monthly gains (+20.7% in January, +20.3% in December and +19.2% in November). LFVN’s decline in February flipped its YTD performance to a slight loss, minus 2.1%. Since the March 1, 2020 establishment of the DSCI, LFVN has gained 44.2%.

On February 5, 2025, LFVN reported 2Q FY 2025 (quarter ended December 31, 2024) revenue, adjusted EBITDA, and adjusted EPS of $67.8 million, $6.5 million and $0.22, each of which markedly increased from $51.6 million, $3.1 million, and $0.10, respectively, in the year ago period. Strong demand for LFVN’s MindBody GLP-1 System (see below) and impressive growth in active accounts drove the robust 2Q FY 2025 results. Notably, active accounts were up 25% in the quarter compared with 1Q FY 2025 levels as the number of enrollments surged to the highest level in five years.

In turn, LFVN boosted its revenue, adjusted EBITDA, and adjusted EPS guidance ranges for FY 2025 (twelve months ending June 30, 2025) to $235-$245 million, $21-$24 million and $0.72-$0.88, respectively. The company’s previous guidance ranges were $200-$210 million, $18-$21 million, and $0.70-$0.80, respectively. LFVN’s FY 2024 revenue totaled $200.2 million; its FY 2024 adjusted EBITDA was $17.0 million; and its FY 2024 adjusted EPS was $0.59.

In early October 2024, LFVN released groundbreaking human clinical trial results from its MindBody GLP-1 System. Participants realized a 140% average increase in GLP-1 levels in the body, leading to an average weight loss of nine pounds in eight weeks and up to 25 pounds in twelve weeks. The 12-week, 60-participant clinical trial began in June 2024.

Oliveda International, Inc. (OTC: OLVI), the fourth largest market cap stock in the DSCI, fell 15.5% in February, making it the second worst performing large cap direct selling stock during the month. Over the first two months of 2025, OLVI has declined 53.5%.

Founded in 2003, OLVI has more than 20 years of experience in: 1) the management and organic certification of mountain olive trees; 2) the extraction of international award-winning extra virgin olive oils; 3) the extraction of hydroxytyrosol, a substance which has several beneficial effects such as antioxidant, anti-inflammatory, anticancer, and as a protector of skin and eyes; and 4) the production and distribution of cosmetic and holistic waterless products related to the olive tree.

OLVI’s 3Q 2024 revenue was $27.7 million, up nearly 1,500% from $1.8 million in 3Q 2023. Its net loss in 3Q 2024 was $38.5 million, or a loss of $0.06 per share, compared with net income of $1.8 million in the year ago period. Over the first nine months of 2024, OLVI generated positive operating cash flow of $10.3 million versus a slight loss over the first nine months of 2023.

OLVI’s Olive Tree People Inc. subsidiary sales increased by remarkable 1,650% and ~1,700+% rates in 4Q 2024 and the full year 2024, respectively, faster than celebrity brands such as JLO Beauty by Jennifer Lopez, and underscoring OLVI’s position as the world’s fastest growing waterless beauty company. Olive Tree People, Inc. sales totaled $104.5 million in 2024. The subsidiary’s daily sales exceeded the $2 million mark for the first time in September 2024. On November 22, Olive Tree’s daily sales were more than $3.7 million.

Note: For the purposes of this report, Direct Selling Capital considers companies with a market capitalization in excess of $1 billion “Large Cap.”

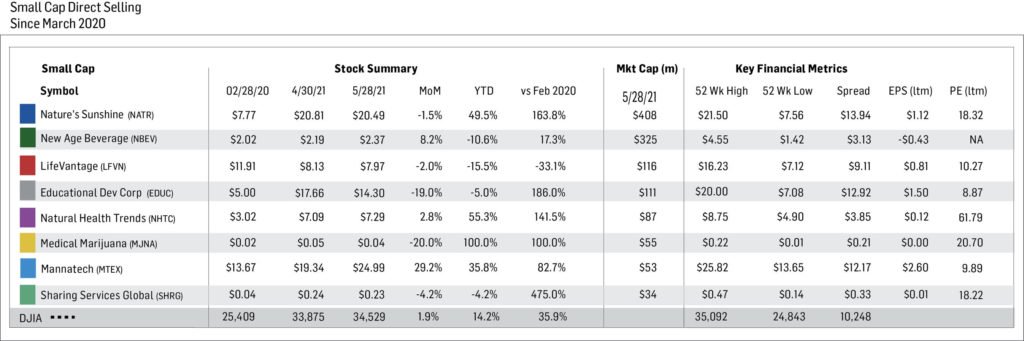

Note: For the purposes of this report, Direct Selling Capital considers companies with a market capitalization in excess of $1 billion “Large Cap.”Small Cap

