Major companies are making serious moves in the cryptocurrency space. Some are exploring accepting online payments in some form of cryptocurrency. In August, Amazon and Walmart posted job openings for product leaders to develop digital currency and blockchain strategies. Both listings indicated the companies are exploring ways to expand payment options for customers. “We’re inspired by the innovation happening in the cryptocurrency space and are exploring what this could look like on Amazon,” a spokesperson for the company told CNN Business.

On AMC Theaters’ earnings call in August, the country’s largest theater chain announced plans to accept Bitcoin for tickets and snacks by the end of 2021. “I’ve had to learn more in the past six months about blockchain and cryptocurrency than I learned about it in the entire decade before that,” CEO Adam Aron said on the call. “We’re quite intrigued by potentially lucrative business [opportunities].”

Other major companies accepting some form of cryptocurrency include AT&T, the Dallas Mavericks, Microsoft, Tesla and Twitch. United Wholesale Mortgage, the country’s second-largest mortgage lender, announced plans in August to accept cryptocurrency for home loans by the end of 2021. “We’ve evaluated the feasibility, and we’re looking forward to being the first mortgage company in America to accept cryptocurrency to satisfy mortgage payments,” CEO Mat Ishbia said in the company’s Q2 earnings call.

Customer Demands

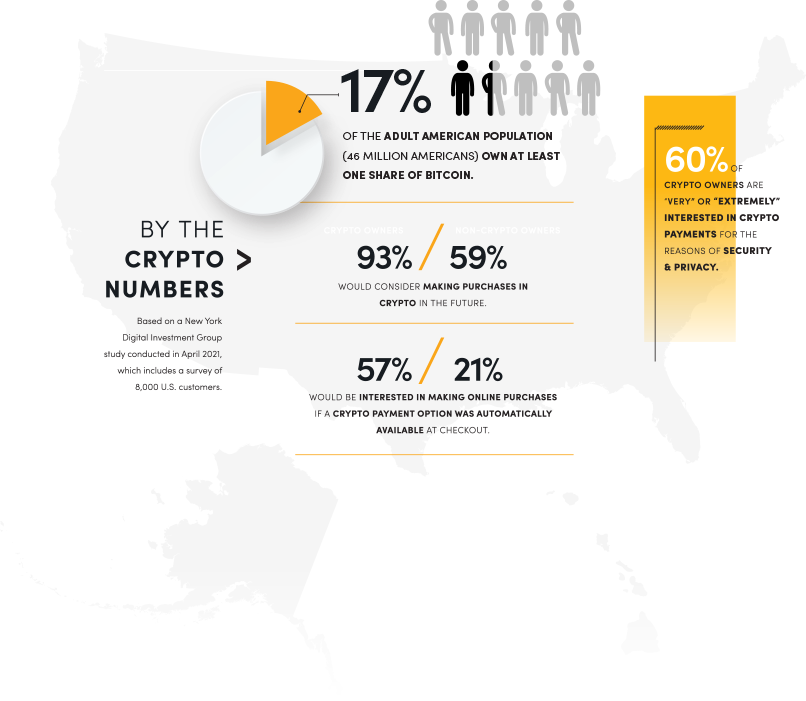

According to a New York Digital Investment Group study conducted in April 2021, 46 million Americans (about 17 percent of the adult population) own at least a share of Bitcoin. Pymnts, a payments-focused publication, surveyed 8,000 U.S. customers, including current and former cryptocurrency holders, as well as non-crypto owners. The survey found that both are interested in crypto payments, with 93 percent of crypto owners saying they would consider making purchases in crypto in the future. Even most of those who do not hold crypto (59 percent) were interested in using it to make purchases.

When it comes to increasing security and privacy, 60 percent of crypto owners said they were “very” or “extremely” interested in crypto payments for these reasons. If a crypto payment option was automatically available at checkout when making online purchases, 57 percent of crypto owners said they would be interested in making such purchases. However, just 21 percent of non-owners said the same. Regardless of purchasing interest from the two groups, the majority of both groups said there is not enough crypto payment adoption in the marketplace. More than 30 percent of respondents indicated that they would spend more if crypto was an additional payment option to typical options such as credit cards.

Crypto Options in Direct Selling

I-payout, one of the most popular pay systems in the industry used by several successful direct selling companies, has featured a Bitcoin payment option for years. So, direct sellers have the option of “getting paid in Bitcoin” along with several other choices such as bank transfers or debit cards. Accepting cryptocurrency from customers is a totally different matter, but as we’ve seen, customer interest is certainly growing. Processing Bitcoin payments is also cheaper. Most Bitcoin payment processors, such as BitPay, charge 1 percent, while traditional credit card transactions cost around 3 to 4 percent per transaction.