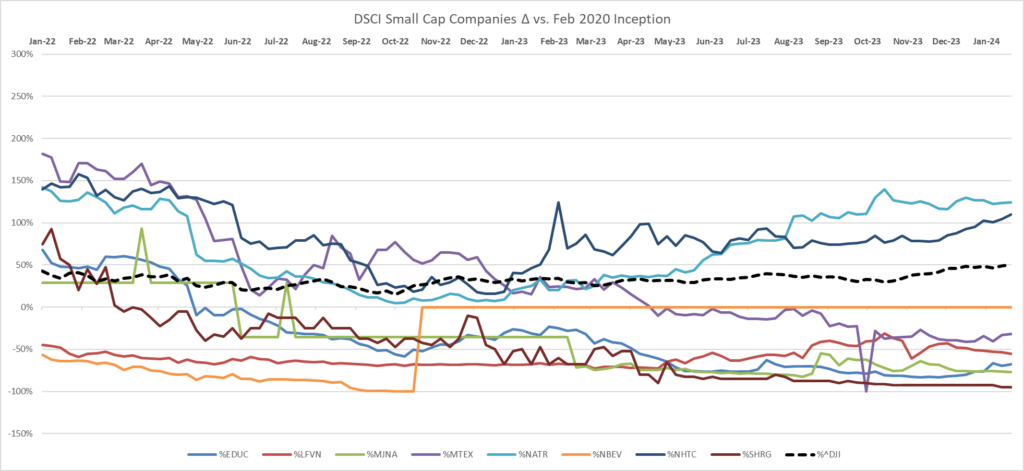

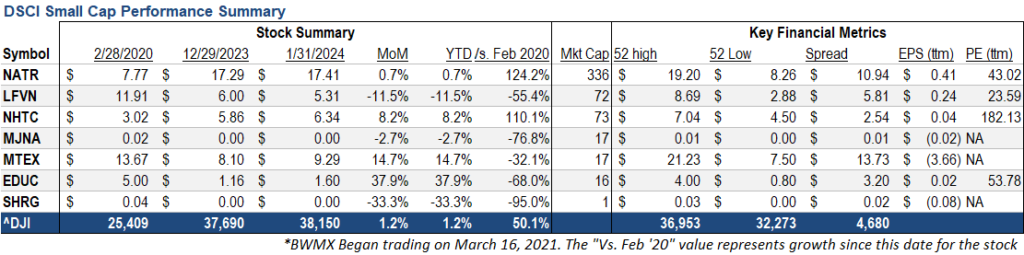

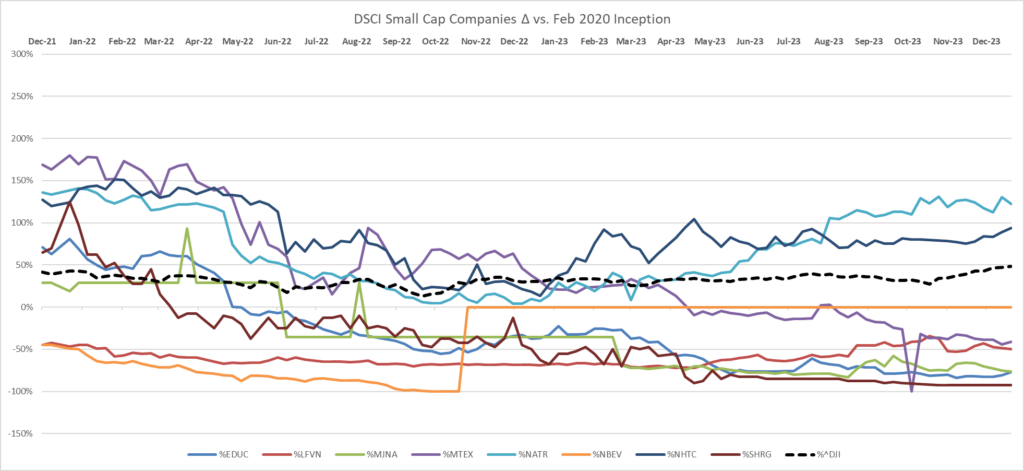

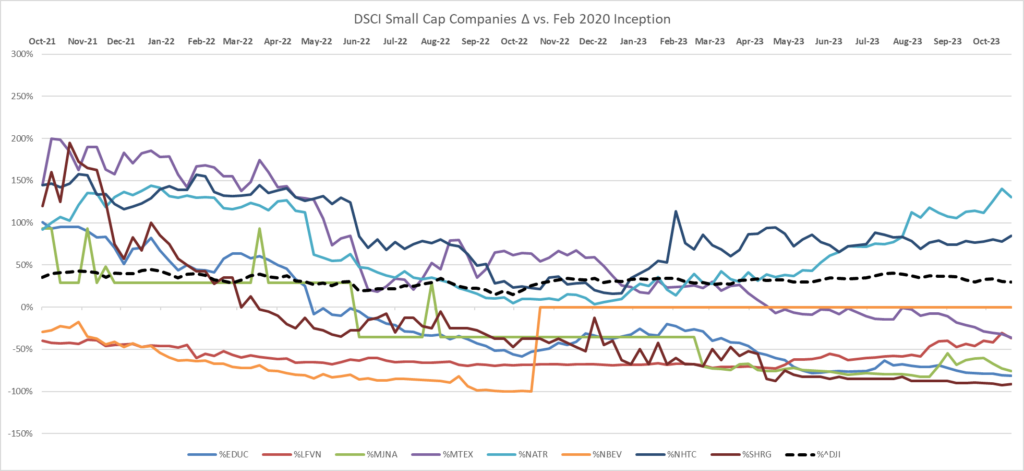

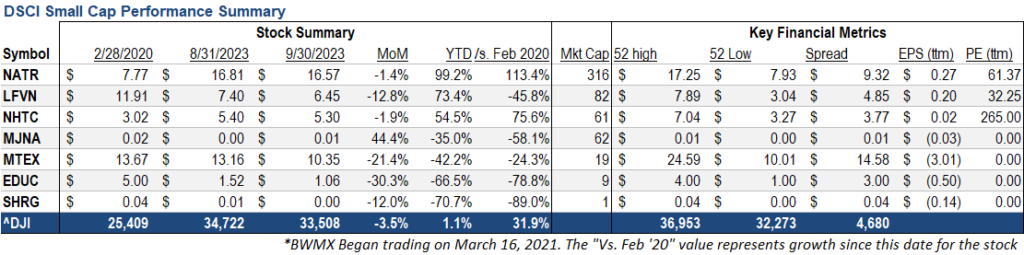

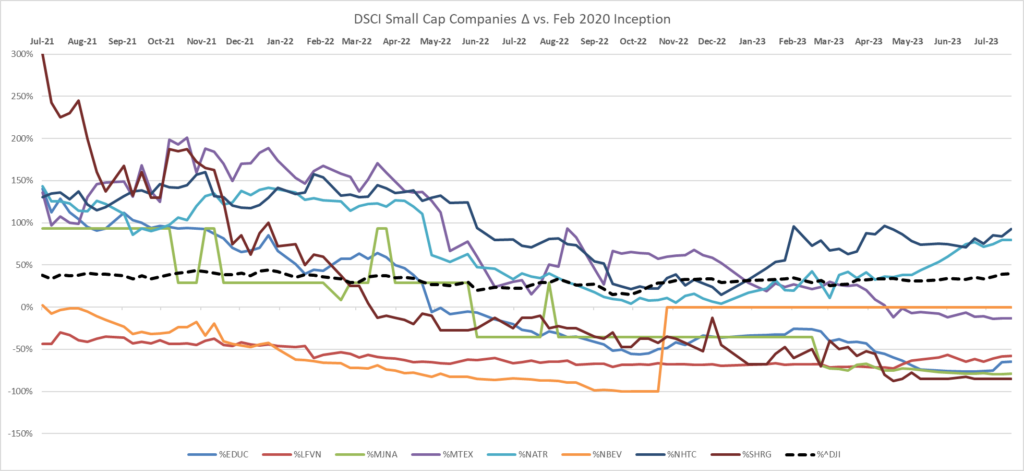

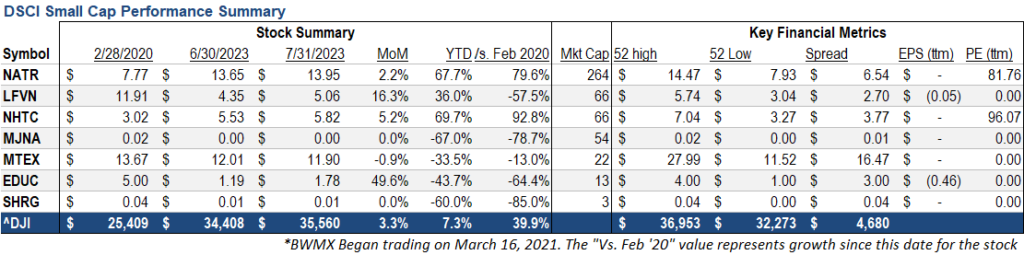

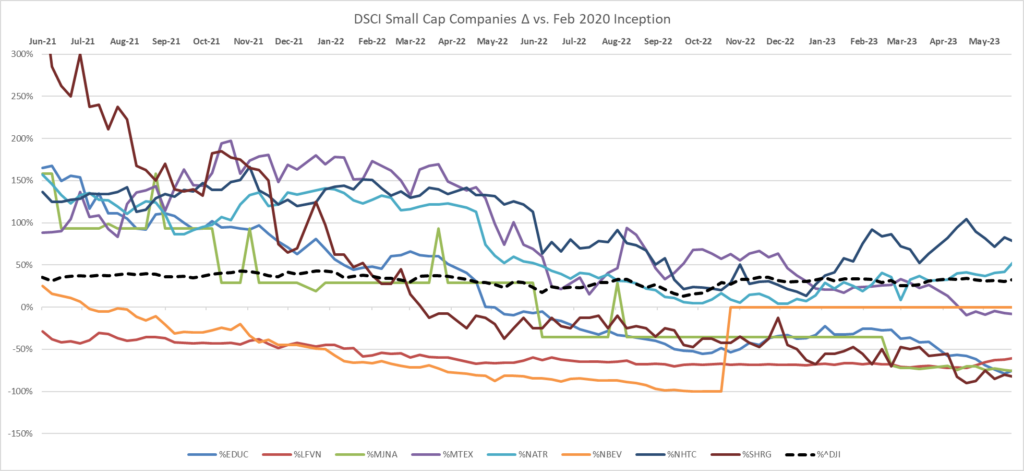

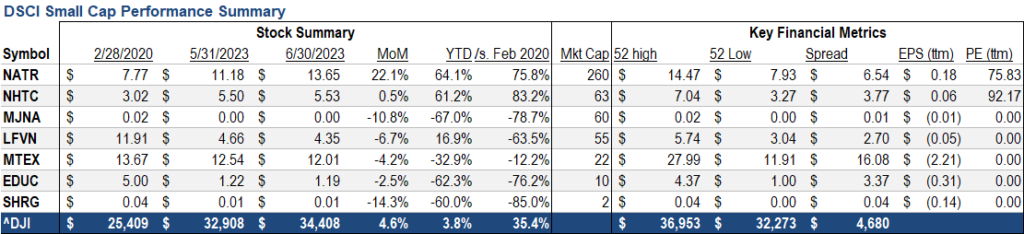

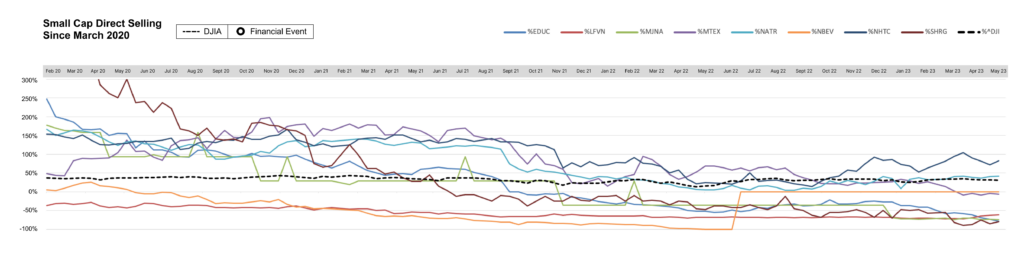

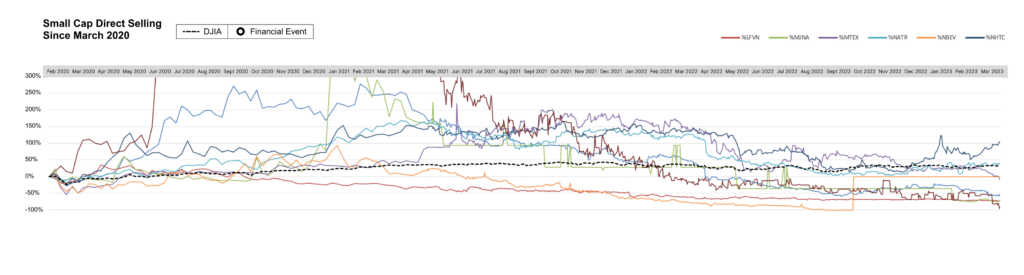

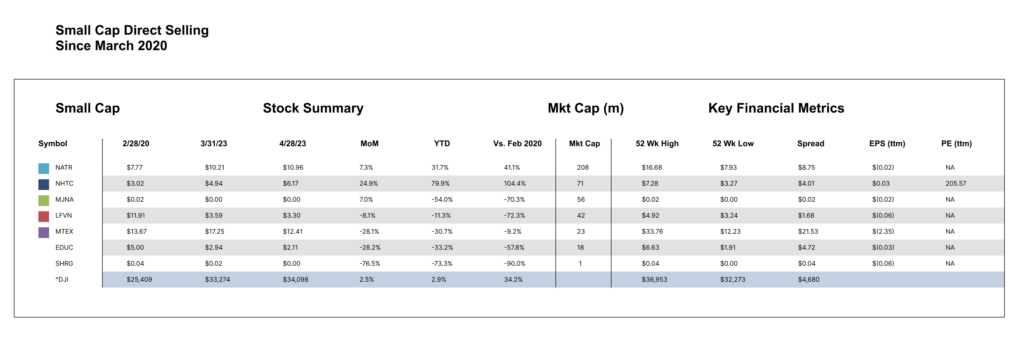

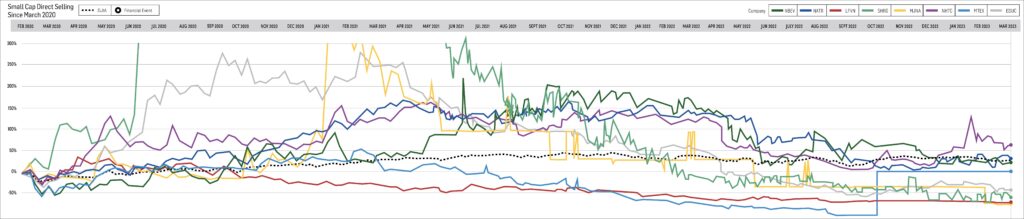

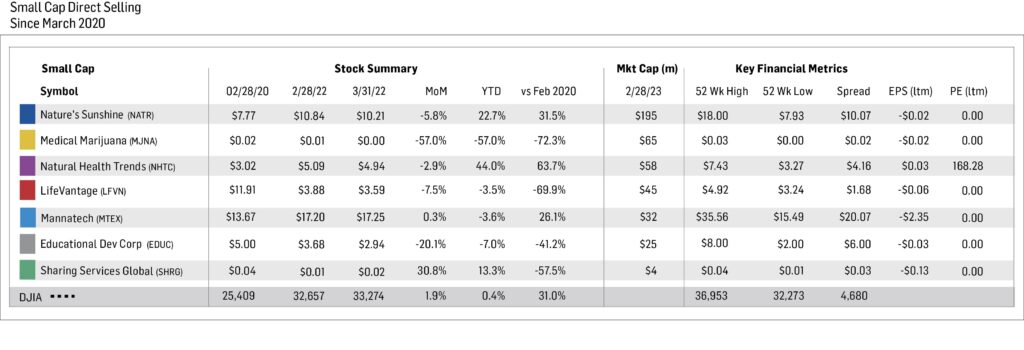

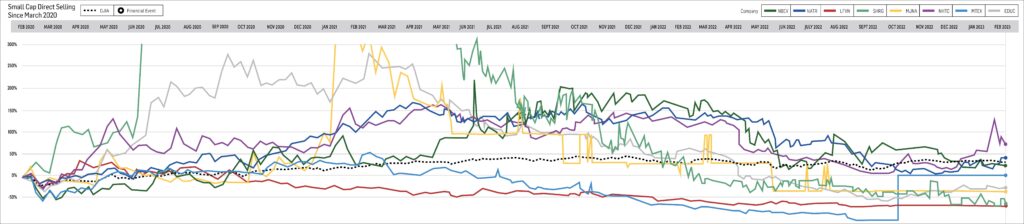

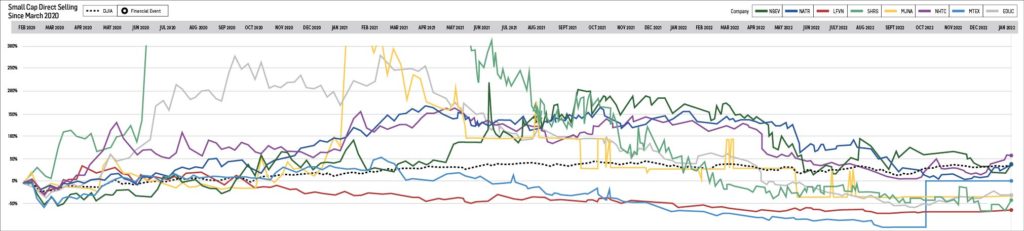

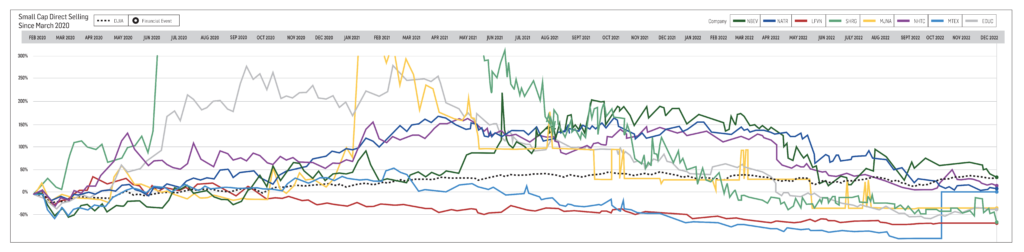

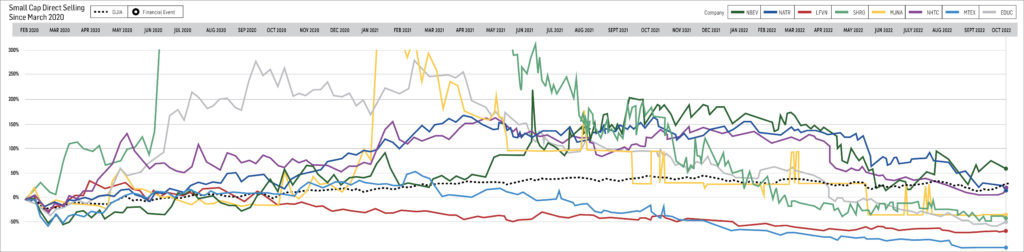

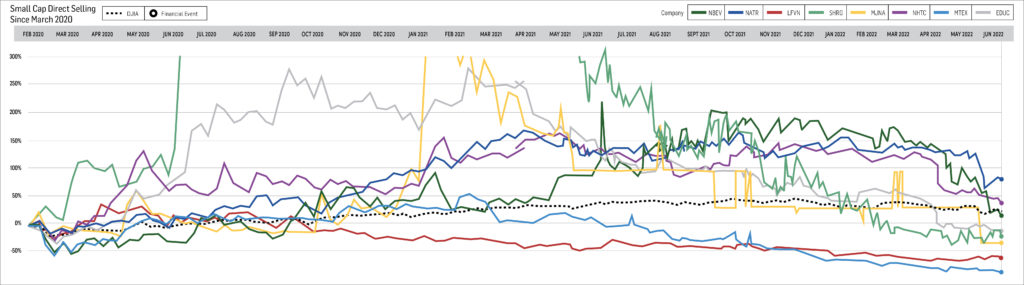

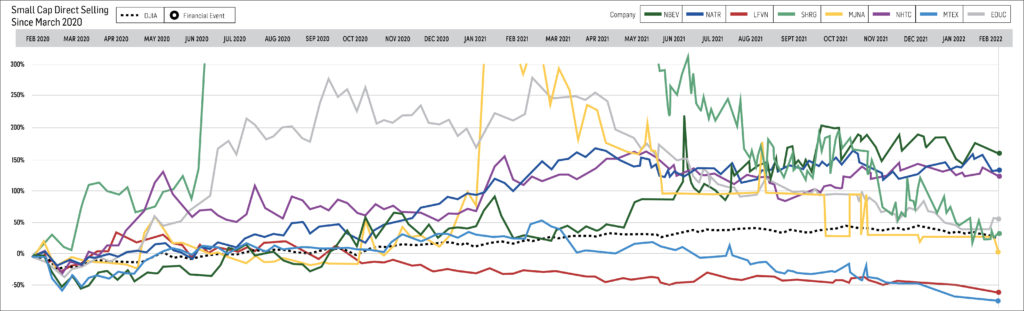

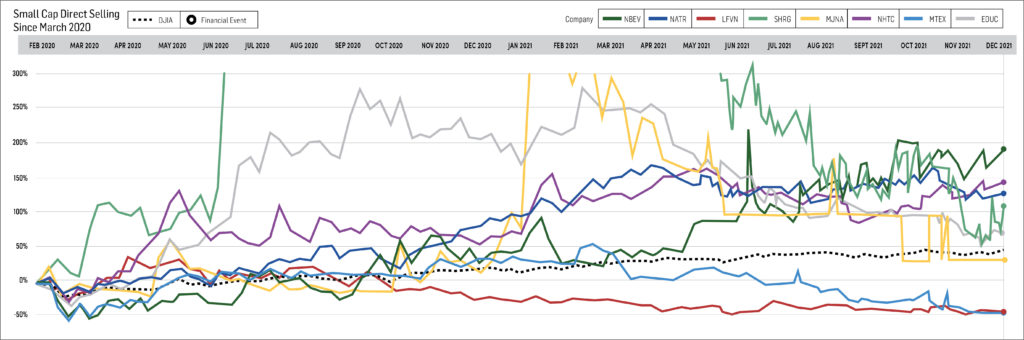

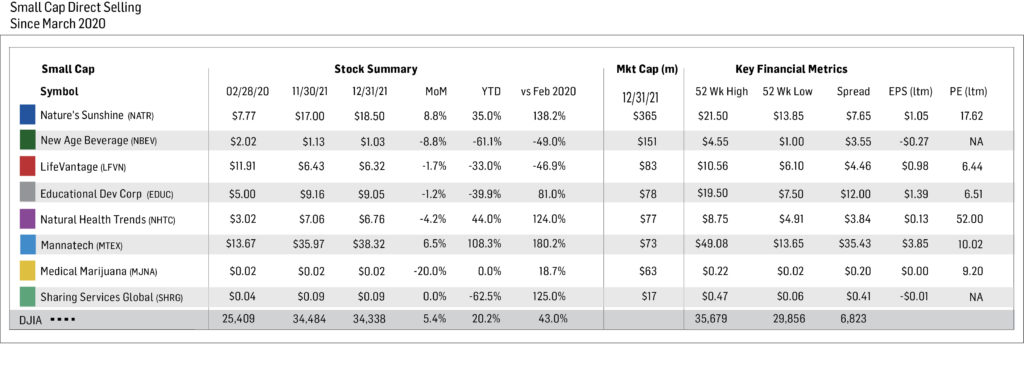

Our small cap tracking set underperformed the large cap DSCI group in February. Of the small caps with a market cap of more than $2 million, one rose during the month, and three declined.

The Beachbody Company, Inc. (NYSE: BODI), a leading fitness and nutrition company, rose 6.2% in February, the best mark of any DSCI small cap member. This performance brought its YTD appreciation to 28.0%, the largest YTD gain for any DSCI component. In 3Q 2024, BODI reported revenue and adjusted EBITDA of $102.2 million and $10.1 million versus $128.3 million and negative $5.8 million, respectively, in the year ago period.

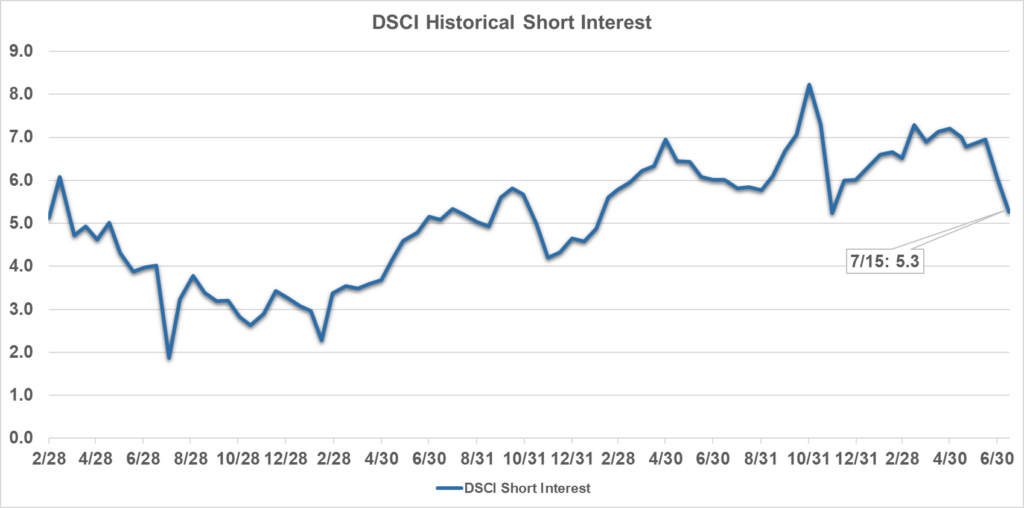

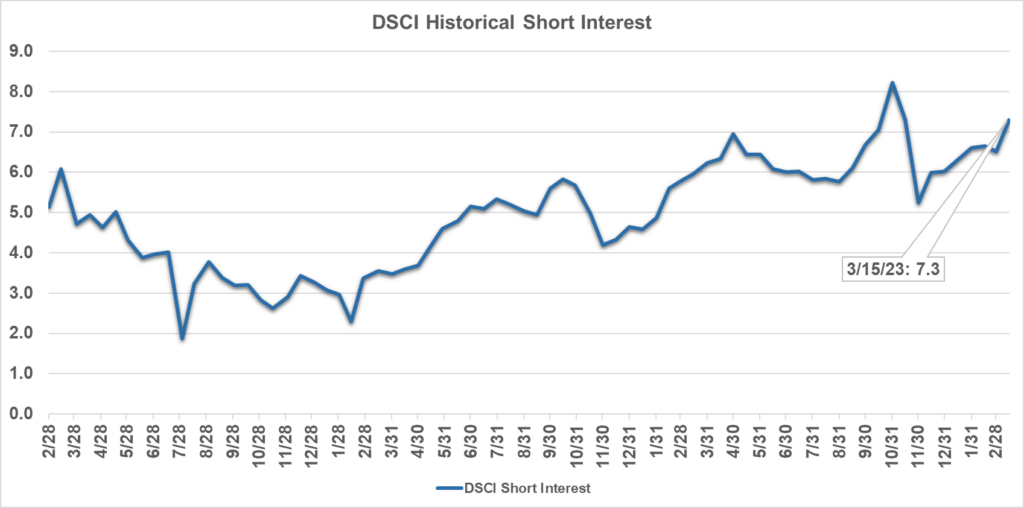

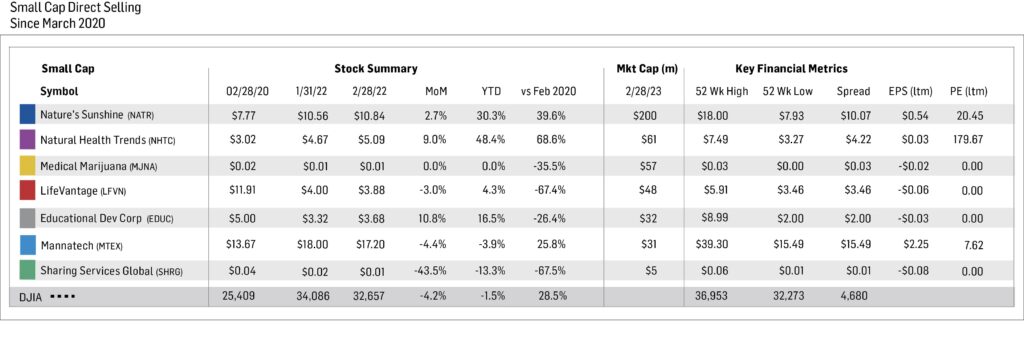

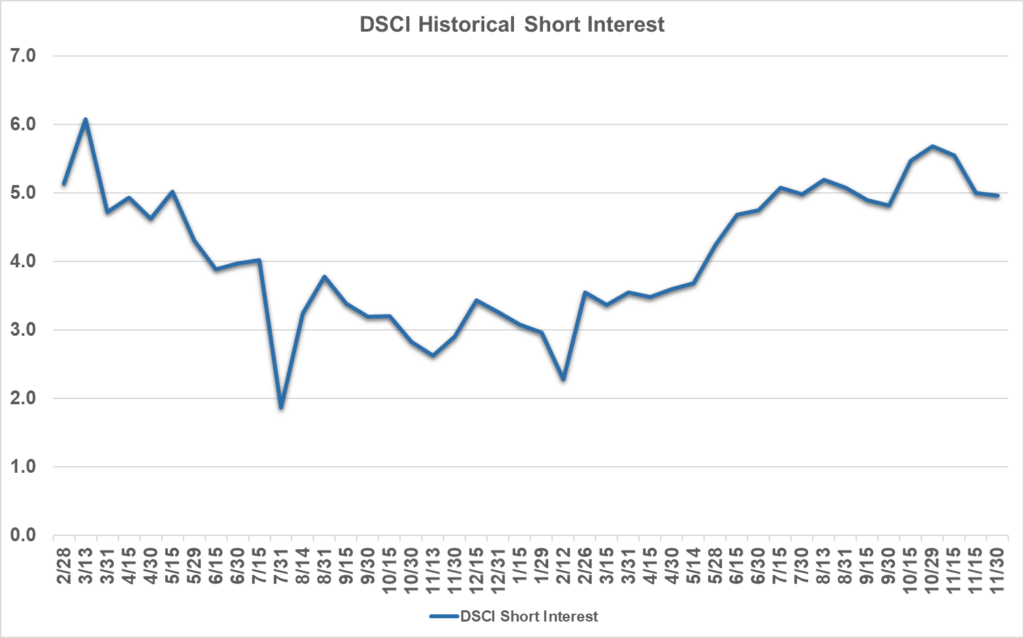

Short Interest Data & Analysis

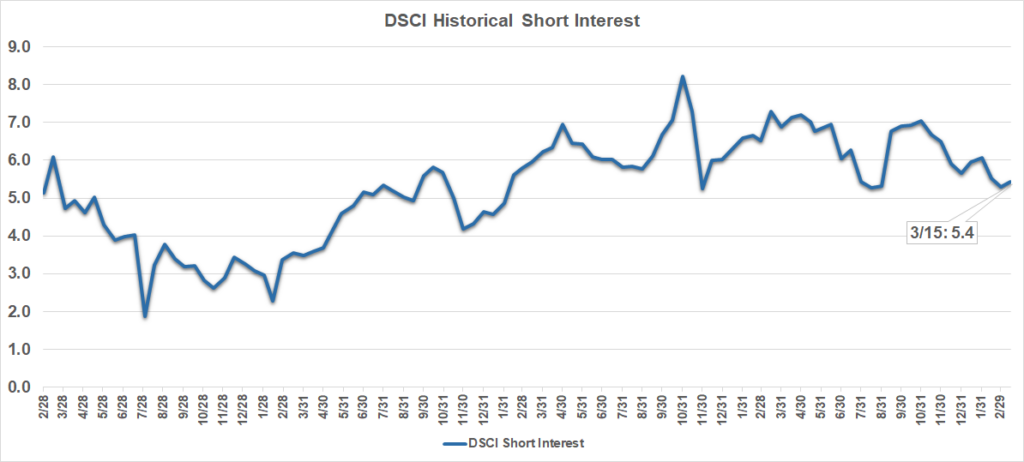

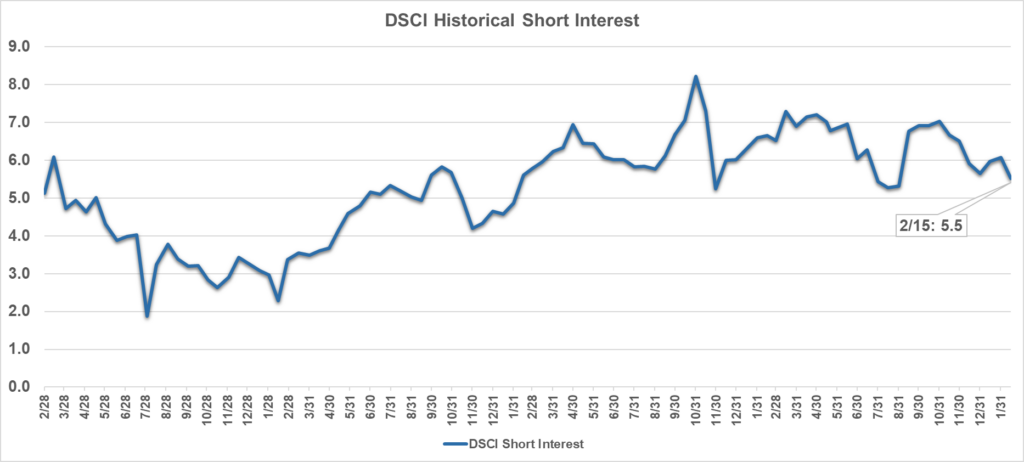

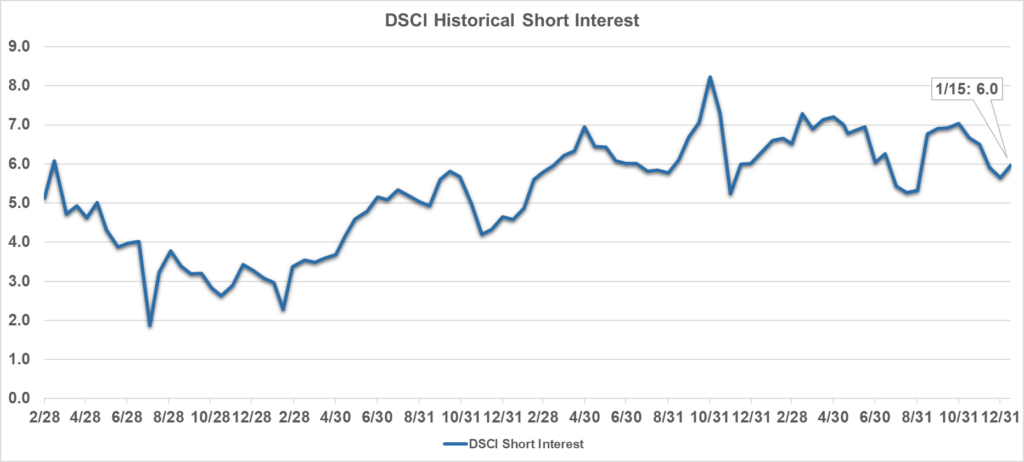

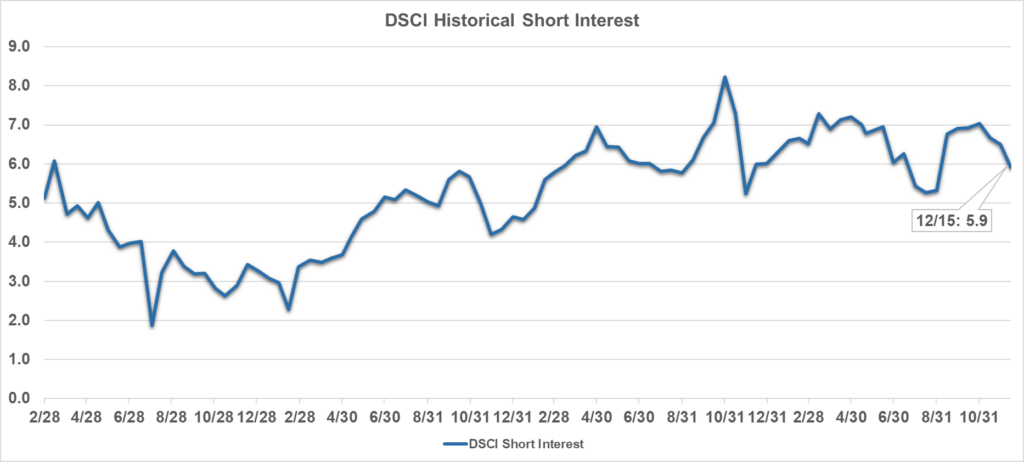

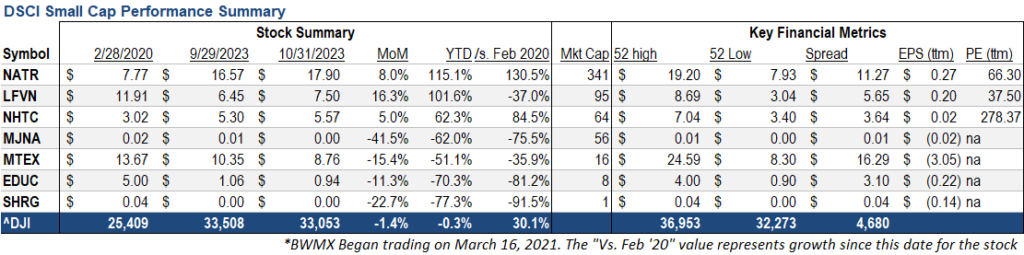

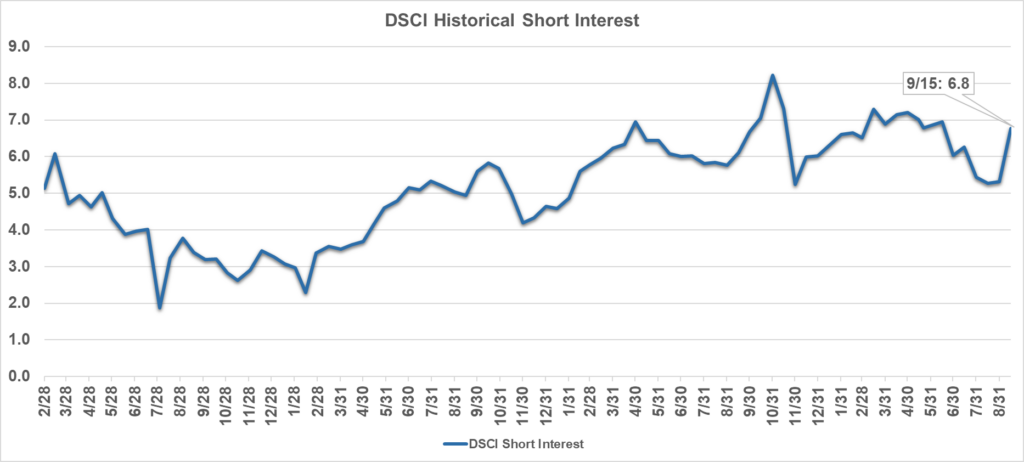

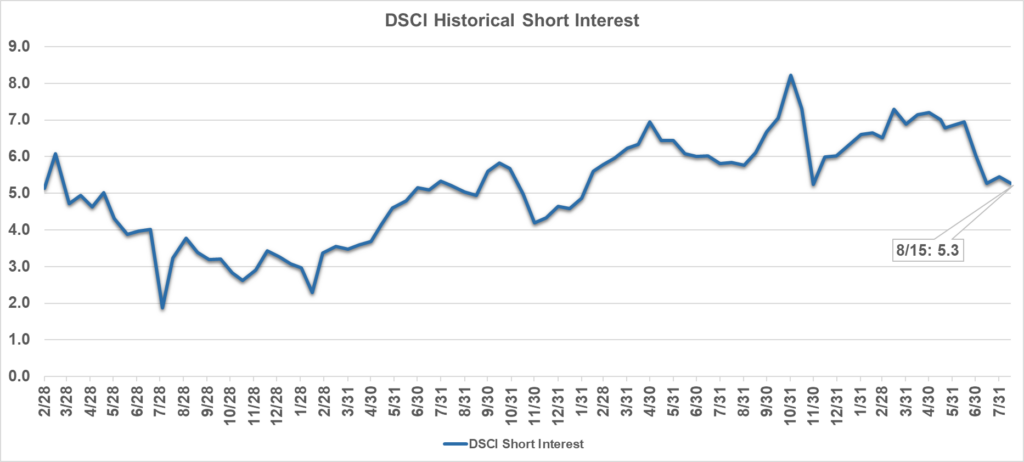

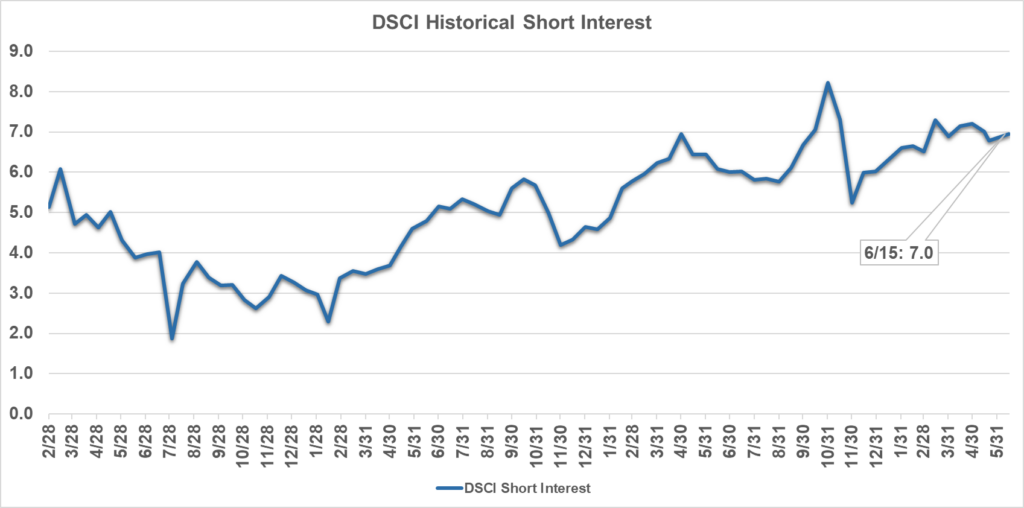

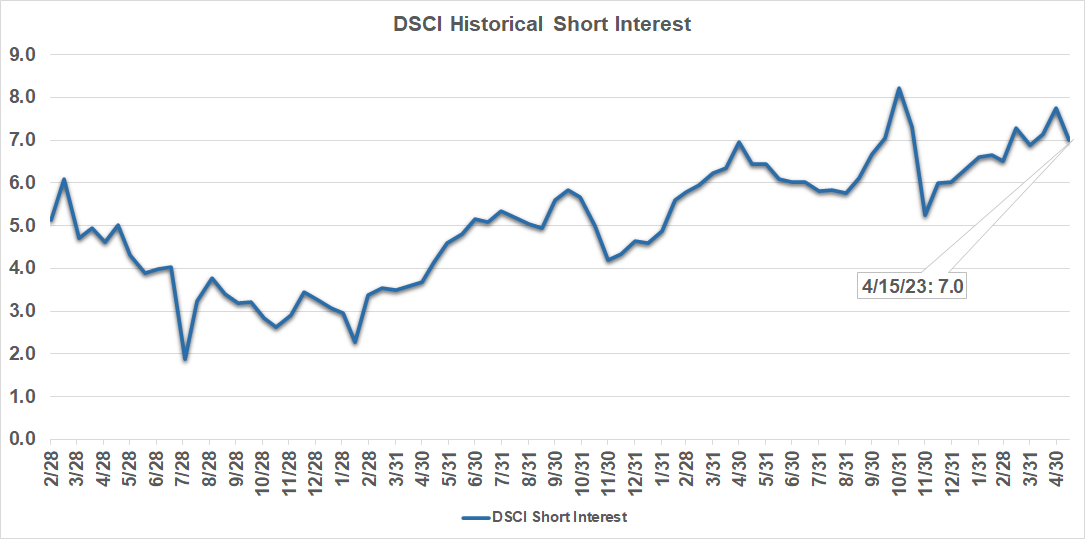

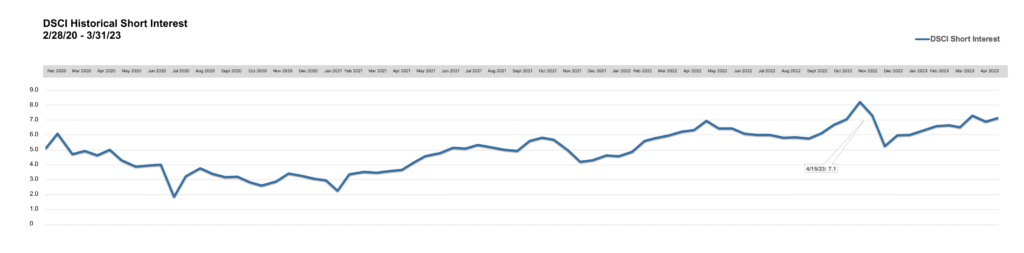

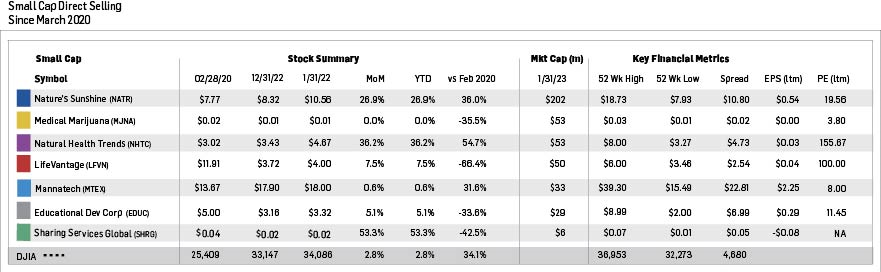

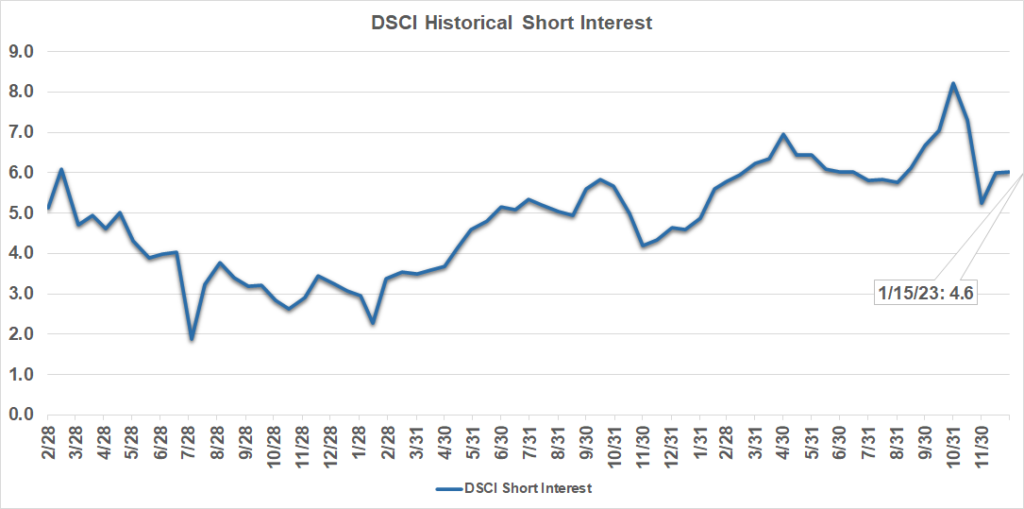

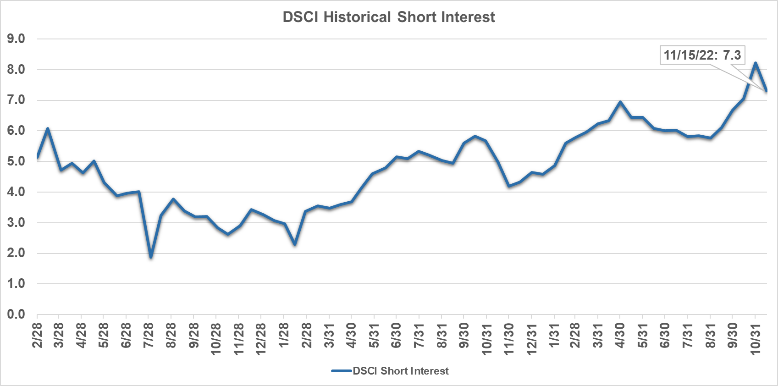

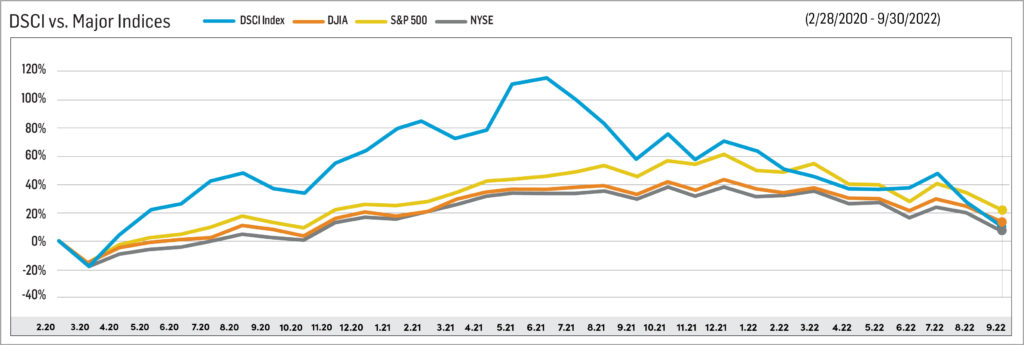

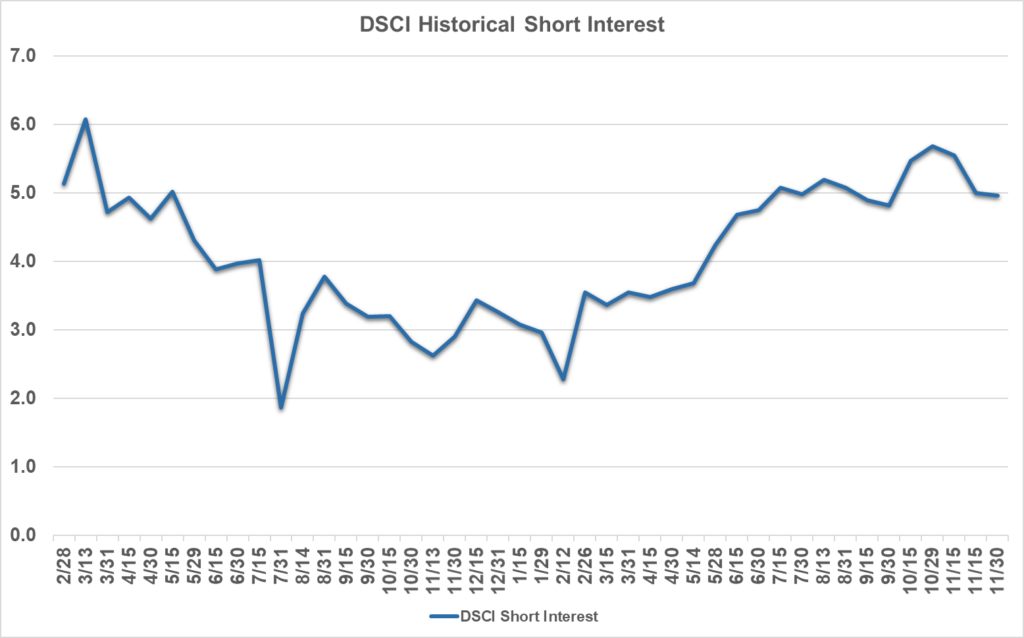

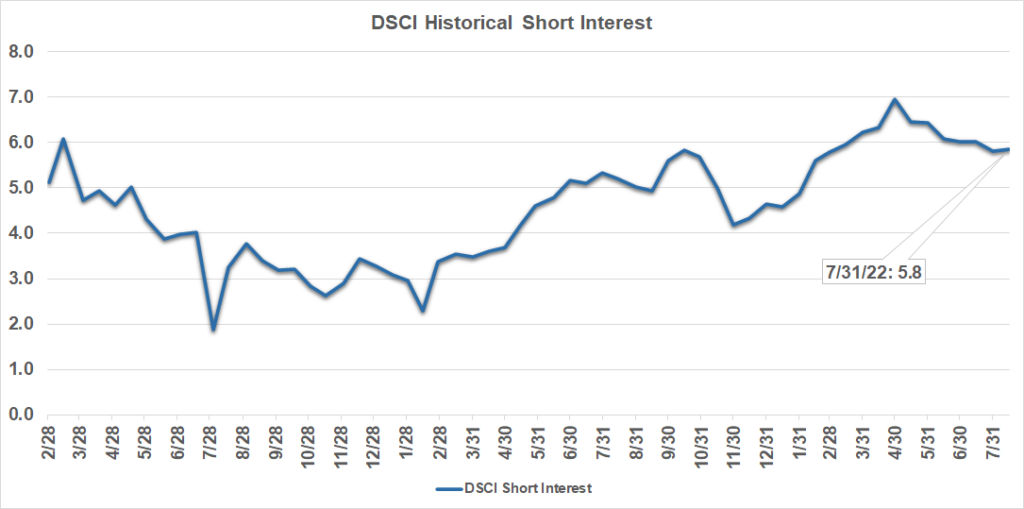

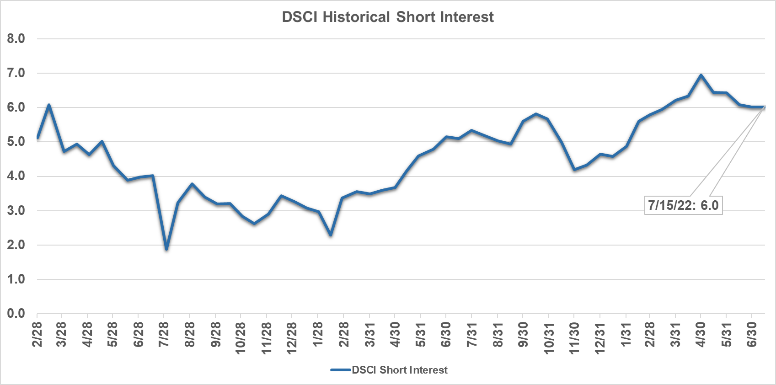

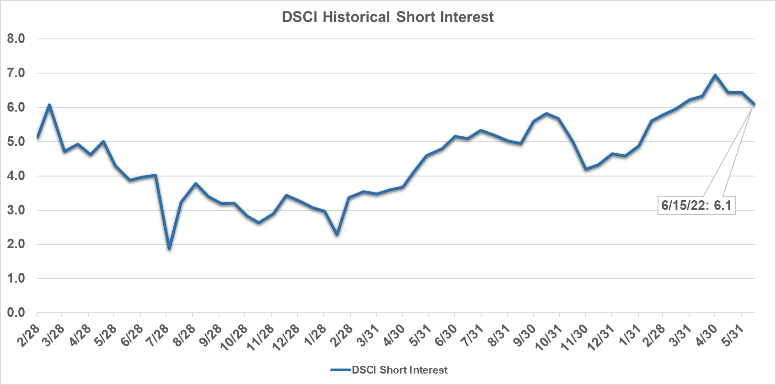

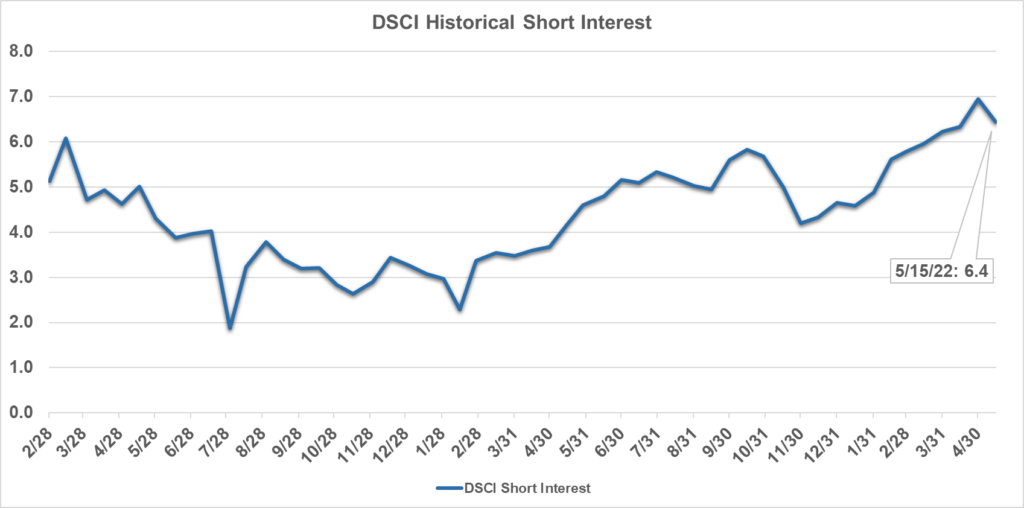

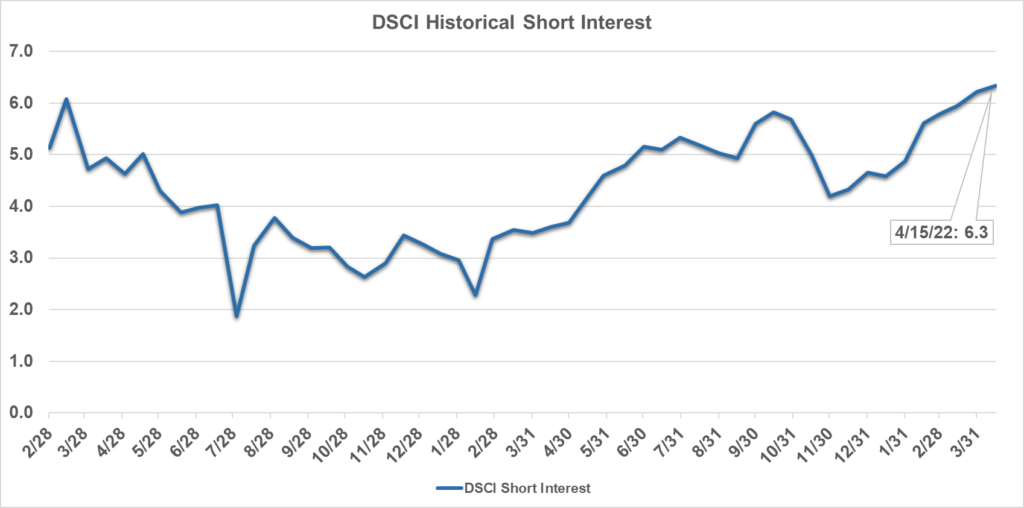

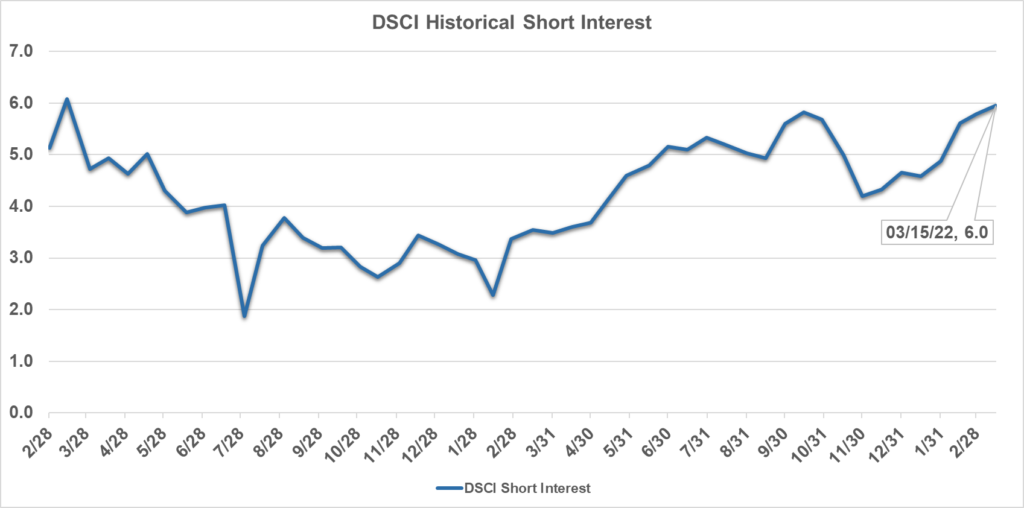

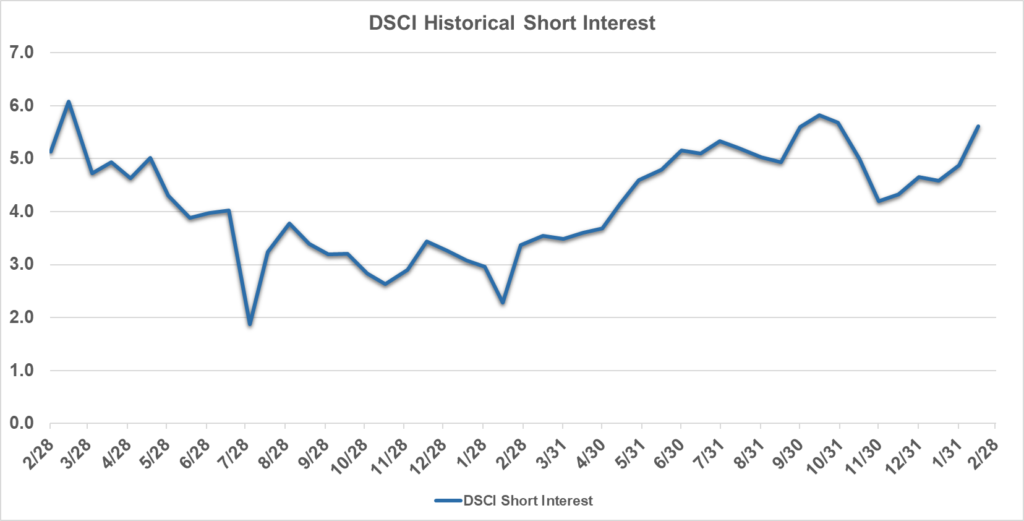

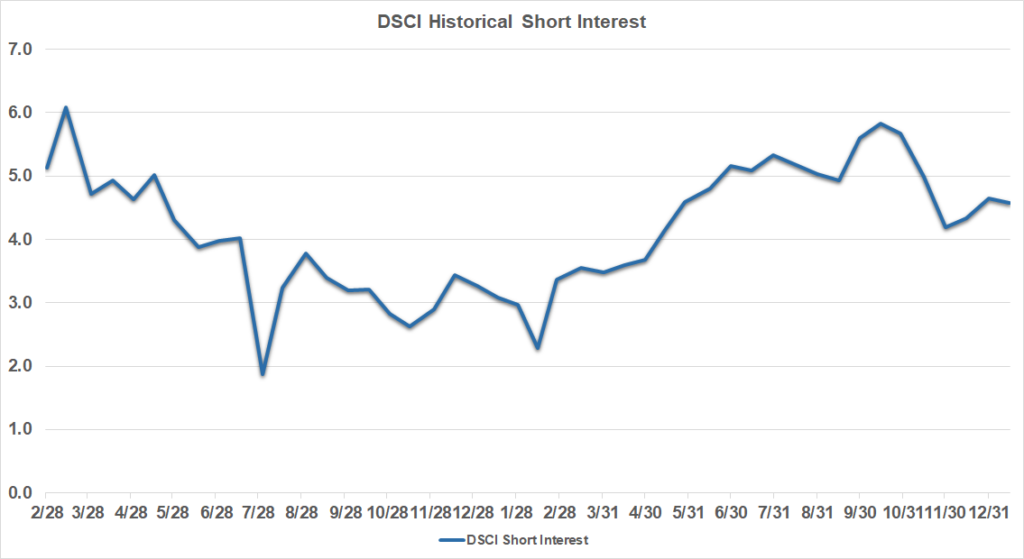

The following chart is an aggregate index of “days to cover” among the entire tracking set. Days to cover (DTC) is a measurement determined by dividing the total outstanding short interest by average daily trading volume.

As indicated in the chart, short interest in DSCI stocks was 5.4 days in mid-February 2025, up from 5.3 days at the end of January 2025 and 5.0 days in mid-January 2025. The biggest absolute increase in DTC in mid-February 2025 from the end of January 2025 for a DSCI component was LFVN’s increase to 6.6 days from 3.2 days.

As indicated in the chart, short interest in DSCI stocks was 5.4 days in mid-February 2025, up from 5.3 days at the end of January 2025 and 5.0 days in mid-January 2025. The biggest absolute increase in DTC in mid-February 2025 from the end of January 2025 for a DSCI component was LFVN’s increase to 6.6 days from 3.2 days.Short interest can be a difficult indicator to analyze. On the one hand, an increase in short interest can be a bearish sign in that it indicates an increased view among investors that a stock is likely to decline based on any number of factors, such as a belief that the company’s fundamentals are deteriorating or that it has run too far, too fast. On the other hand, as a stock moves higher, a significant short interest can serve as extra fuel on the fire as investors scramble to “buy to cover” their short positions and mitigate losses.

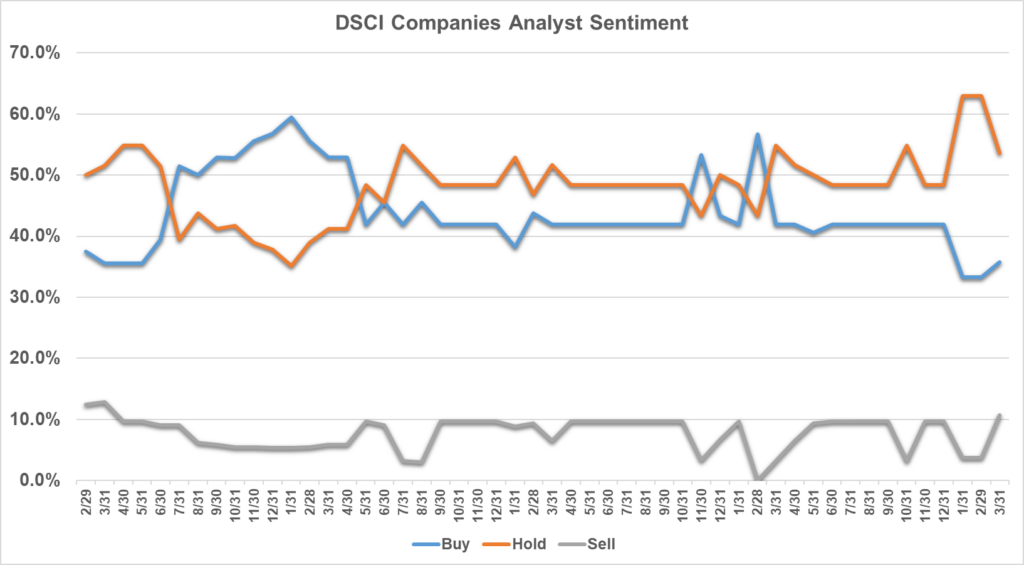

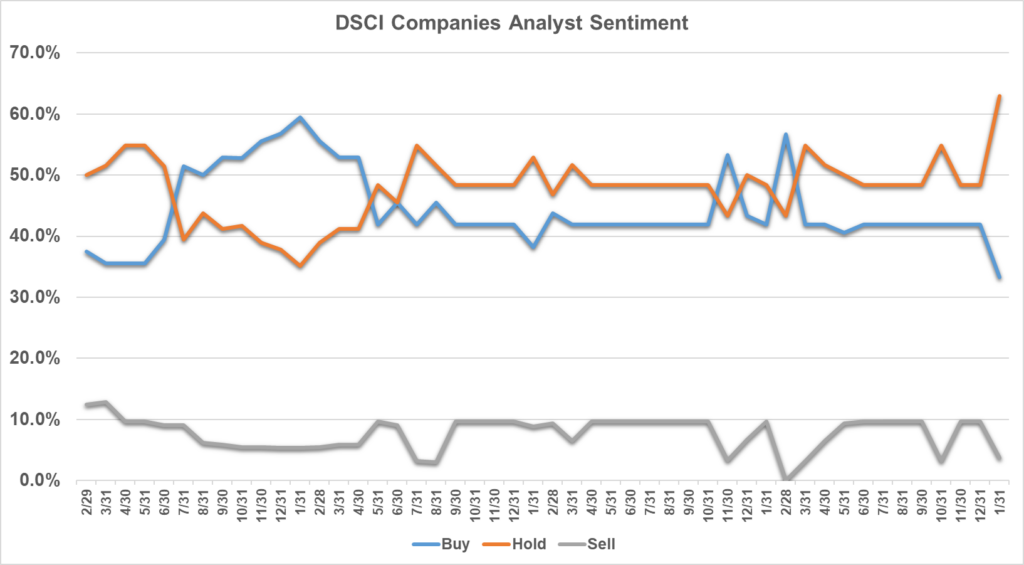

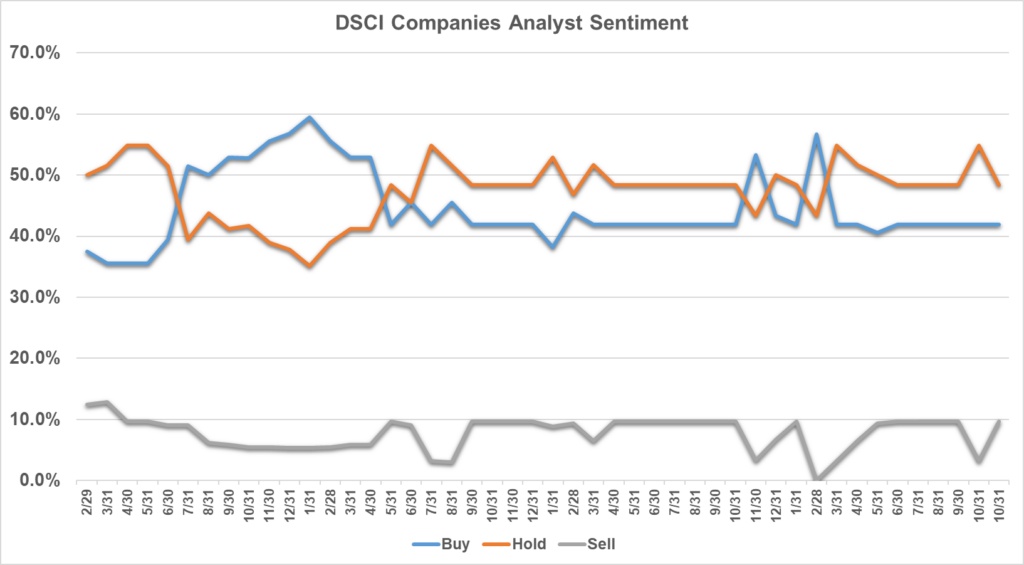

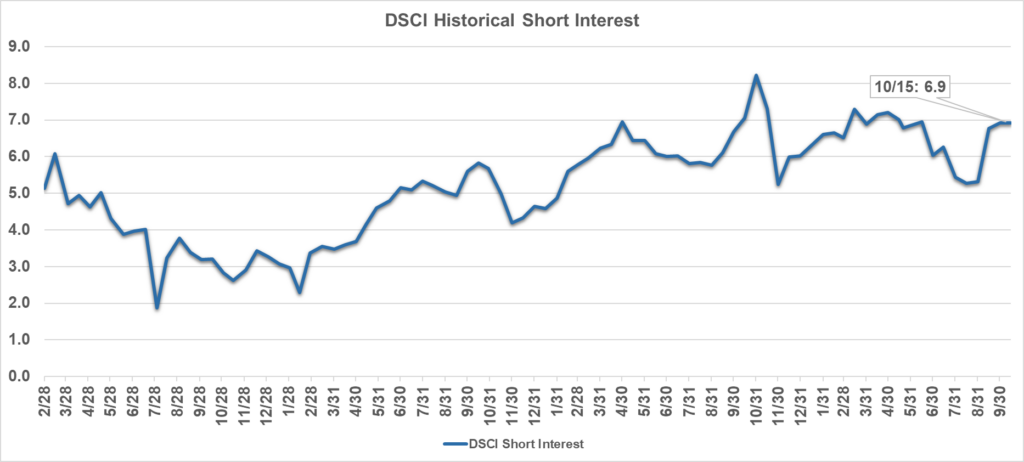

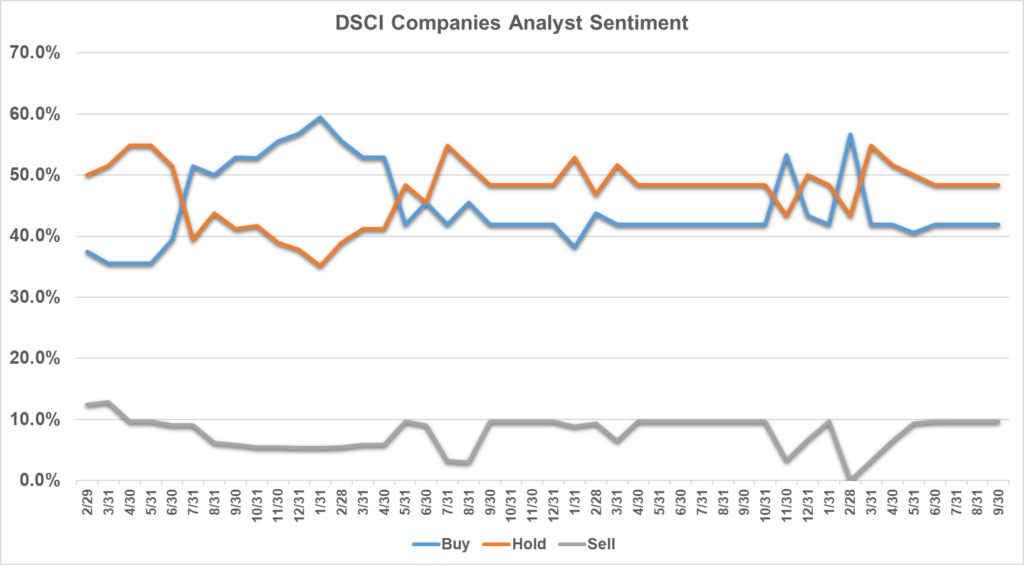

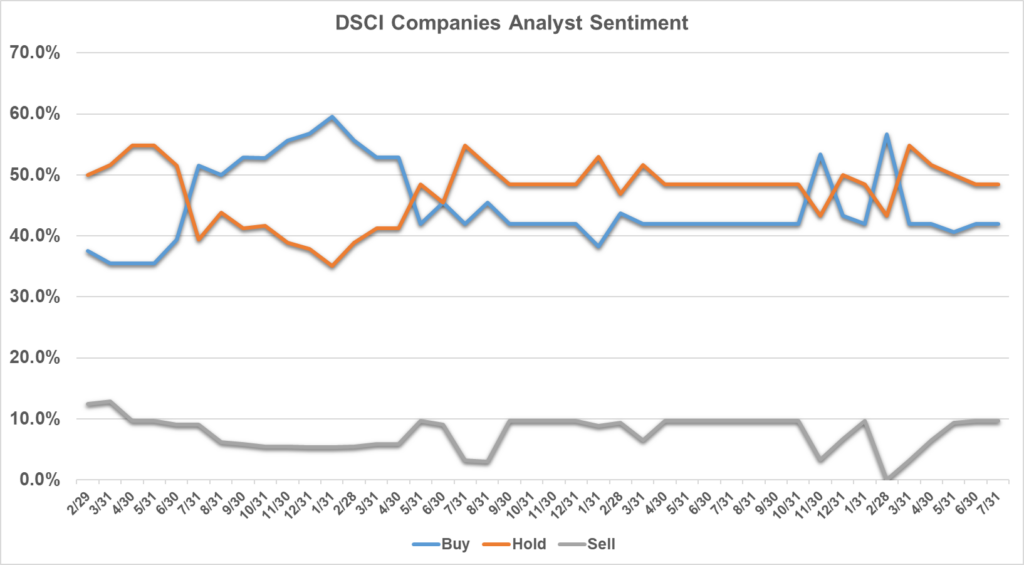

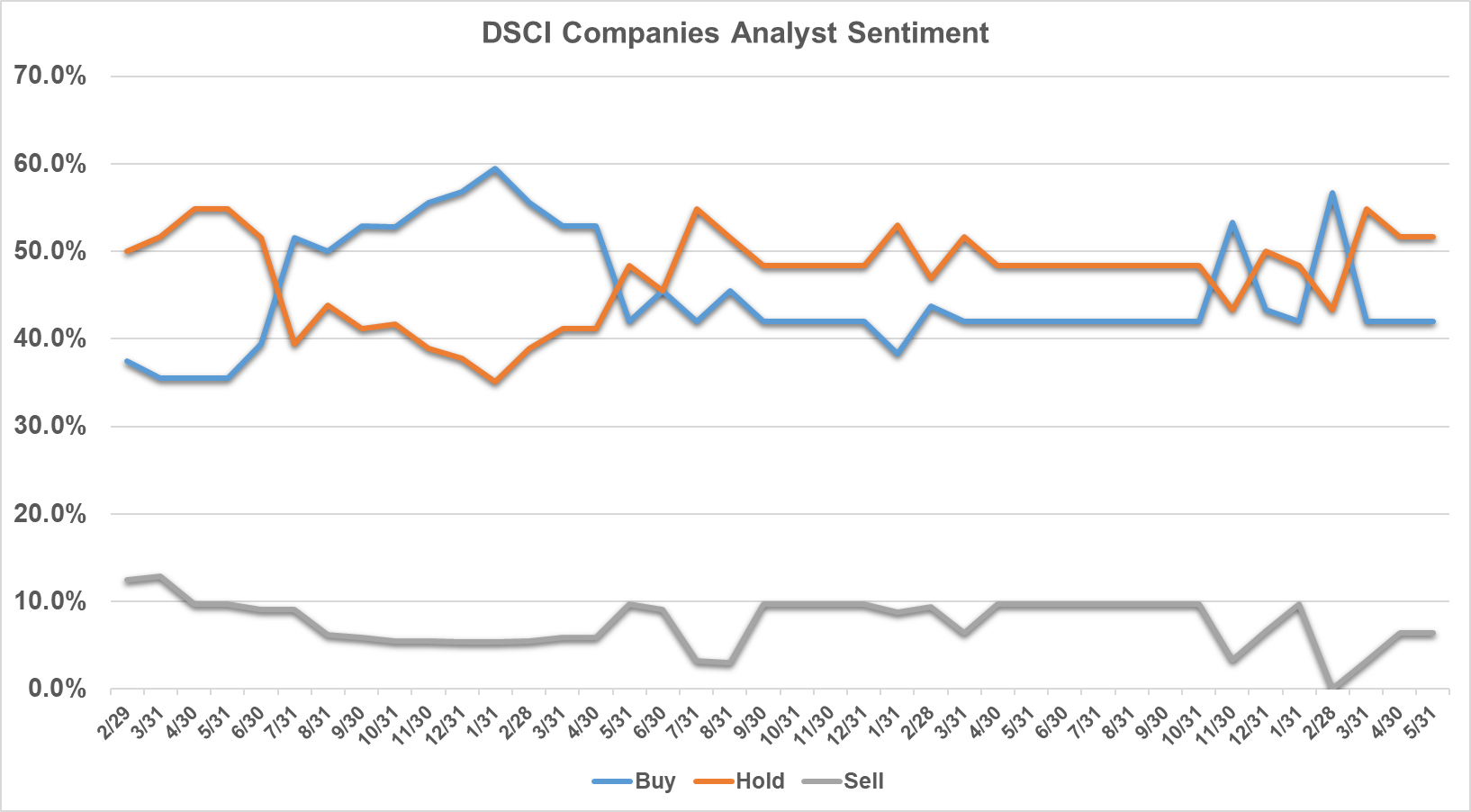

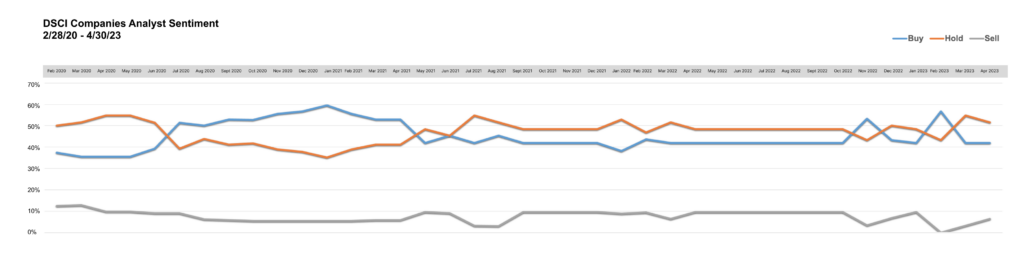

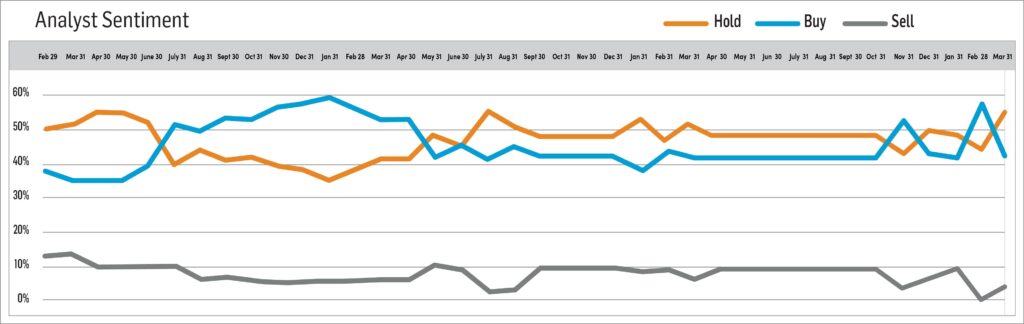

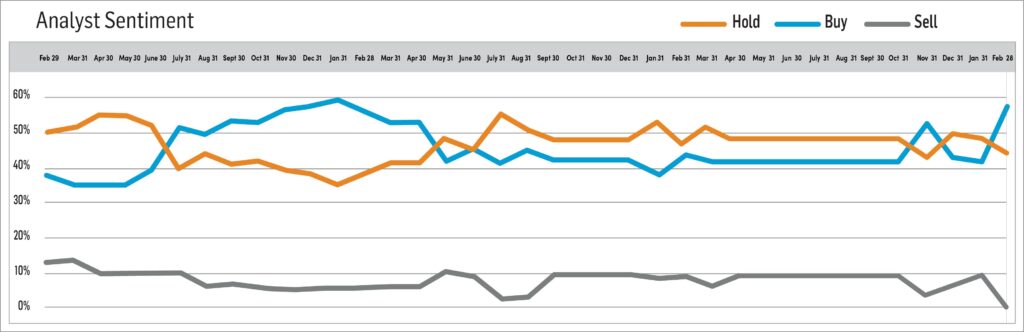

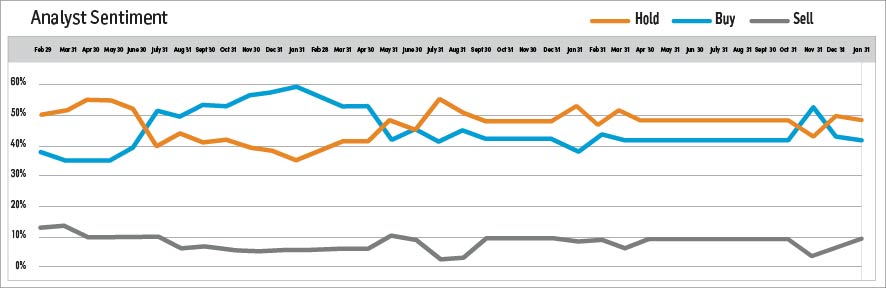

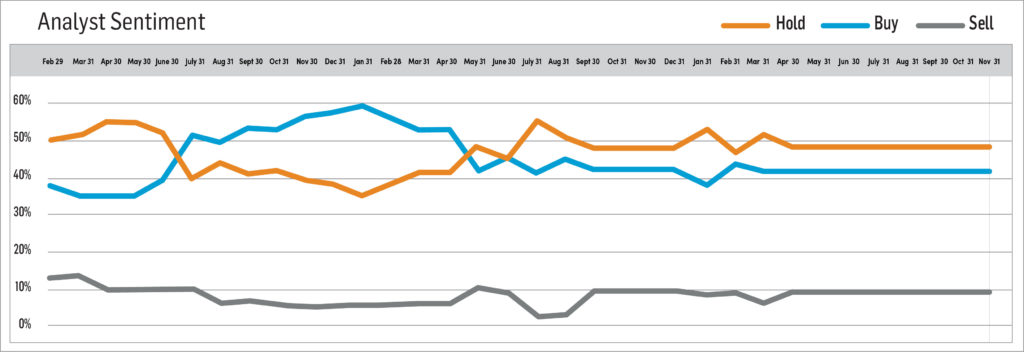

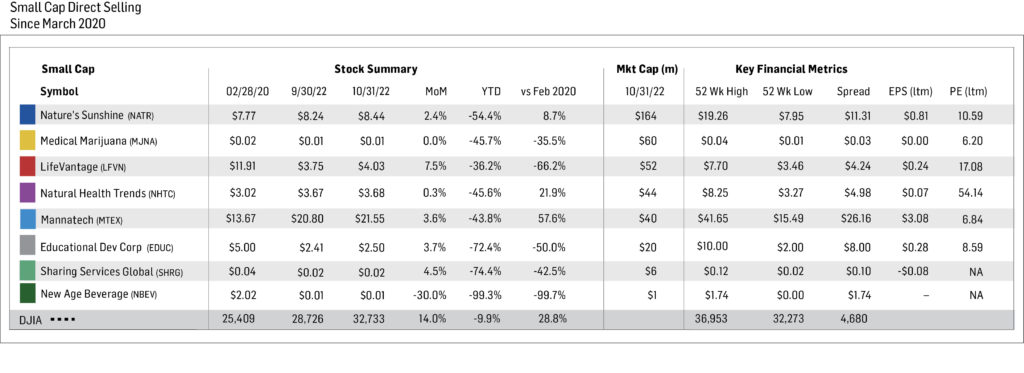

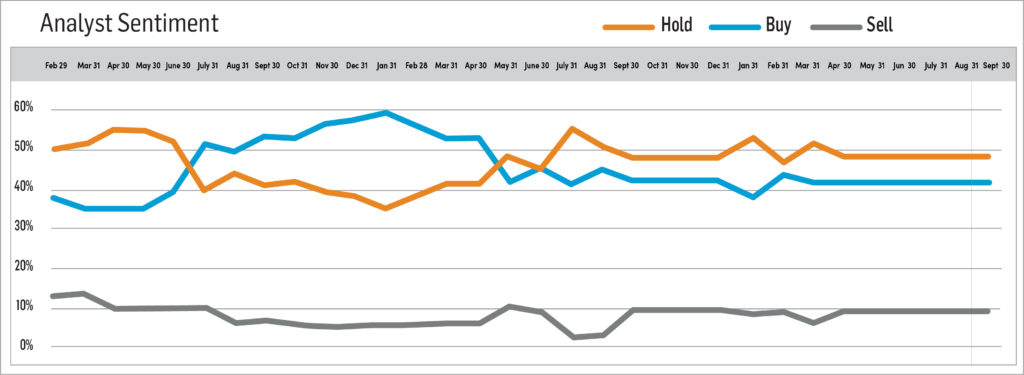

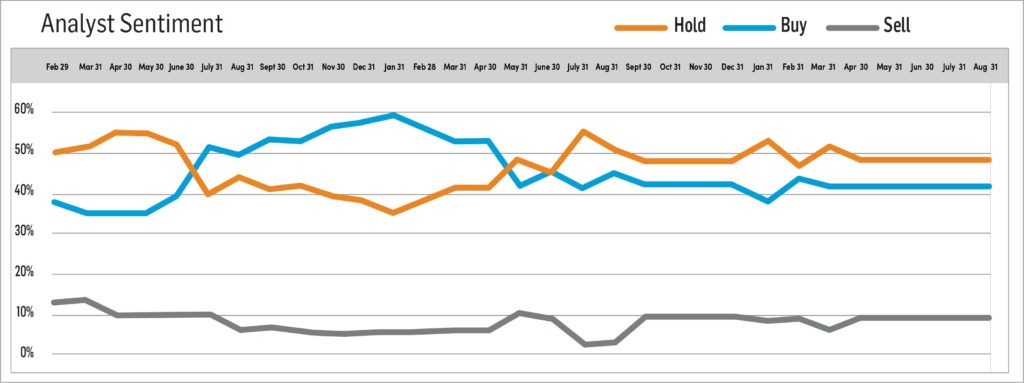

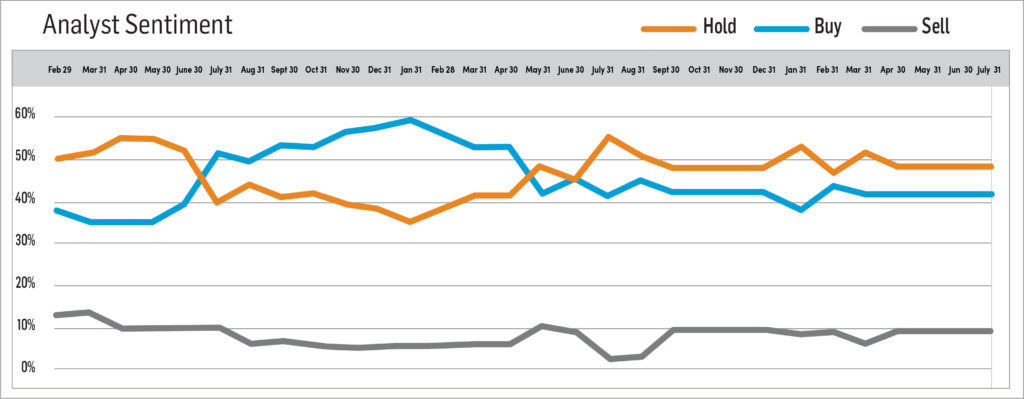

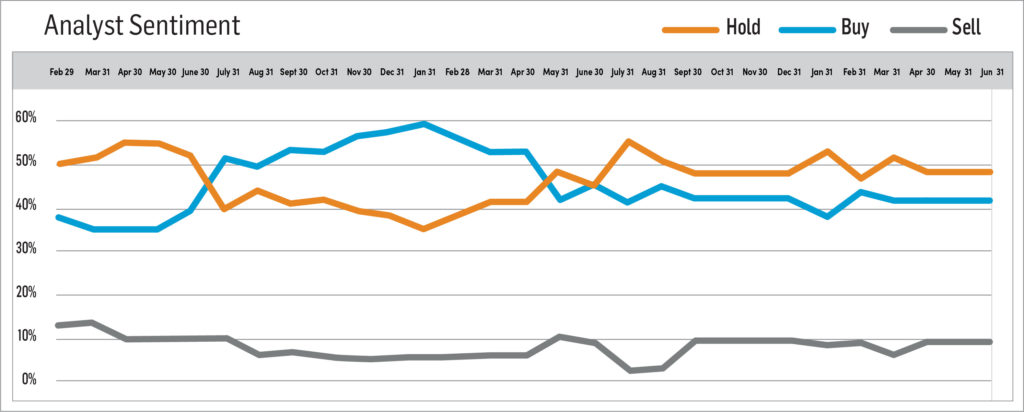

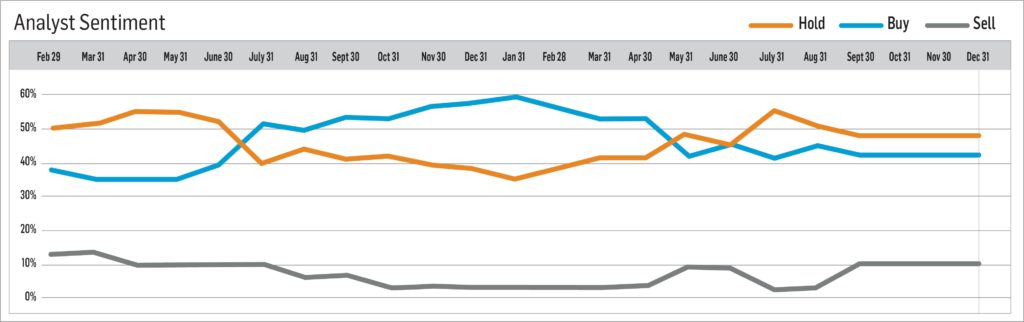

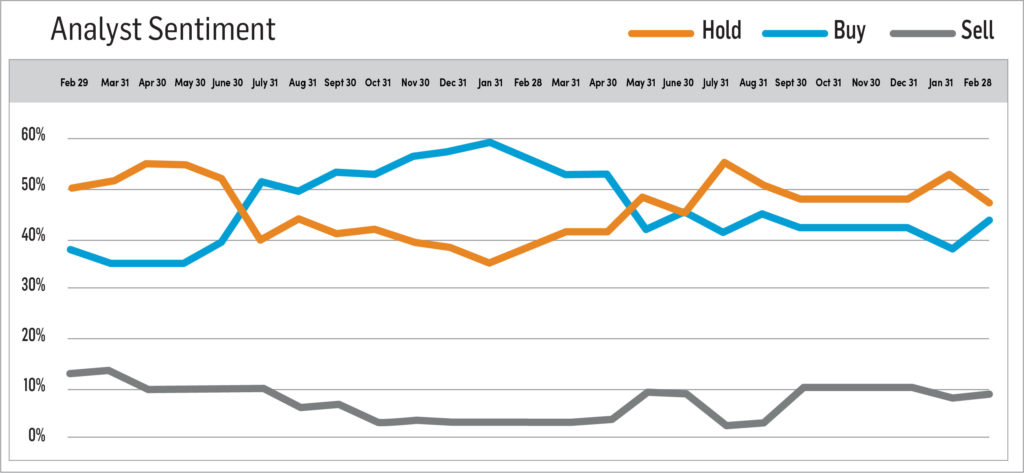

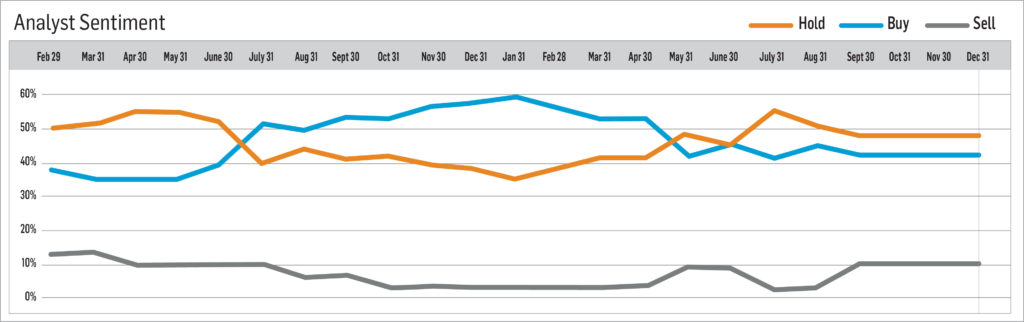

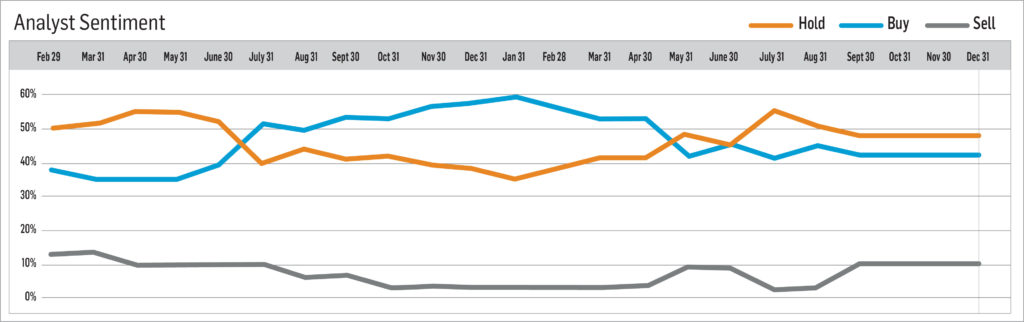

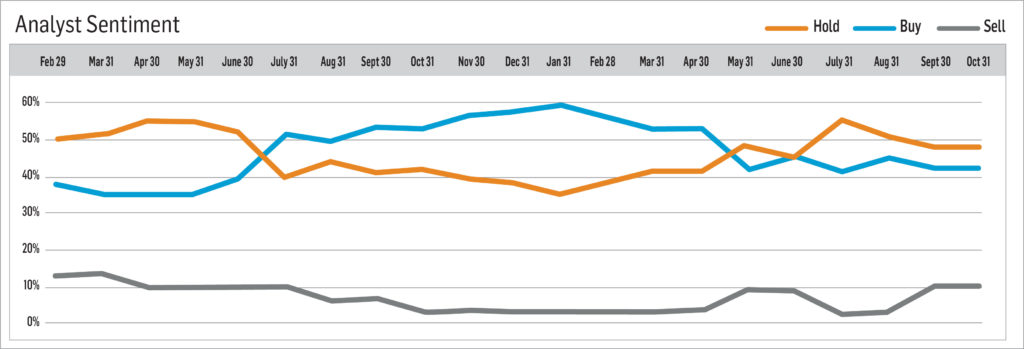

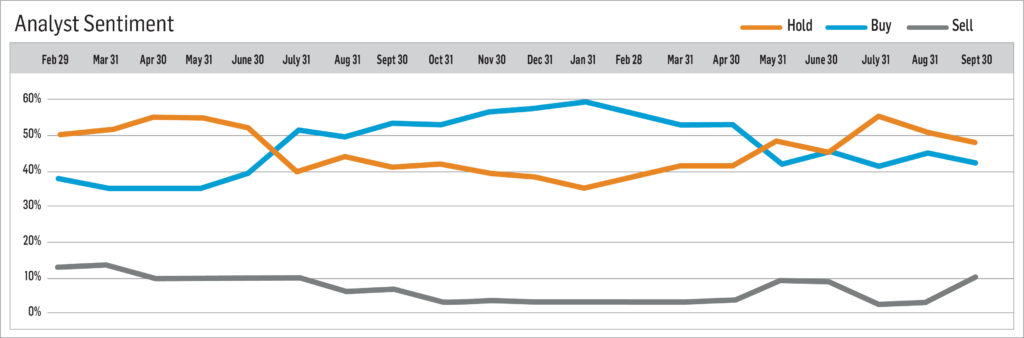

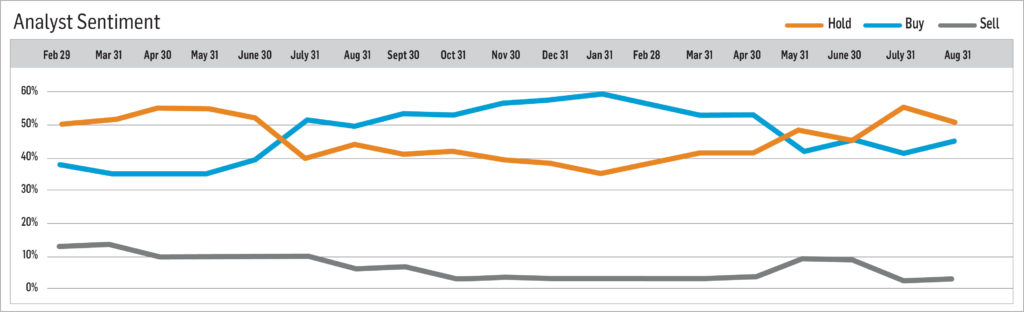

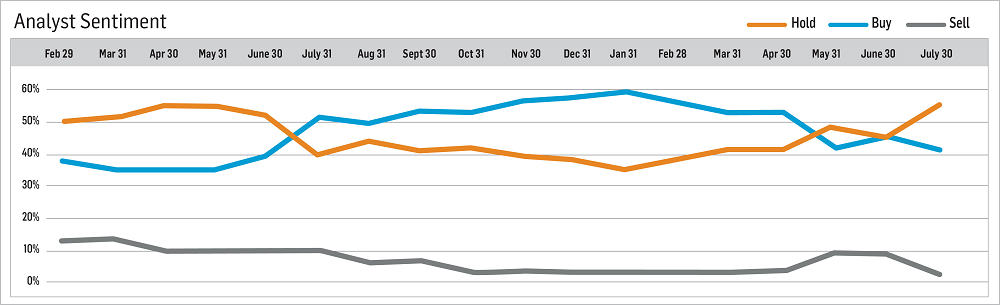

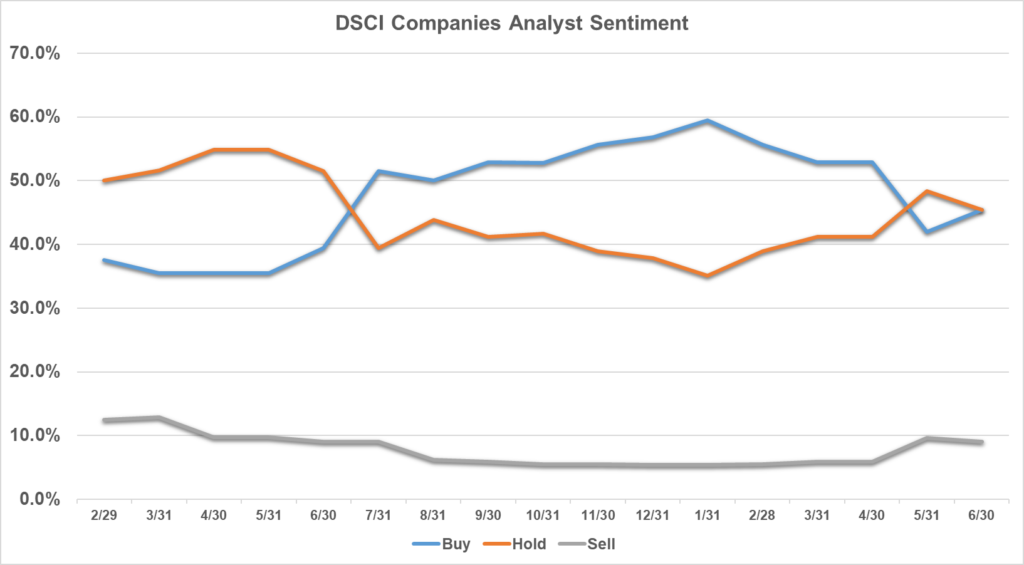

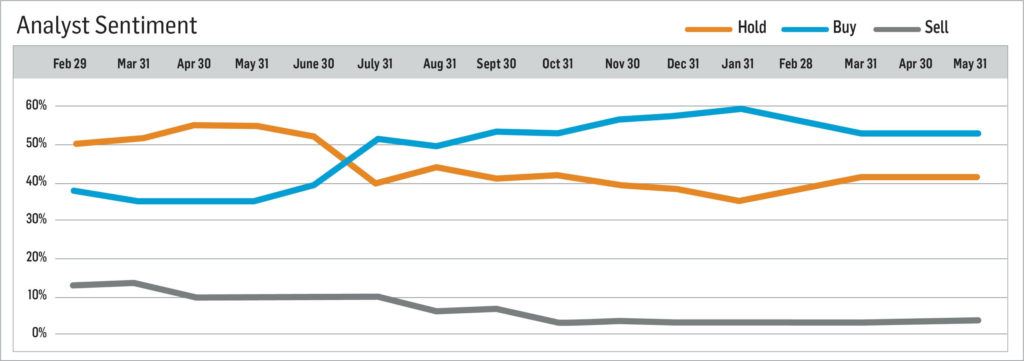

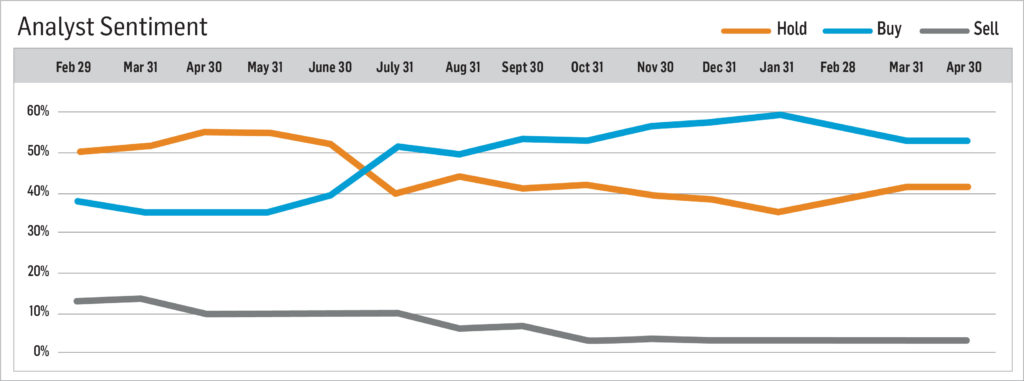

Analyst Sentiment Index

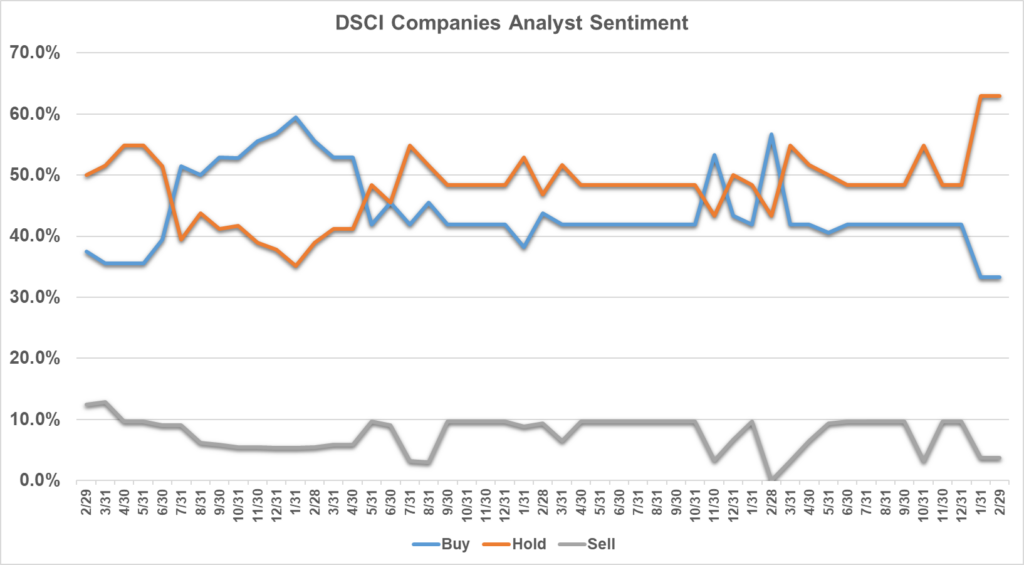

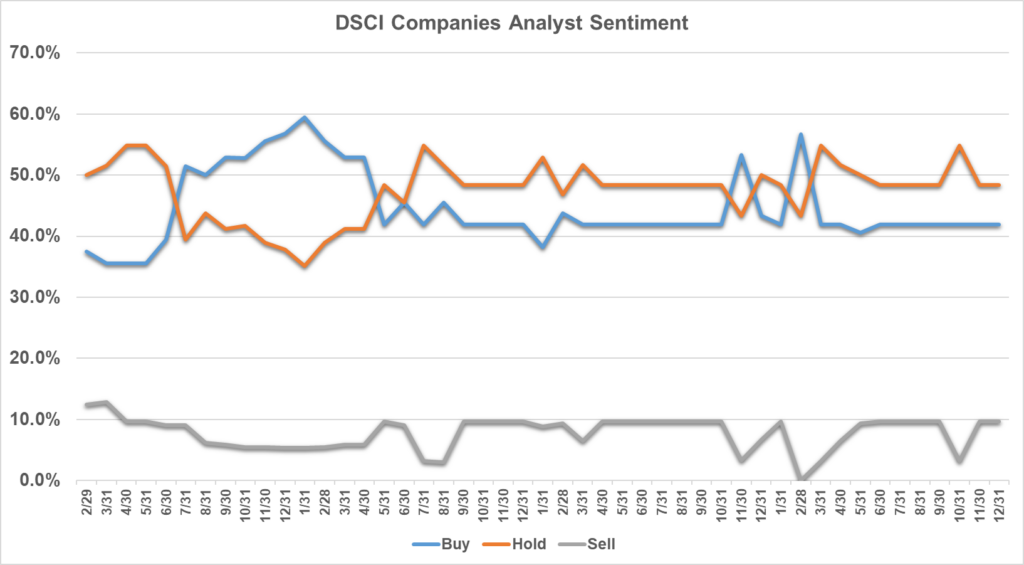

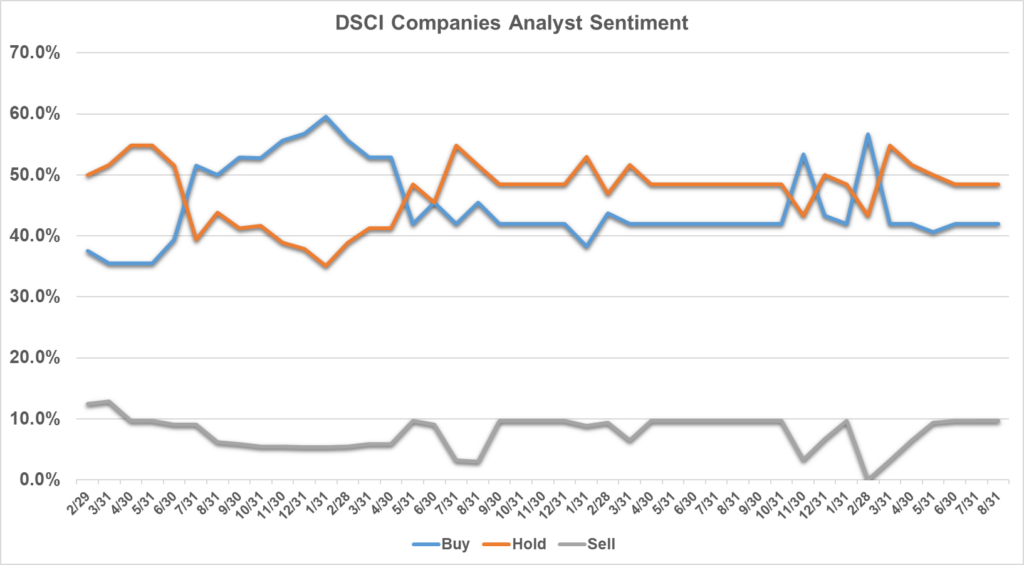

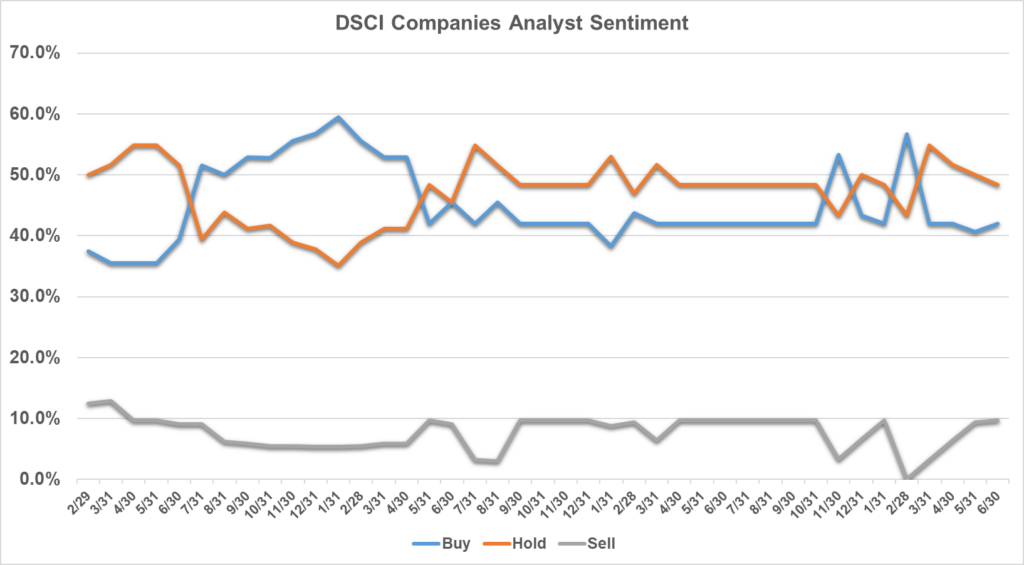

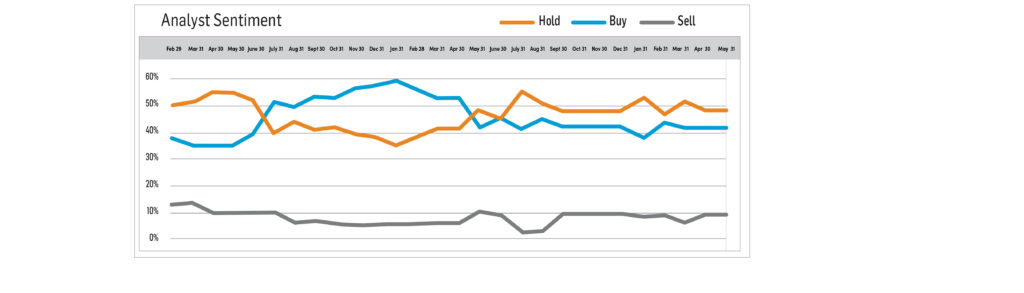

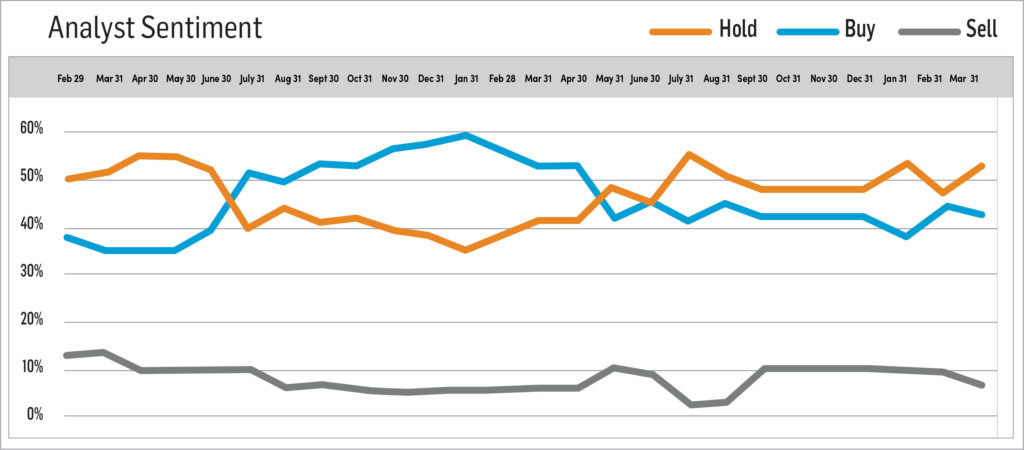

Our Analyst Sentiment Index was unchanged in February from January. The proportion of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks in both months was about 96%. Conversely, the percentage of stocks which analysts recommended selling in each month was around 4%.

Methodology: The DSCA Analyst Sentiment Index is a consensus tracking tool that aggregates and averages the recommendations of all covering analysts across all public direct selling companies.

-

January 2025Brought to you by Direct Selling Capital Advisors

Direct Selling Index Increases 5.4% in January 2025, its 11th Gain in the Last 13 Months

The Direct Selling Capital Advisors Direct Selling Index (DSCI) increased 5.4% in January, marking its eleventh gain in the last 13 months. The Dow Jones Industrial Average (DJIA) also rose in January, but by a smaller amount, +4.7%.

Despite the DSCI’s increase in January, more large cap direct selling stocks fell during the month (three) than increased (seven). Primerica, Inc.’s (NYSE: PRI) 6.9% gain was the main fuel for the index’s 5.4% pop in the month. PRI is by far the largest direct selling stock by market capitalization. One large cap direct selling stock rose by more than 10% in January, while three fell by more than that percentage. Two small cap direct selling stocks with a market value of at least $2 million increased in January, and two fell.

From a longer-term perspective, the DSCI has gained an aggregate 39.4% since its March 1, 2020 inception. The DJIA has outperformed the direct selling index over this period. Since March 1, 2020, the DJIA has appreciated 75.3%.

In January 2025, the DJIA posted its second biggest monthly percentage gain in the last 13 months, trailing only its 7.3% November 2024 increase over this period. Investors reacted enthusiastically to three key pieces of financial data during the month. First, the Commerce Department’s release in late January that 4Q 2024 GDP grew at a 2.3% annualized rate reinforced investor confidence in the U.S. economy. Constructively, 4Q 2024 consumer spending increased at an even faster 4.2% annualized rate.

Second, a Bureau of Labor Statistics (BLS) report released earlier in the month that core CPI inflation moderated slightly in December 2024 likewise quelled inflation fears, and finally, the 4Q 2024 earnings season started strongly. Apple, Microsoft, Meta and most of the major banks reported solid results.

Another positive: investors were able to set aside (at least temporarily) concerns about rising interest rates that had pressured the stock market in the first two weeks of 2025. The yield on the benchmark US 10-year bond touched a 14-month high of 4.8% on January 13, but reversed lower after the CPI report was released. The yield on the 10-year US Treasury closed January 2025 at 4.57%. It has since moved even lower, falling to 4.42% on February 5, 2025.

Looking Forward

Direct selling stocks are beginning to announce their 4Q 2024 and full-year 2024 financials, so DSCI stocks will be quite sensitive to the individual results and forward guidance that management teams issue. Of course, the direct selling stocks will also be affected by the tone of the overall stock market.

The overriding question for the broad stock market in 2025 is whether the major stock indices can continue to perform well after back-to-back 20+% gains in 2023 and 2024. Historically high valuations (a ~22x forward year P/E multiple on the S&P 500) and uncertainties about the economic impacts of the broad tariff and tough deportation policies President Trump may impose are points of concern, while the expected robust and accelerating growth in overall S&P 500 earnings in 2025 and the likely constructive medium-term effects of President Trump’s promised deregulation policies, are the principal positive counterpoints. The stock market fell, but only by a modest amount, on February 3rd after President Trump announced sweeping tariffs against Mexico, Canada and China. However, later that day he put a decision on potential tariffs on Mexican and Canadian products on hold for 30 days after consulting with the leaders of America’s two biggest trading partners.

The most important factor of all these is likely accelerating earnings in 4Q 2024 and 2025. According to FactSet, 4Q 2024 earnings for the S&P 500 are expected to increase 12% in the just completed quarter, which would represent the fastest year-over-year quarterly growth rate in three years. While the stock market will doubtless be more volatile in 2025 than in 2024, it is difficult to foresee a notable market downturn against a backdrop of sharply rising earnings.

CHARTS & ANALYSIS

Direct Selling Capital Advisors Index

The DSCI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million. The index is rebalanced monthly, and no single issue is permitted to represent more than 20% of its total value. In such an event, the excess weighting would be redistributed among the other index components.

The DSCI rose in January, and it outperformed the DJIA during the month. The DSCI gained 5.4% in January, outpacing the DJIA’s 4.7% increase in the month. DSCI data is tracked back to March 1, 2020. The direct selling index has risen 39.4% since that date versus a 75.3% appreciation for the DJIA over the same period.

Large Cap

Betterware de Mexico (NASDAQ: BWMX) inched 0.7% higher in January. Since the March 1, 2020 inception of the DSCI, BWMX has appreciated 19.6%.

In late October 2024, BWMX reported 3Q 2024 consolidated net revenue of 3.33 billion pesos, up 6.6% from 3.12 billion pesos in the year-ago period. BWMX’s adjusted EBITDA increased even more sharply in the quarter, reaching 592 million pesos, about 11.7% higher than the 529 million pesos in 3Q 2023. The company’s impressive quarter reflects the resilience of its core operations despite challenges which included exchange rate fluctuations and cost pressures such as freight costs.

BWMX projects that its 2024 revenue will be 13.8 to 14.4 billion pesos, up from 13.0 billion pesos in 2023, and its 2024 EBITDA will increase to about 2.9 billion pesos versus 2.72 billion pesos in 2023.

BWMX began trading in March 2020 after the company’s merger with SPAC sponsor DD3 Acquisition Corp. BWMX specifically targets the Mexican market; it serves three million households through distributors and associates in approximately 800 communities throughout Mexico.

Nu Skin Enterprises, Inc. (NYSE: NUS) fell 4.9% in January, adding to its 72.2% decline since the direct selling index was established in March 2020. In comparison, the direct selling stock index and the Dow Jones Industrial Average have gained 39.4% and 75.3%, respectively, over this nearly five-year period.

On January 13, 2025, NUS announced that its 4Q 2024 preliminary revenue will be at the high end of the $410 to $445 million revenue guidance the company provided on November 7, 2024. The company plans to release its 4Q 2024 financial results after the market closes on February 13, 2025.

In early January 2025, NUS’ Rhyz subsidiary sold its Mavely affiliate marketing technology platform to Later for approximately $250 million in cash and a minority equity stake in the combined Later/Mavely business. About $33 million of this consideration will be paid to other equity holders in the Mavely business. Later is a portfolio company of Summit Partners. Mavely is expected to continue to provide certain technology and social commerce capabilities to support NUS’ marketing business.

In November 2024, NUS reported 3Q 2024 revenue and adjusted EPS of $430.1 million and $0.17, both of which were down from $498.8 million and $0.56, respectively, in the year ago period. NUS continued to face macroeconomic pressure in 3Q 2024. Constructively, NUS’ Rhyz sales increased 20.9% in 3Q 2024 to $73.1 million versus 3Q 2023. Rhyz’s 3Q 2024 sales totaled about 17% of NUS’ overall sales in the quarter. In addition, NUS’ cost efficiency program saved the company $15 million in G&A expense in 3Q 2024.

Herbalife Nutrition, Inc. (NYSE: HLF) dropped 18.4% in January, its second consecutive double digit percentage monthly decline (minus 13.9% in December 2024). HLF is down 83.1% since the establishment of the DSCI on March 1, 2020, the worst long-term performance for any large-cap DSCI component which has traded continuously since index inception.

In late October, HLF reported 3Q 2024 sales of $1.24 billion, down 3.2% from $1.28 billion in 3Q 2023. More constructively, net sales in the quarter were nearly flat year-over-year on a constant currency basis, and HLF’s gross margin rose to 78.3% in 3Q 2024 from 76.3% in 3Q 2023 due to more favorable pricing and lower input costs. HLF’s 3Q 2024 adjusted EBITDA reached $166.5 million, up from $163.3 million in the year-ago period. In 3Q 2024, the number of new distributors joining HLF worldwide increased 14% year-over-year, representing the second consecutive quarter of year-over-year improvement.

HLF increased its full year 2024 adjusted EBITDA guidance to $590 to $620 million. In addition, HLF narrowed its estimate for full-year 2024 revenue growth to a range of negative 2.0% to negative 1.0% from the negative 3.5% to positive 1.5% range it issued in late July 2024. HLF plans to release its 4Q 2024 and full year 2024 financial results after the stock market closes on February 19, 2025.

Medifast, Inc. (NYSE: MED) shares declined 10.9% in January. MED is the second worst performing DSCI large cap member on a long-term basis; since the March 1, 2020 establishment of the DSCI, the stock has declined 80.2%.

In early November, MED reported 3Q 2024 revenue of $140.2 million, down 40% from $235.9 million in 3Q 2023. The company’s adjusted diluted EPS fell even more sharply to $0.35 in 3Q 2024 from $2.12 in the year ago period. The number of active earning OPTAVIA coaches decreased to 30,000 in 3Q 2024 from 47,100 in 3Q 2023. MED expects its 4Q 2024 revenue and adjusted diluted EPS will be $100-$120 million and a loss of $0.10 to a loss of $0.65, respectively. The company plans to release its 4Q 2024 financial results after the stock market closes on February 18, 2025.

MED is realigning its business to respond to the evolving dynamics in the weight loss industry and to transform its business model to meet the soaring demand for GLP-1 medications. Indeed, up to 20 million people in the US could be using GLP-1 treatments by 2030 according to some projections. MED offers comprehensive support for GLP-1 medication users, including access to clinicians through LifeMD, as well as programs and products to help maintain muscle and minimize side effects. One such product designed for people on GLP-1 medications is OPTAVIA ASCEND, a line of high-protein, fiber-rich mini meals, as well as a daily nutrient pack. MED announced OPTAVIA ASCEND on January 7, 2025.

In January, shares of USANA Health Sciences, Inc. (NYSE: USNA) lost 9.3%. Since the creation of the DSCI on March 1, 2020, USANA shares have lost 50.7% compared with gains of 39.4% and 75.3% for the direct selling index and the DJIA, respectively.

In late October, USANA reported 3Q 2024 revenue and diluted EPS of $200 million and $0.56, both down from $213 million and $0.59, respectively, in the year ago period. USANA’s 3Q 2024 operating results reflected ongoing top line headwinds across many of the company’s markets. Nevertheless, USANA generated $47 million of free cash flow over the first three quarters of 2024.

In its 3Q 2024 earnings report, USANA refined its forecast for 2024. It now expects revenue of $850 million, down slightly from its previous guidance range of $850 to $880 million. Also, management believes its 2024 EPS should be around $2.45. The company announce its 4Q 2024 financial results after the stock market closes on February 25, 2025.

On December 23, 2024, USANA closed its acquisition of a 78.8% controlling ownership stake in Hiya Health Products, LLC, a leading direct-to-consumer provider of high-quality children’s health and wellness products. The $205 million cash transaction is expected to be immediately accretive to USANA’s 2025 adjusted EBITDA. As of September 30, 2024, Hiya had more than 200,000 customers. For the twelve months ended September 30, 2024, Hiya generated net sales of $103 million, net income of $19 million, and adjusted EBITDA of $22 million.

On January 22, 2025, USANA announced Dr. Kathryn Armstrong, Ph.D., will assume the role of it chief scientific officer. She previously worked for Amway, BISSELL Homecare, Inc., and Whirlpool.

eXp World Holdings, Inc. (NASDAQ: EXPI) slipped 1.1% in January. EXPI shares have appreciated an aggregate 138.1% over the 59 months the DSCI has been computed, the second best long-term mark for any DSCI member.

In early November, EXPI, the fastest growing real estate brokerage in the world, reported 3Q 2024 revenue and adjusted EBITDA of $1.23 billion and $23.9 million, respectively. These measures compare favorably with $1.21 billion and $20.8 million, respectively, in 3Q 2023. EXPI increased its margins and profitability in 3Q 2024 despite a continued challenging market.

EXPI’s transaction volume in 3Q 2024 increased 5% to $50.8 billion from $48.4 billion in 3Q 2023. This performance is especially impressive given that US existing home sales in 2024 fell to their lowest level since 1995. Agents and brokers on EXPI’s platform totaled 85,249 as of September 30, 2024, down 4% from December 31, 2023, due primarily to the exit of unproductive agents.

A leading provider of financial services in the US and Canada, and by far the largest market cap stock in the DSCI, Primerica, Inc. (NYSE: PRI) jumped 6.9% in January, the second-best gain for any large cap DSCI component. PRI has appreciated 164.9% since March 1, 2020, the best long-term performance for any DSCI member.

In early November 2024, PRI reported 3Q 2024 adjusted operating revenue of $770.1 million, up 10% from $699.8 million in the year-ago period. The company’s adjusted operating EPS grew at a much faster pace (+31%), reaching $5.72 in 3Q 2024 versus $4.38 in 3Q 2023. Results in PRI’s Term Life segment benefitted from continued strong sales and stable margins. The company’s Investment and Savings Products unit were boosted by favorable equity market conditions in 3Q 2024 which fueled sales growth and higher client asset values. PRI plan to release its 4Q 2024 financial results after the stock market closes on February 11.

In mid-November, PRI’s Board authorized $450 million of share repurchases from mid-November 2024 through December 31, 2025. Over the first three quarters of 2024, the company repurchased $381 million of its own stock, including $129 million in 3Q 2024.

Nature’s Sunshine Products, Inc. (NASDAQ: NATR) lost 5.1% in January. Over the 59 months the DSCI has been calculated, NATR has gained 79.1%, the third best appreciation for any direct selling index stock over this period.

In early November, NATR, which markets and distributes nutritional and personal care products in more than 40 countries, reported 3Q 2024 net sales of $114.6 million, up 3% from $111.2 million in the year ago period. Adjusted EBITDA in 3Q 2024 totaled $10.7 million, about 5% higher than $10.3 million in 3Q 2023. NATR’s impressive results in 3Q 2024 were driven by robust customer growth in Japan and Taiwan, continued progress in South Korea, and customer activation in Central Europe.

Factoring in its solid results in 3Q 2024, NATR reset its full year 2024 net sales and adjusted EBITDA guidance slightly higher to $443-448 million and $40-42 million from previous ranges of $436-445 million and $39-42 million, respectively.

LifeVantage Corporation (NASDAQ: LFVN) soared 20.7% in January, marking its third consecutive month of outsized gains (+20.3% in December and +19.2% in November). Since the March 1, 2020 establishment of the DSCI, LFVN has gained 77.7%.

On February 5, 2025, LFVN reported 2Q FY 2025 (quarter ended December 31, 2024) revenue, adjusted EBITDA, and adjusted EPS of $67.8 million, $6.5 million, and $0.22, each of which dramatically increased from $51.6 million, $3.1 million, and $0.10, respectively, in the year ago period. Strong demand for LFVN’s MindBody GLP-1 System (see below) and impressive growth in active accounts drove the robust 2Q FY 2025 results. Notably, active accounts were up 25% in the quarter from 1Q FY 2025 levels, as the number of enrollments surged to the highest level in five years.

In turn, LFVN boosted its revenue, adjusted EBITDA, and adjusted EPS guidance ranges for FY 2025 (twelve months ending June 30, 2025) to $235-245 million, $21-24 million, and $0.72-0.88, respectively. The company’s previous guidance ranges were $200-210 million, $18-21 million, and $0.70-0.80, respectively. LFVN’s FY 2024 revenue totaled $200.2 million; its FY 2024 adjusted EBITDA was $17.0 million; and its FY 2024 adjusted EPS was $0.59.

In early October 2024, LFVN released groundbreaking human clinical trial results from its MindBody GLP-1 System. Participants realized a 140% average increase in GLP-1 levels in the body, leading to an average weight loss of nine pounds in eight weeks and up to 25 pounds in twelve weeks. The 12-week, 60-participant clinical trial began in early June.

Oliveda International, Inc. (OTC: OLVI), the third largest market cap stock in the DSCI, fell 45.0% in January, making it the worst performing DSCI component last month.

OLVI has more than 20 years of experience in: 1) the management and organic certification of mountain olive trees; 2) the extraction of international award-winning extra virgin olive oils; 3) the extraction of hydroxytyrosol, a substance which has several beneficial effects such as antioxidant, anti-inflammatory, anticancer, and as a protector of skin and eyes; and 4) the production and distribution of cosmetic and holistic waterless products related to the olive tree.

OLVI’s 3Q 2024 revenue was $27.7 million, up nearly 1,500% from $1.8 million in 3Q 2023. Its net loss in 3Q 2024 was $38.5 million, or a loss of $0.06 per share, compared with net income of $1.8 million in the year ago period. Over the first nine months of 2024, OLVI generated positive operating cash flow of $10.3 million versus a slight loss over the first nine months of 2023.

OLVI’s Olive Tree People Inc. subsidiary sales increased a remarkable 1,650+% in 4Q 2024, underscoring its position as the world’s fastest growing waterless beauty company. Olive Tree People, Inc. sales exceeded the $2 million daily sales mark for the first time in September 2024. On November 22, Olive Tree’s daily sales were more than $3.7 million.

Note: For the purposes of this report, Direct Selling Capital considers companies with a market capitalization in excess of $1 billion “Large Cap.”

Note: For the purposes of this report, Direct Selling Capital considers companies with a market capitalization in excess of $1 billion “Large Cap.”Small Cap

Our small cap tracking set performed about in line with the large cap DSCI group in January. Of the small caps with a market cap of more than $2 million, two rose during the month, and the same number declined.

The Beachbody Company, Inc. (NYSE: BODI), a leading fitness and nutrition company, rose 20.5% in January, the second best mark of any DSCI member with a market capitalization of more than $2 million. In 3Q 2024, BODI reported revenue and adjusted EBITDA of $102.2 million and $10.1 million versus $128.3 million and negative $5.8 million, respectively, in the year ago period.

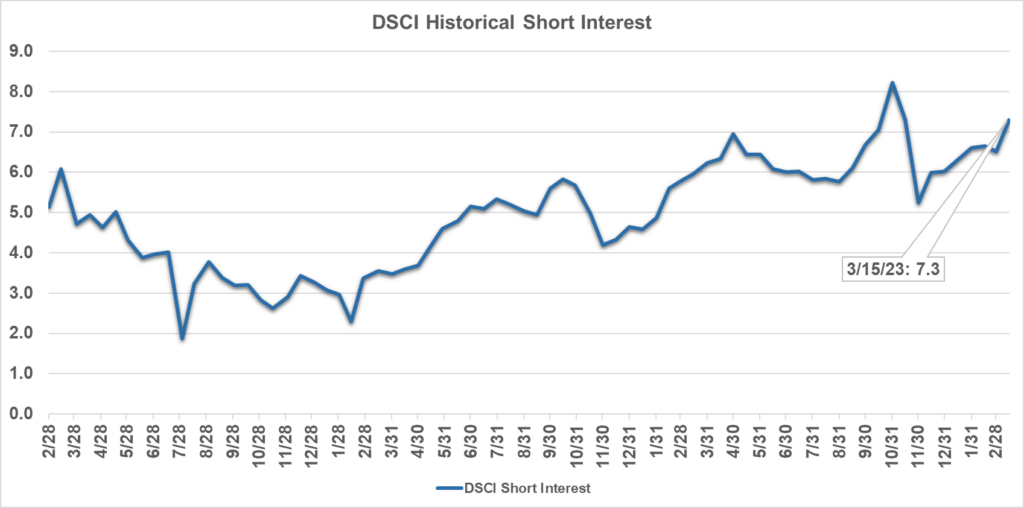

Short Interest Data & Analysis

The following chart is an aggregate index of “days to cover” among the entire tracking set. Days to cover (DTC) is a measurement determined by dividing the total outstanding short interest by average daily trading volume.

As indicated in the chart, short interest in DSCI stocks was 5.0 days in mid-January 2025, down from 5.3 days at year-end 2024, and level with 5.0 days in mid-December 2024. The biggest absolute reduction in DTC in mid-January 2025 from the end of December 2024 for a DSCI component was EXPI’s decrease to 19.9 days from 21.8 days.

As indicated in the chart, short interest in DSCI stocks was 5.0 days in mid-January 2025, down from 5.3 days at year-end 2024, and level with 5.0 days in mid-December 2024. The biggest absolute reduction in DTC in mid-January 2025 from the end of December 2024 for a DSCI component was EXPI’s decrease to 19.9 days from 21.8 days.Short interest can be a difficult indicator to analyze. On the one hand, an increase in short interest can be a bearish sign in that it indicates an increased view among investors that a stock is likely to decline based on any number of factors, such as a belief that the company’s fundamentals are deteriorating or that it has run too far, too fast. On the other hand, as a stock moves higher, a significant short interest can serve as extra fuel on the fire as investors scramble to “buy to cover” their short positions and mitigate losses.

Analyst Sentiment Index

Our Analyst Sentiment Index was unchanged in January 2025 from December 2024. The proportion of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks in both months was about 96%. Conversely, the percentage of stocks which analysts recommended selling in each month was around 4%.

Methodology: The DSCA Analyst Sentiment Index is a consensus tracking tool that aggregates and averages the recommendations of all covering analysts across all public direct selling companies.

-

December 2024Brought to you by Direct Selling Capital Advisors

Direct Selling Index Fell 9.7% in December, Marking Just its Second Monthly Decline of 2024

The Direct Selling Capital Advisors Direct Selling Index (DSCI) dropped 9.7% in December. The decline broke a four-month winning streak and represented only the second down month for the index in 2024. The Dow Jones Industrial Average (DJIA) fell last month as well, but by a smaller 5.3%, so it outperformed the DSCI in December. The DSCI gained 6.8% over the full-year 2024 versus the DJIA’s 12.9% gain.

Most large and small cap direct selling stocks declined in December. During the month, only one large cap rose (LifeVantage Corporation by 20.3%), while nine fell, five by double digit percentage points. Similarly, only one small cap with a market cap of more than $2 million gained, while three declined.

From a longer-term perspective, the DSCI has gained an aggregate 35.2% since its March 1, 2020 inception. The DJIA has outperformed the direct selling index over this period. Since March 1, 2020, the DJIA has appreciated 67.4%.

The Fed slightly increased its 2025 inflation forecast and pointed to just two rate cuts in 2025 when it announced its widely expected 25 basis point reduction in overnight interest rates on December 18th. That news in aggregate might be considered a little disappointing, but investors acted (for at least a short time) like it was the proverbial bell that many wish would have been rung at the top of the market. The three major indices dropped about 3% that day, and the DJIA finished 2024 at about that level.

The stock market faces at least three major challenges/concerns. First, after reeling off two consecutive 20+% years in 2023 and 2024, the S&P 500 cannot be considered cheap: it trades at about 22x forward-year earnings. Second, the broad tariffs proposed by President-elect Trump could reignite inflation in goods, a category which has actually been deflating for months. This of course could threaten whether even the Fed’s two projected rate cuts will be implemented in 2025. Inflation in services has been the key element of a sticky level of overall inflation in 2024. Third, bullish investors have shown worrisome signs of exhaustion. More stocks in the S&P 500 declined than advanced for 14 consecutive trading days through December 19th, a remarkably long streak.

Looking Forward

Direct selling stocks have announced their 3Q 2024 operating results and they will not begin to report their 4Q 2024 and full-year 2024 financials until late January. Consequently, the performance of DSCI stocks will likely be dictated by the performance of the overall stock market until then.

The stock market’s high valuation noted above, by itself, generally does not end bull markets. Most of the time, such ebullient periods draw to a close because inflation increases, which in turn causes interest rates to move higher. Neither condition can be considered to be in place today: the inflation rate is flat to trending slightly downward after CPI growth fell sharply through much of 2023 and the first half of 2024, though reaching the Fed’s 2% annual inflation target is by no means a sure bet. In addition, the ten-year Treasury yield of about 4.6%, while up from the Goldilocks days of 2021 (~1.5% yields) and up around 100 basis points just since mid-September, is still historically low.

Two other constructive factors include: 1) Bull markets tend to last a long time, 46 months on average, per JP Morgan, and the current bull market has been running for only about 27 months. Moreover, the median aggregate return during bull markets is about 110%, about twice the gain of the S&P 500 since the lows of October 2022.

2) Bullish market observers reiterate almost daily that innovation led by the rise in use of AI is driving profit growth in US businesses and that AI and automation represent the fourth industrial revolution, which will dramatically improve the way people live and work. While it seems easy to theorize such soaring rhetoric overstates AI’s potential, the new technology’s effect could well be enormous. IDC, the widely followed technology market intelligence firm, expects AI to increase the world’s aggregate economic output through 2030 by $20 trillion. To put that figure into perspective, the world’s 2024 GDP was around $104 trillion, per Trading Economics.

CHARTS & ANALYSIS

Direct Selling Capital Advisors Index

The DSCI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million. The index is rebalanced monthly, and no single issue is permitted to represent more than 20% of its total value. In such an event, the excess weighting would be redistributed among the other index components.

The DSCI fell in December, and it underperformed the DJIA during the month. The DSCI lost 9.7% in December, while the DJIA dropped 5.3%. DSCI data is tracked back to March 1, 2020. The direct selling index has risen 35.2% since that date versus a 67.4% appreciation for the DJIA over the same period.

Large Cap

Betterware de Mexico (NASDAQ: BWMX) fell 11.4% in November, adding to its full year 2024 loss of 19.8%. More positively, since the March 1, 2020 DSCI inception, BWMX is up 18.7%.

In late October, BWMX reported 3Q 2024 consolidated net revenue of 3.33 billion pesos, up 6.6% from 3.12 billion pesos in the year-ago period. BWMX’s adjusted EBITDA increased even more sharply in the quarter, reaching 592 million pesos, about 11.7% higher than the 529 million pesos in 3Q 2023. The company’s impressive quarter reflects the resilience of its core operations despite challenges which included exchange rate fluctuations and cost pressures, such as freight costs.

BWMX projects that its 2024 revenue will be 13.8 to 14.4 billion pesos, up from 13.0 billion pesos in 2023, and its 2024 EBITDA will increase to about 2.9 billion pesos versus 2.721 billion pesos in 2023.

BWMX began trading in March 2020 after the company’s merger with SPAC sponsor DD3 Acquisition Corp. BWMX specifically targets the Mexican market; it serves three million households through distributors and associates in approximately 800 communities throughout Mexico.

Nu Skin Enterprises, Inc. (NYSE: NUS) dropped 5.6% in December. In 2024, NUS fell 64.5%, the second worst mark last year for any large cap direct selling stock. Since the March 2020 establishment of the DSCI, NUS has declined 70.8%. In comparison, the direct selling stock index and the Dow Jones Industrial Average have gained 35.2% and 67.4%, respectively, over this 58-month period.

On January 3, 2025, NU’s Rhyz subsidiary sold its Mavely affiliate marketing technology platform to Later for approximately $250 million in cash and a minority equity stake in the combined Later/Mavely business. About $33 million of this consideration will be paid to other equity holders in the Mavely business. Later is a portfolio company of Summit Partners. Mavely is expected to continue to provide certain technology and social commerce capabilities to support NUS’ marketing business.

In early November 2024, NUS reported 3Q 2024 revenue and adjusted EPS of $430.1 million and $0.17, both of which were down from $498.8 million and $0.56, respectively, in the year-ago period. NUS continued to face macroeconomic pressure in 3Q 2024. NUS’s immediate focus is to strengthen its core business with a revised business model intended especially to improve channel activation and customer growth in North America and South Korea.

Constructively, Rhyz sales increased 20.9% in 3Q 2024 to $73.1 million versus 3Q 2023. Rhyz’s 3Q 2024 sales totaled about 17% of NUS’ overall sales in the quarter. In addition, NUS’ cost efficiency program saved the company $15 million in G&A expense in 3Q 2024, and the company is on track to reach $45 to $65 million of G&A savings in 2024.

Given ongoing pressures in its core business, NUS reduced its revenue and non-GAAP EPS guidance ranges for full-year 2024 to $1.70-$1.73 billion and $0.65-$0.75, respectively. The comparable figures for full-year 2023 were $1.97 billion and $1.85, respectively.

Herbalife Nutrition, Inc. (NYSE: HLF) dropped 13.9% in December, bringing its 2024 loss to 56.2%. HLF is down 79.3% since the establishment of the DSCI on March 1, 2020, the worst long-term performance for any large-cap DSCI component which has traded continuously since index inception.

In late October, HLF reported 3Q 2024 sales of $1.24 billion, down 3.2% from $1.28 billion in 3Q 2023. More constructively, net sales in the quarter were nearly flat year-over-year on a constant currency basis, and HLF’s gross margin rose to 78.3% in 3Q 2024 from 76.3% in 3Q 2023 due to more favorable pricing and lower input costs. HLF’s 3Q 2024 adjusted EBITDA reached $166.5 million, up from $163.3 million in the year-ago period.

In 3Q 2024, the number of new distributors joining HLF worldwide increased 14% year-over-year, representing the second consecutive quarter of year-over-year improvement. In addition, CFO John DeSimone reaffirmed HLF’s plans to reduce total debt by $1 billion over the next four to five years.

HLF increased its full-year 2024 adjusted EBITDA guidance to $590 to $620 million. In addition, HLF narrowed its estimate of full-year 2024 revenue growth to a range of negative 2.0% to negative 1.0% from the negative 3.5% to positive 1.5% range it issued in late July 2024. HLF plans to release its 4Q 2024 and full-year 2024 financial results after the stock market closes on February 19, 2025.

Medifast, Inc. (NYSE: MED) shares dropped 10.4% in December, adding to its 73.8% loss in 2024, the worst mark for any large cap DSCI component. MED is the second worst performing DSCI large cap member on a long-term basis; since the March 1, 2020 establishment of the DSCI, the stock has declined 77.8%.

In early November, MED reported 3Q 2024 revenue of $140.2 million, down 40% from $235.9 million in 3Q 2023. The company’s

adjusted diluted EPS fell even more sharply to $0.35 in 3Q 2024 from $2.12 in the year-ago period. The number of active earning OPTAVIA coaches decreased to 30,000 in 3Q 2024 from 47,100 in 3Q 2023. MED expects its 4Q 2024 revenue and adjusted diluted EPS will be $100-$120 million and a loss of $0.10 to a loss of $0.65, respectively.

MED is realigning its business to respond to the evolving dynamics in the weight loss industry, and to transform its business model to meet the soaring demand for GLP-1 medications. Indeed, up to 20 million people in the U.S. could be using GLP-1 treatments by 2030, according to some projections. MED offers comprehensive support for GLP-1 medication users, including access to clinicians through LifeMD, as well as programs and products to help maintain muscle and minimize side effects.

In December, shares of USANA Health Sciences, Inc. (NYSE: USNA) lost 6.9%. In the full year 2024, USANA fell 33.0%. Since the creation of the DSCI on March 1, 2020, USANA shares have lost 45.7% compared with gains of 35.2% and 67.4% for the direct selling index and the DJIA, respectively.

In late October, USANA reported 3Q 2024 revenue and diluted EPS of $200 million and $0.56, both down from $213 million and $0.59, respectively, in the year ago period. USANA’s 3Q 2024 operating results reflected ongoing top line headwinds across many of the company’s markets. USANA’s sales force continued to face challenges in attracting new customers as consumer sentiment remained cautious, including in the company’s largest market, China. Nevertheless, USANA has generated $47 million of free cash flow over the first three quarters of 2024.

In its 3Q 2024 earnings report, USANA refined its forecast for 2024. It now expects revenue of $850 million, down slightly from its previous guidance range of $850 to $880 million. Also, management believes its 2024 EPS should be $2.45; USANA had guided to 2024 EPS of $2.40 to $2.55 in its 2Q 2024 earnings release.

On December 23, 2024, USANA closed its acquisition of a 78.8% controlling ownership stake in Hiya Health Products, LLC, a leading direct-to-consumer provider of high-quality children’s health and wellness products. The $205 million cash transaction is expected to be immediately accretive to USANA’s 2025 adjusted EBITDA. As of September 30, 2024, Hiya had more than 200,000 customers. For the twelve months ended September 30, 2024, Hiya generated net sales of $103 million, net income of $19 million, and adjusted EBITDA of $22 million

eXp World Holdings, Inc. (NASDAQ: EXPI) fell 16.9% in December, the worst monthly performance of any large cap DSCI component. In 2024, EXPI lost 25.8%. EXPI shares have appreciated an aggregate 140.8% over the 58 months the DSCI has been computed, the second best long-term mark for any DSCI member.

In early November, EXPI, the fastest growing real estate brokerage in the world, reported 3Q 2024 revenue and adjusted EBITDA of $1.23 billion and $23.9 million, respectively. These measures compared favorably with $1.21 billion and $20.8 million, respectively, in 3Q 2023. EXPI increased its margins and profitability in 3Q 2024 despite a continued challenging market.

EXPI’s transaction volume in 3Q 2024 increased 5% to $50.8 billion from $48.4 billion in 3Q 2023. Agents and brokers on the company’s platform totaled 85,249 as of September 30, 2024, down 4% from December 31, 2023, due primarily to the exit of unproductive agents.

A leading provider of financial services in the US and Canada, and by far the largest market cap stock in the DSCI, Primerica, Inc. (NYSE: PRI) dropped 10.3% in December. In the full year 2024, PRI gained 31.9%, the second-best annual return for any large cap DSCI component. PRI has appreciated 147.7% since March 1, 2020, the best long-term performance for any DSCI member.

In early November, PRI reported 3Q 2024 adjusted operating revenue of $770.1 million, up 10% from $699.8 million in the year-ago period. The company’s adjusted operating EPS grew at a much faster pace (+31%), reaching $5.72 in 3Q 2024 versus $4.38 in 3Q 2023. Results in PRI’s Term Life segment benefitted from continued strong sales and stable margins. The company’s Investment and Savings Products unit were boosted by favorable equity market conditions in 3Q 2024 which fueled sales growth and higher client asset values.

In mid-November, PRI’s Board authorized $450 million of share repurchases from mid-November 2024 through December 31, 2025. Over the first three quarters of 2024, the company repurchased $381 million of its own stock, including $129 million in 3Q 2024.

Nature’s Sunshine Products, Inc. (NASDAQ: NATR) lost 9.7% in December, which brought its 2024 loss to 15.2%. Over the 58 months the DSCI has been calculated, NATR has gained 88.8%, the third best appreciation for any direct selling index stock over this period.

In early November, NATR, which markets and distributes nutritional and personal care products in more than 40 countries, reported 3Q 2024 net sales of $114.6 million, up 3% from $111.2 million in the year-ago period. Adjusted EBITDA in 3Q 2024 totaled $10.7 million, about 5% higher than $10.3 million in 3Q 2023. NATR’s impressive results in 3Q 2024 were driven by robust customer growth in Japan and Taiwan, continued progress in South Korea, and customer activation in Central Europe.

Factoring in its solid results in 3Q 2024, NATR reset its full-year 2024 net sales and adjusted EBITDA guidance slightly higher to $443-$448 million and $40-$42 million from previous ranges of $436-$445 million and $39-$42 million, respectively.

LifeVantage Corporation (NASDAQ: LFVN) jumped 20.3% in December, marking its second consecutive month of outsized gains (+19.2% in November). This performance pushed LFVN’s 2024 gain

to 192.2%, by far the biggest increase for any direct selling stock. Since the March 1, 2020 establishment of the DSCI, LFVN has gained 47.2%.

In early October, LFVN released groundbreaking human clinical trial results from its MindBody GLP-1 System. Participants realized a 140% average increase in GLP-1 levels in the body, leading to an average weight loss of nine pounds in eight weeks and up to 25 pounds in twelve weeks. The 12-week, 60-participant clinical trial began in early June.

In late October, LFVN reported revenue of $47.2 million in 1Q FY 2025 (quarter ended September 30, 2024), down 8.1% from $51.4 million in the year-ago period. LFVN’s adjusted EBITDA was $4.4 million in 1Q FY 2025, up from $4.0 million in 1Q FY 2024. LFVN continues to focus on optimizing its cost structure while being strategic with its investments in growth and innovation.

LFVN maintained its revenue and adjusted EBITDA guidance ranges for FY 2025 (twelve months ending June 30, 2025) of $200-$210 million and $18-$21 million, respectively. The company’s FY 2024 revenue totaled $200.2 million, and its FY 2024 adjusted EBITDA was $17.0 million.

Oliveda International, Inc. (OTC: OLVI), the third largest market cap stock in the DSCI, dropped 5.3% in December, making it the second best performing large cap DSCI component last month.

OLVI has more than 20 years of experience in: 1) the management and organic certification of mountain olive trees; 2) the extraction of international award-winning extra virgin olive oils; 3) the extraction of hydroxytyrosol, a substance which has several beneficial effects such as antioxidant, anti-inflammatory, anticancer, and as a protector of skin and eyes; and 4) the production of and distribution of cosmetic and holistic waterless products related to the olive tree.

OLVI’s 3Q 2024 revenue was $27.7 million, up nearly 1,500% from $1.8 million in 3Q 2023. Its net loss in 3Q 2024 was $38.5 million, or a loss of $0.06 per share, compared with net income of $1.8 million in the year-ago period. Over the first nine months of 2024, OLVI generated positive operating cash flow of $10.3 million versus a slight loss over the first nine months of 2023.

OLVI’s Olive Tree People Inc. subsidiary exceed the $2 million daily sales mark for the first time in September 2024. On November 22, Olive Tree’s daily sales exceeded $3.7 million.

Note: For the purposes of this report, Direct Selling Capital considers companies with a market capitalization in excess of $1 billion “Large Cap.”

Note: For the purposes of this report, Direct Selling Capital considers companies with a market capitalization in excess of $1 billion “Large Cap.”Small Cap

Our small cap tracking set performed about in line with the large cap DSCI group in December. Of the small caps with a market cap of more than $2 million, one rose during the month, and three fell.

Mannatech, Incorporated (NASDAQ: MTEX), a global health and wellness company, was the best performer of any DSCI member in December (+58.0%). This follows MTEX’s strong November performance when it gained 8.7%, the largest increase in that month for any DSCI small cap member with a market value of at least $1 million. For the full year 2024, MTEX stock soared 65.8%. In mid-November, MTEX reported 3Q 2024 revenue and EPS of $31.7 million and a $0.17 loss versus $32.6 million and positive $0.01, respectively, in the year-ago period.

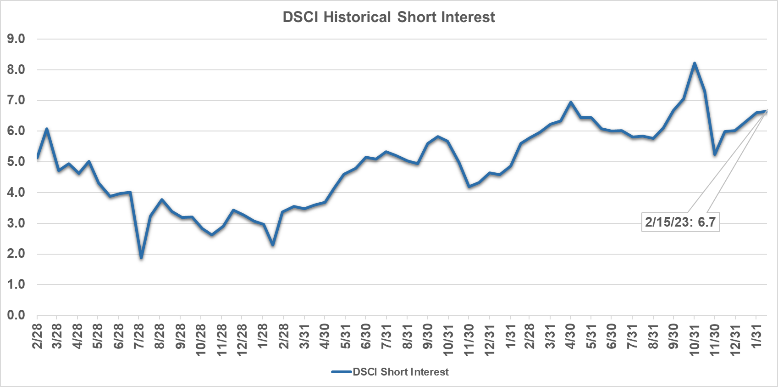

Short Interest Data & Analysis

The following chart is an aggregate index of “days to cover” among the entire tracking set. Days to cover (DTC) is a measurement determined by dividing the total outstanding short interest by average daily trading volume.

As indicated in the chart, short interest in DSCI stocks was 5.0 days in mid-December, the fewest number of days since mid-April, and down from 5.3 days at both the end of November and in mid-November. The biggest absolute reduction in DTC in mid-December from the end of November for a DSCI component was EXPI’s decrease to 20.9 days from 23.4 days.

As indicated in the chart, short interest in DSCI stocks was 5.0 days in mid-December, the fewest number of days since mid-April, and down from 5.3 days at both the end of November and in mid-November. The biggest absolute reduction in DTC in mid-December from the end of November for a DSCI component was EXPI’s decrease to 20.9 days from 23.4 days.Short interest can be a difficult indicator to analyze. On the one hand, an increase in short interest can be a bearish sign in that it indicates an increased view among investors that a stock is likely to decline based on any number of factors, such as a belief that the company’s fundamentals are deteriorating or that it has run too far, too fast. On the other hand, as a stock moves higher, a significant short interest can serve as extra fuel on the fire as investors scramble to “buy to cover” their short positions and mitigate losses.

Analyst Sentiment Index

Our Analyst Sentiment Index rose significantly in December from November. The proportion of sell-side analysts maintaining “buy” and “hold” ratings on industry stocks in December was about 96%, up from 92% in November. Conversely, the percentage of stocks which analysts recommended selling was around 4% in December and 8% in November.

Methodology: The DSCA Analyst Sentiment Index is a consensus tracking tool that aggregates and averages the recommendations of all covering analysts across all public direct selling companies.

Methodology: The DSCA Analyst Sentiment Index is a consensus tracking tool that aggregates and averages the recommendations of all covering analysts across all public direct selling companies. -

November 2024Brought to you by Direct Selling Capital Advisors

Direct Selling Index Soared 6.7% in November; Index Has Posted Monthly Gains in 12 of the Last 13 Months

In November, the Direct Selling Capital Advisors Direct Selling Index (DSCI) jumped 6.7%. This marked the index’s fourth successive monthly gain and the index’s twelfth increase in the last thirteen months. Nevertheless, the DSCI slightly underperformed the Dow Jones Industrial Average (DJIA) in November as the DJIA added 7.5% during the month. The DSCI and DJIA have increased by similar percentages over the first eleven months of 2024: +18.3% and +19.2%, respectively.

Large cap direct selling stocks as a group markedly outperformed their smaller cap peers in November. During the month, eight large cap members rose, three by more than 10%, while only two declined, including one by double digit percentage points. On the other hand, three small cap members rose during November, and the same number declined. Only one small cap with a market cap of more than $5 million moved by double digit percentage points in November, a 10.3% decline by Educational Development Corporation.

From a longer-term perspective, the DSCI has gained an aggregate 49.7% since its March 1, 2020 inception. The DJIA has outperformed the direct selling index over this period. Since March 1, 2020, the DJIA has appreciated 76.7%.

The DJIA’s 7.5% increase in November was by far the benchmark index’s best monthly gain of 2024. The market soared on President-elect Trump’s election win in a broad rally as investors embraced the business-friendly incoming Administration and were relieved that a prolonged battle over the election result was avoided. The DJIA subsequently retraced some of its election rally gains before recommencing its rally on November 18th, an upturn which has continued into early December. Indeed, all major stock market indices are currently at or near all-time highs. The market’s brief decline in mid-November seemed to stem from uncertainty about the details and the potential impact of President-elect Trump’s tariff plans, as well as fears that Department of Health and Human Services-nominee RFK Jr. could negatively impact the healthcare sector.

The best performing sectors in November were small caps, consumer discretionary stocks, banks, and industrial. The strong performance of the these first two categories augurs well for direct selling stocks.

Looking Forward

Direct selling stocks have announced their 3Q 2024 operating results and they will not begin to report their 4Q 2024 and full-year 2024 financials until late January. Consequently, the performance of DSCI stocks will likely be dictated by the performance of the overall stock market until then. This linkage could be constructive as investors seem less focused on stock market valuation parameters which are well above historical averages and are more centered on the robust economy. Indeed, the current key economic barometers of GDP growth (2.8% year-over-year in 3Q 2024), low unemployment (a 4.1% rate), and acceptably low inflation (3.3% core year-over-year CPI growth in October) would individually be considered constructive. They are even more powerful since they are present in unison.

Another positive factor which is infrequently discussed by equity investors is the extraordinarily tight spreads in the corporate bond market. More specifically, the spreads on both investment grade and junk bonds are at their tightest levels in at least ten years. It would be highly unusual for stocks to correct when bond investors see little near- and medium-term risk in the overall economy.

CHARTS & ANALYSIS

Direct Selling Capital Advisors Index

The DSCI is a market capitalization weighted index of all domestic public direct selling companies with a market capitalization of at least $25 million. The index is rebalanced monthly, and no single issue is permitted to represent more than 20% of its total value. In such an event, the excess weighting would be redistributed among the other index components.

The DSCI rose in November, though it slightly underperformed the DJIA during the month. The DSCI gained 6.7% in November, about 80 basis points less than the 7.5% increase for the DJIA. DSCI data is tracked back to March 1, 2020. The direct selling index has risen 49.7% since that date versus a 76.7% appreciation of the DJIA over the same period.

Large Cap

Betterware de Mexico (NASDAQ: BWMX) dropped 0.6% in November, bringing its YTD loss to 9.5%. More constructively, since the March 1, 2020 DSCI inception, BWMX is up 34.0%.

In late October, BWMX reported 3Q 2024 consolidated net revenue of 3.33 billion pesos, up 6.6% from 3.12 billion pesos in the year-ago period. BWMX’s adjusted EBITDA increased even more sharply in the quarter, reaching 592 million pesos, about 11.7% higher than the 529 million pesos in 3Q 2023. The company’s impressive quarter reflects the resilience of its core operations despite challenges which included exchange rate fluctuations and cost pressures, such as freight costs.

BWMX continues to project that 1) its 2024 revenue will be 13.8 to 14.4 billion pesos, up from 13.0 billion pesos in 2023; and 2) its 2024 EBITDA will increase to 2.9-3.1 billion pesos versus 2.721 billion pesos last year, though the company now believes its 2024 EBITDA will likely come in at the lower end of this range.

BWMX began trading in March 2020 after the company’s merger with SPAC sponsor DD3 Acquisition Corp. BWMX specifically targets the Mexican market; it serves three million households through distributors and associates in approximately 800 communities throughout Mexico.

Nu Skin Enterprises, Inc. (NYSE: NUS) jumped 17.9% in November, ending a two-month streak when it declined by double digit percentage points in each month (-16.0% in October and -17.5% in September). Nevertheless, on a YTD basis, NUS is still down 62.4%, the second worst mark for any large cap direct selling stock. Since the March 2020 establishment of the DSCI, NUS has lost 69.1%. In comparison, the direct selling stock index and the Dow Jones Industrial Average have gained 49.7% and 76.7%, respectively, over this 57-month period.

On November 7, NUS reported 3Q 2024 revenue and adjusted EPS of $430.1 million and $0.17, both of which were down from $498.8 million and $0.56, respectively, in the year-ago period. NUS continued to face macroeconomic pressure in 3Q 2024. NUS’s immediate focus is to strengthen its core business with a revised business model intended especially to improve channel activation and customer growth in North America and South Korea.

Constructively, the company’s Rhyz sales increased 20.9% in 3Q 2024 to $73.1 million versus 3Q 2023. Rhyz’s 2Q 2024 sales totaled about 17% of NUS’s overall sales in the quarter. In addition, NUS’s cost efficiency program saved the company $15 million in G&A expense in 3Q 2024, and the company is on track to reach $45 to $65 million of G&A savings in 2024.

Given ongoing pressures in its core business, NUS reduced its revenue and non-GAAP EPS guidance ranges for full year 2024 to $1.70-$1.73 billion and $0.65-$0.75 from $1.73-$1.81 billion and $0.75-$0.95, respectively. The comparable figures for full year 2023 were $1.97 billion and $1.85, respectively.

Herbalife Nutrition, Inc. (NYSE: HLF) increased 2.9% in November. This gain cut its YTD loss to 49.1%. HLF is down 76.0% since the establishment of the DSCI on March 1, 2020, the worst performance for any large-cap DSCI component which has traded continuously since index inception.

In late October, HLF reported 3Q 2024 sales of $1.24 billion, down 3.2% from $1.28 billion in 3Q 2023. More constructively, net sales in the quarter were nearly flat year-over-year on a constant currency basis, and HLF’s gross margin rose to 78.3% in 3Q 2024 from 76.3% in 3Q 2023 due to more favorable pricing and lower input costs. HLF’s 3Q 2024 adjusted EBITDA reached $166.5 million, up from $163.3 million in the year-ago period.

In 3Q 2024, the number of new distributors joining HLF worldwide increased 14% year-over-year, representing the second consecutive quarter of year-over-year improvement. In addition, CFO John DeSimone reaffirmed HLF’s plans to reduce total debt by $1 billion over the next four to five years. This initiative will be the primary use of the company’s free cash flow through the balance of the decade.

HLF increased its full-year 2024 adjusted EBITDA guidance to $590 to $620 million, up from $560 to $600 million. In addition, HLF narrowed its estimate of full-year 2024 revenue growth to a range of negative 2.0% to negative 1.0% from the negative 3.5% to positive 1.5% range it issued in late July.

Medifast, Inc. (NYSE: MED) shares jumped 7.0% in November, cutting its YTD loss to 70.7%, the worst mark of any large cap DSCI component. MED is the second worst performing DSCI large cap member on a long-term basis; since the March 1, 2020 establishment of the DSCI, the stock has declined 75.3%.

In early November, MED reported 3Q 2024 revenue of $140.2 million, down 40% from $235.9 million in 3Q 2023. The company’s adjusted diluted EPS fell even more sharply to $0.35 in 3Q 2024 from $2.12 in the year-ago period. The number of active earning OPTAVIA coaches decreased to 30,000 in 3Q 2024 from 47,100 in 3Q 2023. MED expects its 4Q 2024 revenue and adjusted diluted EPS will be $100-$120 million and a loss of $0.10 to a loss of $0.65, respectively.

MED is realigning its business to respond to the evolving dynamics in the weight loss industry, and to transform its business model to meet the soaring demand for GLP-1 medications. Indeed, up to 20 million people in the US could be using GLP-1 treatments by 2030, according to some projections. MED offers comprehensive support for GLP-1 medication users, including access to clinicians through LifeMD, as well as programs and products to help maintain muscle and minimize side effects.

In November, shares of USANA Health Sciences, Inc. (NYSE: USNA) added 4.3%, slicing its YTD loss to 28.1%. Since the creation of the DSCI on March 1, 2020, USANA shares have lost 41.7% compared with gains of 49.7% and 76.7% for the direct selling index and the DJIA, respectively.

In late October, USANA reported 3Q 2024 and diluted EPS of $200 million and $0.56, both down from $213 million and $0.59, respectively, in the year ago period. USANA’s 3Q 2024 operating results reflected ongoing top line headwinds across many of the company’s markets. USANA’s sales force continued to face challenges in attracting new customers as consumer sentiment remained cautious, including in the company’s largest market, China. Nevertheless, USANA has generated $47 million of free cash flow over the first three quarters of 2024.

In its 3Q 2024 earnings report, USANA refined its forecast for 2024. It now expects revenue of $850 million, down slightly from its previous guidance range of $850 to $880 million. Also, management believes its 2024 EPS should be $2.45; USANA had guided to 2024 EPS of $2.40 to $2.55 in its 2Q 2024 earnings release.

eXp World Holdings, Inc. (NASDAQ: EXPI) increased 4.0% in November, though it has declined 10.8% YTD. EXPI shares have appreciated an aggregate 189.7% over the 57 months the DSCI has been computed, the best long-term mark for any DSCI member.

On November 7, EXPI, the fastest growing real estate brokerage in the world, reported 3Q 2024 revenue and adjusted EBITDA of $1.23 billion and $23.9 million, respectively. These measures compared favorably with $1.21 billion and $20.8 million, respectively, in 3Q 2023. EXPI increased its margins and profitability in 3Q 2024 despite a continued challenging market.

EXPI’s transaction volume in 3Q 2024 increased 5% to $50.8 billion from $48.4 billion in 3Q 2023. Agents and brokers on the company’s platform totaled 85,249 as of September 30, 2024, down 4% from December 31, 2023, due primarily to the exit of unproductive agents.

A leading provider of financial services in the US and Canada, and by far the largest market cap stock in the DSCI, Primerica, Inc. (NYSE: PRI) jumped 9.4% in November. Year to date, PRI has gained 47.1%, the second-best return for any large cap DSCI component. PRI has appreciated 176.3% since March 1, 2020, the second best long-term performance for any DSCI member.

In early November, PRI reported 3Q 2024 adjusted operating revenue of $770.1 million, up 10% from $699.8 million in the year-ago period. The company’s adjusted operating EPS grew at a much faster pace (+31%), reaching $5.72 in 3Q 2024 versus $4.38 in 3Q 2023. Results in PRI’s Term Life segment benefitted from continued strong sales and stable margins. The company’s Investment and Savings Products unit was boosted by favorable equity market conditions in 3Q 2024 which fueled sales growth and higher client asset values.

On November 14, PRI’s Board authorized $450 million of share repurchases from mid-November 2024 through December 31, 2025. Over the first three quarters of 2024, the company repurchased $381 million of its own stock, including $129 million in 3Q 2024.

In August 2024, PRI increased its quarterly dividend to $0.90 per share ($3.60 annualized) from $0.75 per share ($3.00 annualized). The next $0.90 dividend payable date is December 12th. Since 2018, PRI had announced an increase in its dividend once a year in February, so this accelerated dividend increase action by PRI’s Board represents a significant vote of confidence in the company’s prospects.